Constitution of India :

Power to levy and collect taxes whether direct or indirect emerges from the Constitution of India. Without a study of the basic provisions in the Constitution, no study would be complete. Part XI of the Constitution deals with relationship between the Union and States. The power for enacting the laws is conferred on the Parliament and on the Legislature of a State by Article 245 of the Constitution. The said Article states:

(i) Subject to the provisions of this Constitution, Parliament may make laws for the whole or any part of the territory of India, and the legislature of a State may make laws for the whole or any part of the State.

(ii) No law made by the Parliament shall be deemed to be invalid on the ground that it would have extra-territorial operation.

Article 246 gives the respective authority to Union and State Governments for levying tax. Whereas Parliament may make laws for the whole of India or any part of the territory of India, the State Legislature may make laws for whole or part of the State.

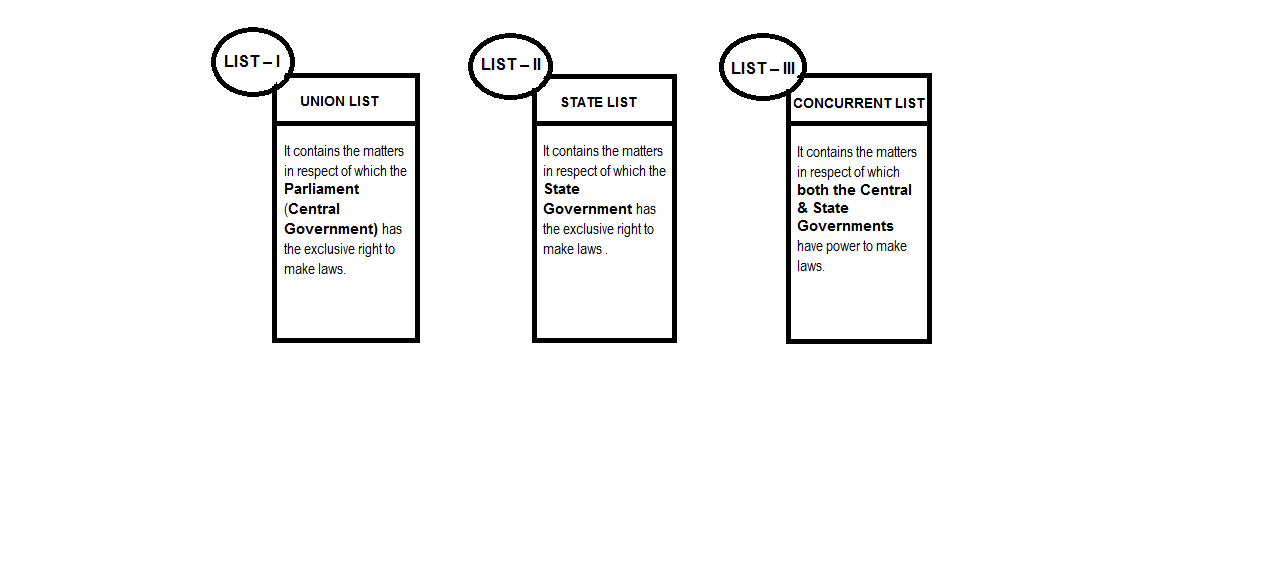

Seventh Schedule to Article 246: It contains three lists which enumerate the matters under which the Union and the State Governments have the authority to make laws.

Entries 82 to 92C of List I enumerate the subjects where the Central Government has power to levy taxes. Entries 45 to 63 of List II enumerate the subjects where the State Governments have the power to levy taxes. Parliament has a further power to make any law for any part of India not comprised in a state, notwithstanding that such matter is included in the state list.

Part XII of the Constitution of India contains matters related to “Finance, Property, Contracts and Suits” in the Articles 264 to Article 300A. Article 265 states that “no tax shall be levied or collected except by authority of law”.

It has been held by the Supreme Court in Kunnathat v. State of Kerala AIR 1961 SC 552 that the term “authority of law” means that tax proposed to be levied must be within the legislative competence of the Legislature imposing the tax.

The law must not be a colourable use of or a fraud upon the legislative power to tax. It must not also violate the fundamental rights such as Article 14, 19 etc. [Express Newspapers v. U.O.I. 1999 (110) E.L.T. 3 (S.C.)]

Some of the relevant entries in the Union List I of the Seventh Schedule are:

Entry 82 – Taxes on income other than agriculture income

Entry 83 – Duties of Customs including Export duties

Entry 84 – Duties of excise on tobacco and other goods manufactured or produced in India except:

(a) alcoholic liquors for human consumption

(b) opium, Indian hemp and other narcotic drugs and narcotics; but

including

medicinal and toilet preparations containing alchohol, or any substance stated before.

Example: Medical syrups for cold and cough contains a small portion of alcohol. Even though it contains alcohol, it will come under Union List 1.