CHANGE IN THE PROFIT SHARING RATIO :

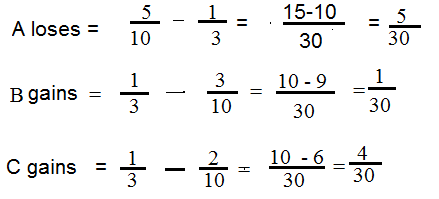

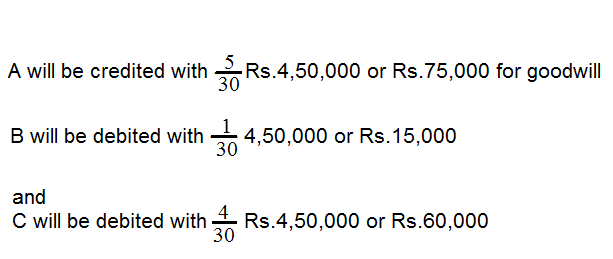

Whenever there is a change in the profit sharing ratio of the existing partners, there arises the need for valuation of goodwill. A change in the profit sharing ratio results in gain to one partner and loss to the other. As a result, the partner who gains from the new ratio has to compensate the partner who loses. The gaining partner, in respect of share of profit, may buy his share of profits from any one or two partners, as the case may be. The partners who sell the shares may sacrifice in equal or unequal proportions. The amount of goodwill credited to partner(s) from whom the gaining partner purchases his share is always in proportion to the sacrifice made. The journal entry for this purpose is to debit the partner’s capital account (one who gains) with the proportionate share of goodwill and credit the capital account or accounts of the partners (who lose) with the same amount.

Illustration :

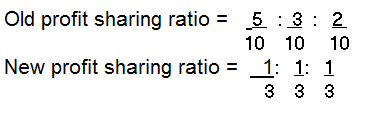

On 1st April, 2013 A, B and C who were sharing profits and losses in the ratio of 5:3:2 respectively decided to become equal partners. Goodwill of the firm was valued at Rs. 4,50,000. It was also decided to appreciate the book value of land and buildings by Rs. 1,40,000. No goodwill account appeared in the books of the firm and none was opened on change in profit sharing ratio. Pass journal entries to make the necessary adjustments.

Solution:

Journal Entries

| Particulars | Rs. | Rs. |

| Land and Buildings Account Dr. | 1,40,000 | |

| To Revaluation Account | 1,40,000 | |

| (Appreciation in the value of land and buildings) | ||

| Revaluation Account Dr. | 1,40,000 | |

| To A’s Capital Account | 70,000 | |

| To B’s Capital Account | 42,000.00 | |

| To C’s Capital Account | 28,000 | |

| (Transfer of profit on revaluation to partners’ capital accounts in old profit sharing ratio) | ||

| B’s Capital Account Dr. | 15,000 | |

| Capital Account Dr. | 60,000 | |

| To A’s Capital Account | 75,000 | |

| (Adjustment for goodwill on change in profit sharing ratio) |