Compulsory filing of return of income [Section 139(1)] :

(1) As per section 139(1), it is compulsory for companies and firms to file a return of income or loss for every previous year on or before the due date in the prescribed form.

(2) In case of a person other than a company or a firm, filing of return of income on or before the due date is mandatory, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeds the basic exemption limit.

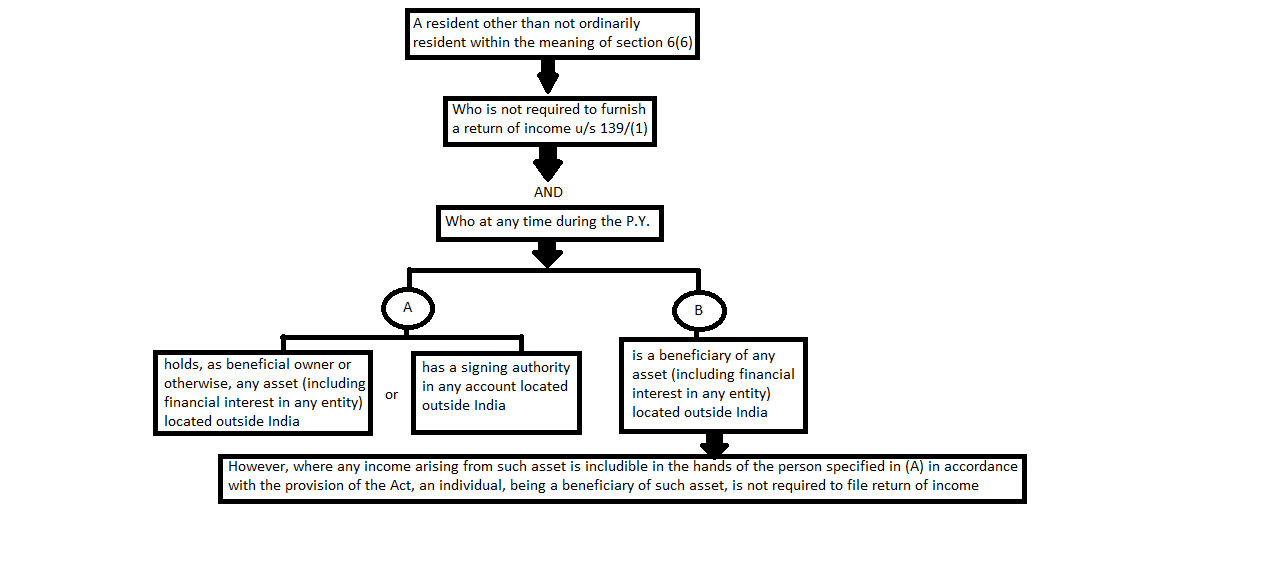

(3) A return of income or loss for the previous year in the prescribed form and verified in the prescribed manner on or before the due date, has to be filed by every person, being a resident other than not ordinarily resident in India within the meaning of sec tion 6(6), who is not required to furnish a return under section 139(1) if such person, at any time during the previous year –

(a) holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has a signing authority in any account located outside India; or

(b) is a beneficiary of any asset (including any financial interest in any entity) located outside India.

However, an individual being a beneficiary of any asset (including any financial interest in any entity) located outside India would not be required to file return of income, where, income, if any, arising from such asset is includible in the income of the person referred to in (a) above in accordance with the provisions of the Income-tax Act, 1961.

(4) All such persons mentioned in (1), (2) & (3) above should, on or before the due date, furnish a return of his income or the income of such other person during the previous year in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed.

(5) Further, every person, being an individual or a HUF or an AOP or BOI or an artificial juridical person –

- whose total income or the total income of any other person in respect of which he is assessable under this Act during the previous year

- without giving effect to the provisions of Chapter VI-A

- exceeded the basic exemption limit.

is required to file a return of his income or income of such other person on or before the due date in the prescribed form and manner and setting forth the prescribed particulars.

For the A.Y.2016-17, the basic exemption limit is Rs 2,50,000 for individuals/HUFs/AOPs/BOIs and artificial juridical persons, Rs 3,00,000 for resident individuals of the age of 60 years but less than 80 years and Rs 5,00,000 for resident individuals of the age of 80 years or more at any time during the previous year. These amounts denote the level of total income, which is arrived at after claiming the admissible deductions under Chapter VI -A. However, the level of total income to be considered for the purpose of filing return of income is the income before claiming the admissible deductions under Chapter VI -A.

(6) ‘Due date‘ means –

(i) 30th September of the assessment year, where the assessee, other than an assessee referred to in clause (ii), is –

(a) a company,

(b) a person (other than a company) whose accounts are required to be audited under the Income-tax Act, 1961 or any other law in force; or

(c) a working partner of a firm whose accounts are required to be audited under the Income-tax Act, 1961 or any other law for the time being in force.

(ii) 30th November of the assessment year, in the case of an assessee who is required to furnish a report referred to in section 92E.

(iii) 31st July of the assessment year, in the case of any other assessee.