Cognizance of offences [Section 90] :

Section 90 provides that offence involving collection of any amount as service tax but failure to pay the amount so collected to the credit of the Central Government beyond a period of six months would be a cognizable offence if the amount exceeds `50 lakh. Therefore, arrest can be made for such an offence without a warrant.

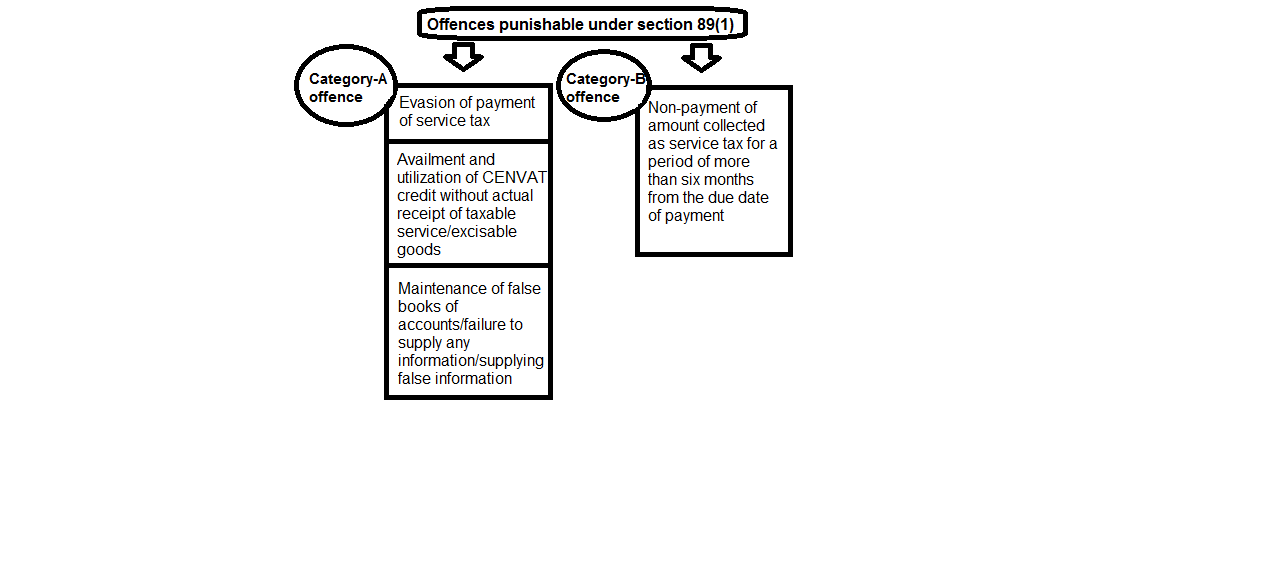

All the category ‘A‘ offences would be non-cognizable and bailable. Further, non-payment of amount collected as service tax beyond a period of six months, when the amount does not exceed Rs 50 lakh, would also be a non-cognizable and bailable offence. The provisions of section 89 and 90 have been summarized on the next page.

Points which merit consideration:

1. In order to constitute an offence under clause (b) of Category A offences, the taxpayer must both avail as well as utilize the credit without having actually received the goods or the service. The clause is not meant to apply to situations where an invoice has been issued for a service yet to be provided on which due tax has been paid. It is only meant for such invoices that are typically known as “fake” where the tax has not been paid at the so called service provider‘s end or where the provider stated in the invoice is non – existent. It will also cover situations where the value of the service stated in the invoice and/or tax thereon have been altered with a view to avail CENVAT credit in excess of the amount originally stated. While calculating the monetary limit for the purpose of launching prosecution, the value shall be the amount availed as credit in excess of the amount originally stated in the invoice.

2. Clause (c) of Category A offences, is based on similar provision in the central excise law. It should be noted that the offence in relation to maintenance of false books of accounts or failure to supply the required information or supplying of false information, should be in material particulars have a bearing on the tax liability. Mere expression of opinions shall not be covered by the said clause. Supplying false information, in response to summons, will also be covered under this provision.

3. Category B offence will apply only when the amount has been collected as service tax. It is not meant to apply to mere non-payment of service tax when due. This provision would be attracted when the amount was reflected in the invoices as service tax, service receiver has already made the payment and the period of six months has elapsed from the date on which the service provider was required to pay the tax to the Central Government. Where the service receiver has made part payment, the service provider will be punishable to the extent he has failed to deposit the tax due to the Government.

4. Section 9C of Central Excise Act, 1944, which is made applicable to Finance Act, 1994, provides that in any prosecution for an offence, existence of culpable mental state shall be presumed by the court. Therefore each offence described in section 89(1) of the Finance Act, 1994, has an inherent mens rea. Delinquency by the defaulter of service tax itself establishes his ‘guilt‘. If the accused claims that he did not have guilty mind, it is for him to prove the same beyond reasonable doubt. Thus “burden of proof regarding non existence of ‘mens rea’ is on the accused”.

| Offence Category | If any person is convicted under section 89 for an offence for | ||

| A | First time | where the amount is | Term of imprisonment |

| (i) upto Rs 50 lakh | Upto 1 year | ||

| (ii) more than Rs 50 lakh | 6 months* – 3 years | ||

| Second & every subsequent offence | The term of imprisonment may extend to 3 years. | ||

| B | First time | where the amount is | Term of imprisonment |

| (i) upto Rs 50 lakh | Upto 1 year | ||

| (ii) more than Rs 50 lakh | 6 months* – 7 years | ||

| Second & every

subsequent time |

(i) upto Rs 50 lakh | Upto 3 years | |

| (ii) more than Rs 50 lakh | Upto 7 years | ||

*Such imprisonment shall be for a term of less than six months if there are special and adequate reasons to be recorded in the judgment of the Court.