Components of valid GST Return for Outward Supplies made by the Taxpayer (FORM GSTR-1)

This Statement of outward supplies would capture the following information:

1. GSTIN

2. Name

3. Period to which the return pertains

4. Aggregate turnover of the taxpayer in the previous Financial Year. This information would be submitted by the taxpayers only in the first year, first tax period and will be auto-populated in subsequent tax periods and years.

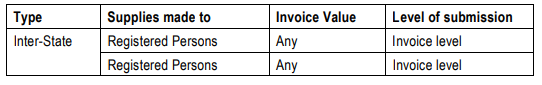

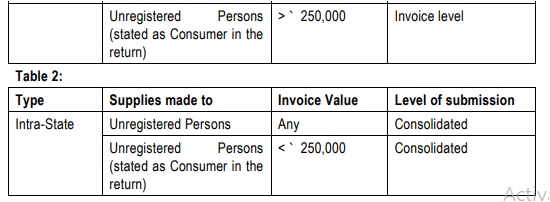

5. The transactions of outward supplies is required to be furnished in the said Statement i.e., Form GSTR 1 at an invoice / consolidated level, as per the requirements laid down in law / rules which is as mentioned in the below table:

Table 1: Submission of information at Invoice level.

Table 2: Submission of information at consolidated (Place of supply) level.

Table 1:

Note: For all B2C supplies (whether inter-State or intra-State) where invoice value is up to ` 2,50,000/- State-wise and rate-wise summary of supplies should be uploaded in Table 7 of the Form GSTR-1.

Additional Comments: Every registered person furnishing any statement or return or making any application, shall make sure that they have read the instructions provided by GSTN which is to be followed by every registered person furnishing such statement / return / application. The said instruction is available in the format(s) of Form(s) prescribed in CGST Rules, 2017 as well as at the offline utility of each of the Statement / Return / Application.

Illustration:

1. HSN requirement: HSN summary to be provided in Table 12 of Form GSTR 1 is divided into three parts i.e., (a) every registered person with annual turnover above ` 1.5 Crore but below ` 5 Crore in the preceding FY, is required to furnish details of supply HSN wise atleast at 2 digit level; (b) person with annual turnover above ` 5 Crore is required to provide details of outward supplies at 4 digit level; and (c) supplier not falling under (a) or (b) above, is required to provide details of goods supplied at the level of description of goods supplied.

Further, Unit Quantity Code (UQC) for which no specific unit of measurement is available, shall be selected as ‘OTHERS’ for example in case of supply of services, UQC can be on the basis of number of invoices issued under particular HSN for a particular tax period.

It is also important to note that, HSN Summary or summary of supplies at description of goods / services level, shall also contain details of supplies which are exempt from payment of tax or is not liable to Goods and Service Tax i.e., non-taxable supply (example supply of alcoholic liquor meant for human consumption).

2. Furnishing of details of Physical Exports as against supplies made to SEZ unit or SEZ developer / Deemed Exports: Details of Physical export of goods or services or both are to be separately furnished in Table 6A of Form GSTR 1. However, details of supply of goods or services or both made to SEZ unit or SEZ developer or a supply qualifying as deemed exports is to be reported in Table 4 of Form GSTR 1 along with invoice level details of regular supplies (However, one needs to select the option for type of supplies as ‘SEZ supplies with payment’ or ‘deemed exports’ based on the nature of the transaction’.