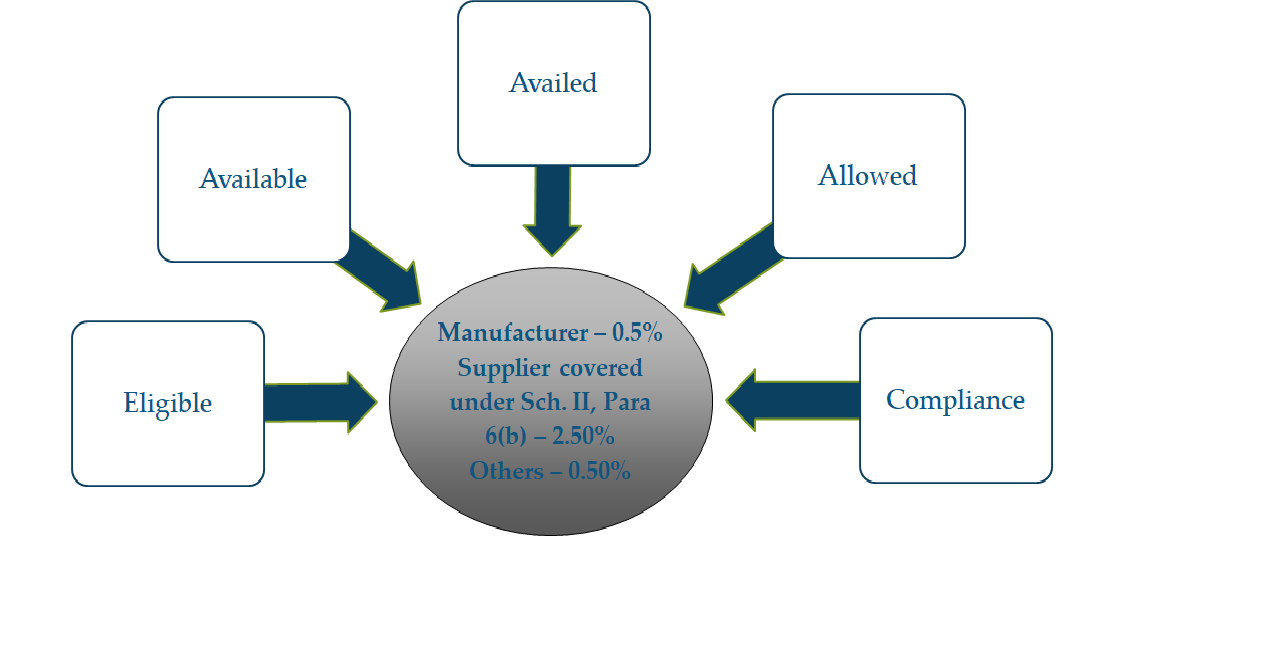

Composition Levy – Section 10 of CGST Act :

- Option to pay an amount in lieu of tax; minimum rate to be:

- 0.50% of the turnover in case of manufacturers ( other than specified);

- 2.50% of the turnover in case of suppliers covered under Sch. II, Para 6(b) such as Restaurants or Caterers

- 0.50% of the turnover in other cases

- Note: State GST rate in addition expected to be equal.

- No tax to be collected; No Input Tax Credit available

- Aggregate Turnover < Rs. 1 Crore* in the preceding FY (all-India basis for taxable persons having same PAN – who shall also opt for composition)

* Turnover Limit is Rs. 75 lakhs for Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh

Not economically viable for Business to Business Transactions

- No composition option in the following specific cases:

- Services supplied:

ØAny / all services (includes goods treated as supply of services by Schedule II), other than services covered under Schedule II, Paragraph 6(b) such as Restaurants

- Goods supplied:

ØNon-taxable goods

ØInter-State outward supplies

ØThrough e-commerce operators required to collect tax at source under section 52

ØNotified goods manufactured by the supplier

- Manufacture Of:

ØIce cream and other edible ice, whether or not containing cocoa

ØPan masala

ØAll goods, i.e. Tobacco and manufactured tobacco substitutes

- If aggregate turnover (all India basis) of preceding FY exceeds 1 Crore (If during the FY, the aggregate turnover exceeds 75 Lakhs, no composition from the following day.)