Computation of anti-dumping duty:

Anti-dumping duty is:

(i) Margin of dumping

or

(ii) Injury margin

whichever is lower.

The anti-dumping duty chargeable under this section is in addition to any other duty imposed under this Act or any other law for the time being in force.

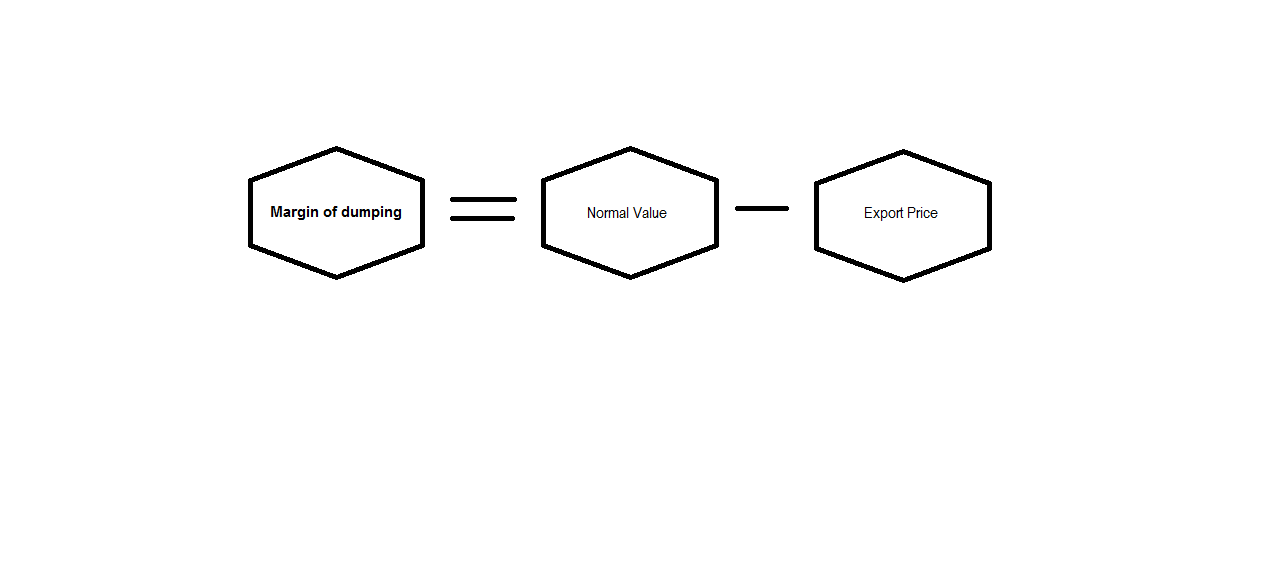

(a) Margin of dumping: In relation to an article, it means the difference between its export price and normal value. It is generally expressed as a percentage of the export price.

(b) Export price: in relation to an article, means of goods imported into India is the price of an article exported from the exporting country or territory.

Constructed export price: In cases where there is no export price or the export price is unreliable because of association or a compensatory arrangement between the exporter and the importer or a third party, the export price may be constructed at the price at which the imported articles are first resold to an independent buyer.

In case where the article is not resold to an independent buyer or not resold in the condition as imported, the export price shall be constructed on such reasonable basis as may be determined in accordance with the rules made.

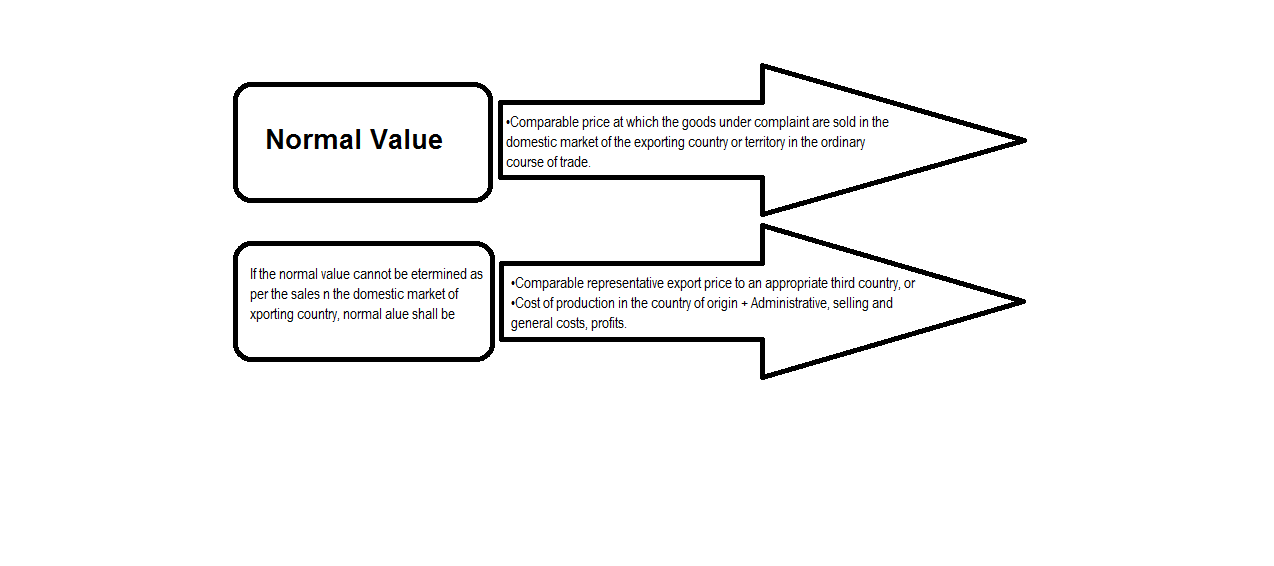

(c) Normal value: in relation to an article, means comparable price, in the ordinary course of trade, for the like article when destined for consumption in the exporting country or territory as determined in accordance with the rules.

When there are no sales of the like article in the ordinary course of trade in the domestic market of the exporting country or territory, or when because of the particular market situation or low volume of sales in the domestic market of the exporting country or territory, such sales do not permit a proper comparison, the normal value shall be either –

(i) Comparable representative price of the like article when exported from the exporting country or territory or an appropriate third country as determined in accordance with the rules made; or

(ii) The cost of production of the said article in the country of origin along with reasonable addition for administrative, selling and general costs, and for profits, as determined in accordance with the rules made:

However, in case the article is imported from a country other than the country of origin or where the article has merely been transshipped through the country of export or such article is not produced in the country of export or there is no comparable price in the country of export, the normal value shall be determined with reference to its price in the country of origin.

(d) Injury margin: Injury margin is the margin adequate to remove the injury to the domestic industry. It is the difference between the Fair Selling Price [Non-Injurious Price (NIP)] due to the Domestic Industry and the Landed Value of the dumped imports.

(e) Fair Selling Price (FSP) [Non-Injurious Price]: is that level of price, which the industry is, expected to have charged under normal circumstances in the Indian market during the period defined. This price would have enabled reasonable recovery of cost of production and profit after nullifying adverse impact of those factors of production which could have adversely effected the company and for which dumped imports can‘t be held responsible. In other words, it is the fair selling price of a product for the domestic industry.

There would be a single Non-Injurious Price for a product and not several Non-Injurious Price for the same product [Reliance Industries ltd. v. Designated Authority 2006 (202) E.L.T. 23 (S.C.)].

(f) Landed Value: is taken as the assessable value under the Customs Act and the applicable basic customs duties except CVD, SAD and special duties.