F. No. 279/Misc.l140/201SIITJ

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

Subject: Computation of admissible deduction uls lOA of the Income Tax Act, 1961 – Regarding

As per the provisions of sub-section (4) of section lOA of the Income Tax Act, 1961 (the’ Act’), the profits derived from export of articles or things or computer software shall be the amount which bears to the profits of the business of the undertaking, the same proportion as the export turnover in respect of such articles or things or computer software bears to the total turnover of the business carried on by the undertaking.

2. Further as per clause (iv) to Explanation 2 to section lOA of the Act, “export turnover'” means the consideration in respect of export by the undertaking of articles or things or computer software received in, or brought into, India by the assessee in convertible foreign exchange in accordance with sub-section (3), but does not include freight, telecommunication charges or insurance attributable to the delivery of the articles or things or computer software outside India or expenses, if any, incurred in foreign exchange in providing the technical services outside India.

3 The issue whether freight. telecommunication charges and insurance expenses are to be excluded from both “‘export turnover”” and “”total turnover'” while working out deduction admissible under section lOA of the Act on the ground that they are attributable to delivery of articles or things or computer software outside India has been highly contentious. Similarly, the issue whether charges for providing technical services outside India are to be excluded both from “”export turnover”‘ and ‘”total turnover'” while computing deduction admissible under section lOA of the Act on the ground that such charges are relatable towards expenses incurred in convertible foreign exchange In providing technical services outside India has also been highly contentious.

4. The controversy has been finally settled by the Hon’ ble Supreme Court vide its judgement dated 24.4.2018 in the case of Commissioner of Income Tax, Central-III Vs. MIs HCL Technologies Ltd. l While deciding the issue the Apex Court has held as under:

“17) The similar nature of controversy. akin to this case, arose before the Kamataka High COllrt in C1Tvs. Tata Elxsi Ltd (2012) 20-1 TcLY/nan 32111 7. The isslle before the Kamataka High Court was whether the Tribunal was correct in holding that while computing reli~r under Seclion10A Of the IT Act, the amount of communicalion expenses should be excluded from Ihe lolallurnover if Ihe same are reduced from Ihe export turnover:’ While giving Ihe answer 10 the issue, Ihe High Co urI, inler-alia, held Ihal when a parlicular word is nol defined by Ihe legislalllre and an ordinary meaning is 10 be allribuled 10 iI, Ihe said ordinalY meaning is 10 be in conformity wilh Ihe context in which il is used. Hence, what is excludedfrom ‘exporllurnover ‘ musl also be excludedji’om ‘Iolallurnover’, since one of Ihe components of ‘Iotal turnover’ is export turnover. Any other inlerpretalion would run counter to Ihe legislalive intent and would be impermissible.

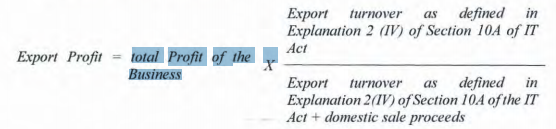

18) AccGrdingly. theformulafor computation oflhe deduction under SectionlOA of the Act would be as follows:

19) In the inslant case. if Ihe deductions on freight. telecommunication and insurance allribulable 10 the delivery of computer sojhvare under SeclionlOA of the IT Ar.t are allowed only in £’port Turnover but not from the Total Turnover then, it would give rise to inadverlent. IInla\l1l1l, meaningless and illogical result which wOllld calise grave injustice to the Respondent which cOllld have never been the intention of the legislature.

20) Even in common parlance, when the object of the formula is to arrive atlhe profit from export business. expenses excluded from export lurnover have to be excluded froll1 lotalturnover also. Othenvise. any other interpretation makes the formula unworkable and absurd. Hence, we are satisfied that sllch dedllction shall be allowedfrom the totallllrnover in same proportion as well.

21) On Ihe issue of expenses on technical services provided outside. we have to follow the same principle of interpretation as followed in the case of expenses of freight, telecommunication etc. , othenvise the formula of calculation would be fillile. Hence. in the same way. expenses incurred in foreign exchange for providing the technical services outside shall be allowed to exclude/rom the total turnover. ”

5. The issue has been examined by the Board and it is clarified that freight, telecommunication charges and insurance expenses are to be excluded both from “export turnover” and ·’total turnover” , while working out deduction admissible under section lOA of the Act to the extent they are attributable to the delivery of articles or things or computer software outside India.

6. Similarly, expenses incurred in foreign exchange for providing the technical services outside India are to be excluded from both “export turnover” and “total turnover” while computing deduction admissible under section lOA of the Act.

Thus, all charges/expenses specified in Explanation 2(iv) to section lOA of the Act, are liable to be excluded from total turnover also for the purpose of computation of deduction u/s lOA of the Act.

7. Accordingly, henceforth, appeals may not be filed by the Department on the abovensettled issue, and those already filed may be withdrawn/ not pressed upon.

8. The above may be brought to the notice of all concerned.

9. Hindi version of the same will follow.