Certain offences to be non-cognizable [Section 9A]:

The offences are broadly divided in to two categories under Code of Criminal Procedure,1973 in the following manner:

(i) cognizable and non-cognizable offences

(ii) bailable and non-bailable offences.

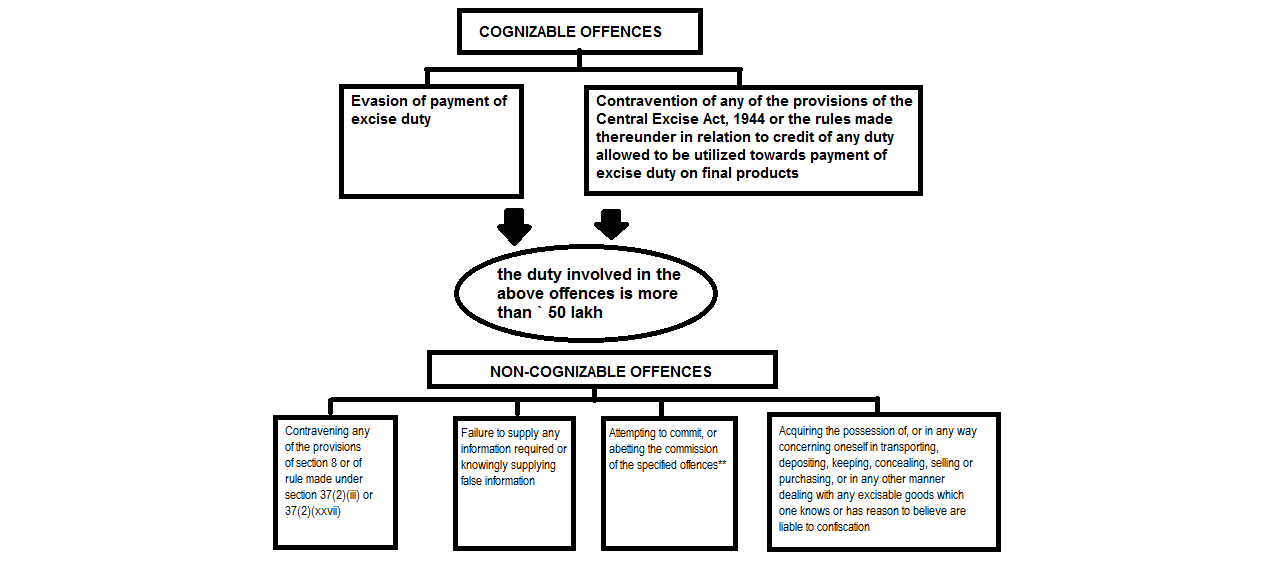

Cognizability of offences under central excise: The offences relating to excisable goods involving duty liability of more than ` 50 lakh and punishable under clause (b) or clause (bbbb) of section 9(1) are cognizable and non-bailable. However, all the remaining offences as specified in section 9 are non-cognizable within the meaning of the Code of Criminal Procedure, 1973. Following diagrams depict the cognizable and non-cognizable offences:-

| *Specified offences are:-

(a) Contravention of any of the provisions of section 8 (dealing with restriction on possession of certain goods specified in the Second Schedule) or of a rule made under section 37(2)(iii) [relating to power of Central Government to restrict transit of excisable goods to any part of India] or section 37(2)(xxvii) [relating to power of Central Government to specify the persons required to get registered], OR (b) Evasion of payment of any duty payable under the Central Excise Act. |

It is pertinent to note that offences under Central Excise come under what is termed “warrant case”. Warrant case according to Section 2(x) of the Code of Criminal Procedure, 1973 means a case relating to an offence punishable with death, imprisonment for life or imprisonment for a term exceeding two years. Other offences are called as “summons case” under Section 2(w) of the Code of Criminal Procedure, 1973.