Construction services under Declared services [Section 66E] :

This entry covers the services provided by builders or developers or any other person, where building complexes, civil structure or part thereof are offered for sale but the payment for such building or complex or part thereof is received before the issuance of completion certificate by a competent authority.

SERVICE TAX LEVIABILITY ON CONSTRUCTION SERVICES UNDER VARIOUS BUSINESS MODELS

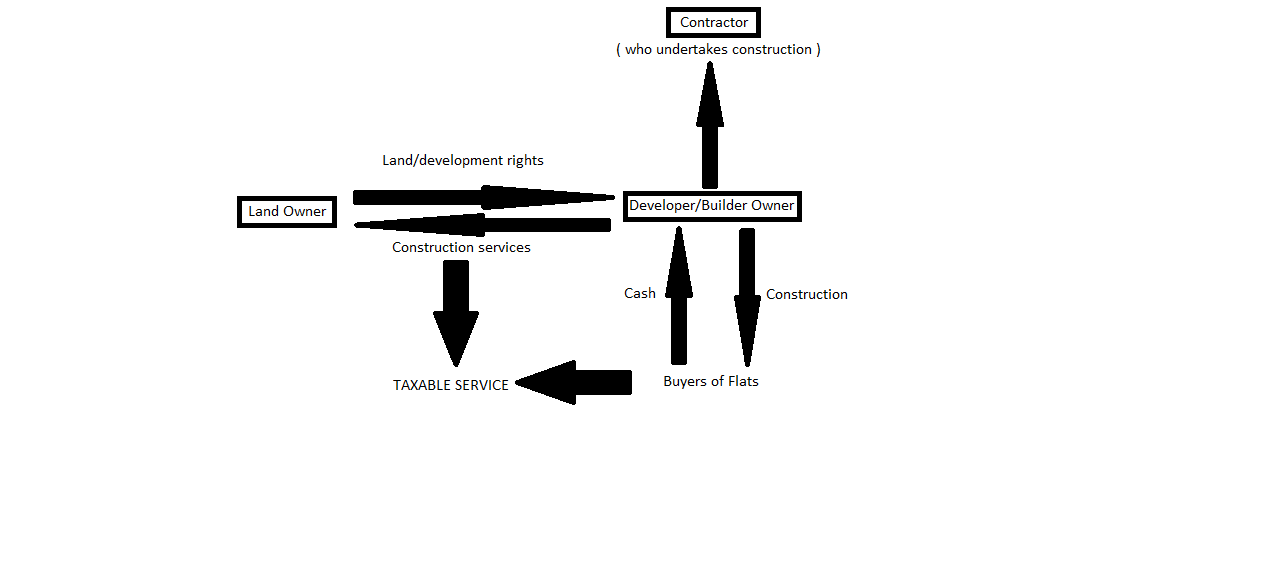

(a) Model-I: In this model, two important transactions are identifiable: (a) sale of land by the landowner which is not a taxable service; and (b) construction service provided by the builder/developer. The builder/developer receives consideration for the construction service provided by him, from two categories of service receivers: (a) from landowner: in the form of land/development rights; and (b) from other buyers: normally in cash.

Parties in the model: (i) landowner; (ii) builder or developer; and (iii) contractor who undertakes construction).

Issue: Whether service tax is liable to be paid on flats/houses agreed to be given by builder/developer to the land owner towards the land /development rights and to other buyers?

Clarification:

I. Taxability: Construction service provided by the builder/developer is taxable in case any part of the payment/development rights of the land was received by the builder/ developer before the issuance of completion certificate and the service tax would be required to be paid by builder/developers even for the flats given to the land owner.

II. Valuation: Value, in the case of flats given to first category of service receiver will be the value of the land when the same is transferred and the point of taxation will also be determined accordingly.

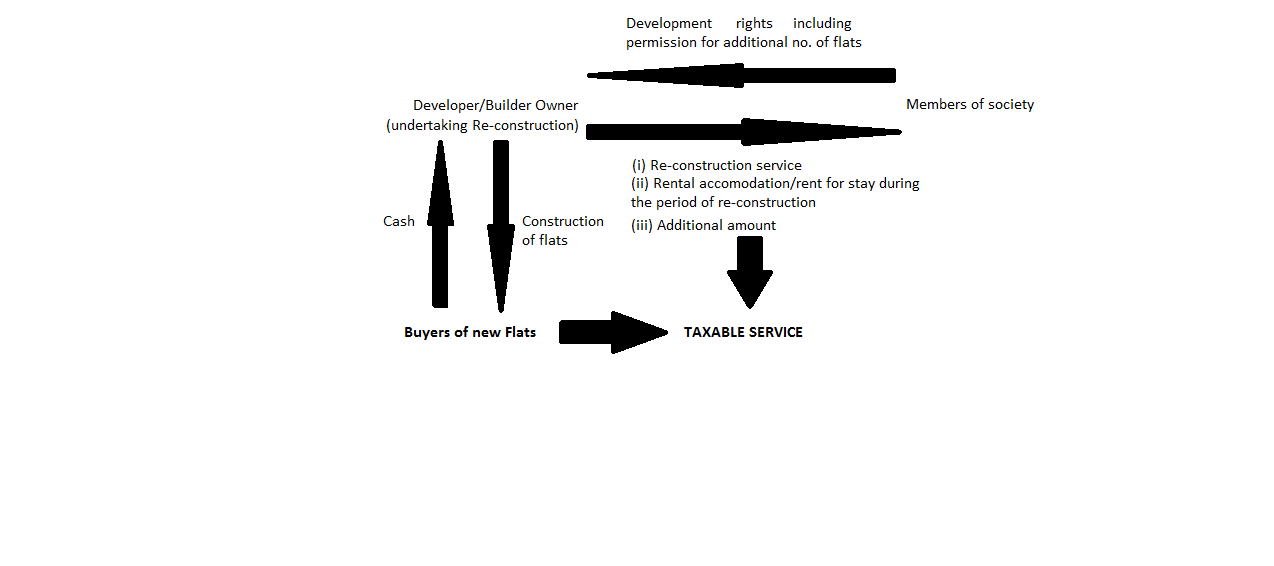

(b) Model-II: In this model, land is owned by a society, comprising members of the society with each member entitled to his share by way of an apartment. When it becomes necessary after the lapse of a certain period, society/its flat owners may engage a builder/developer for undertaking re-construction.

Society /individual flat owners give ‘No Objection Certificate‘ (NOC) or permission to the builder/developer, for re-construction. The builder/developer makes new flats with same or different carpet area for original owners of flats and additionally may also be involved in one or more of the following:

(i) construct some additional flats for sale to others;

(ii) arrange for rental accommodation or rent payments for society members/original owners for stay during the period of re-construction;

(iii) pay an additional amount to the original owners of flats in the society.

Re-construction undertaken by a building society by directly engaging a builder/developer will be chargeable to service tax as works contract service for all the flats built now.

(c) Model-III: Conversion of any hitherto untaxed construction /complex or part thereof into a building or civil structure to be used for commerce or industry, after lapse of a period of time is a mere change in the use of the building. Hence, it does not involve any taxable service. If the renovation activity is done on such a complex on contract basis the same would be a works contract, which would also be taxable if other ingredients of taxability are present.

(d) Model-IV: In certain States, completion certificates have been waived or are considered as not required for certain specified types of buildings. In terms of Explanation to clause

(b) of section 66E in such cases the completion certificate issued by an architect or a chartered engineer or a licensed surveyor of the respective local body or development or planning authority would be treated as completion certificate for the purposes of determining chargeability of service tax.

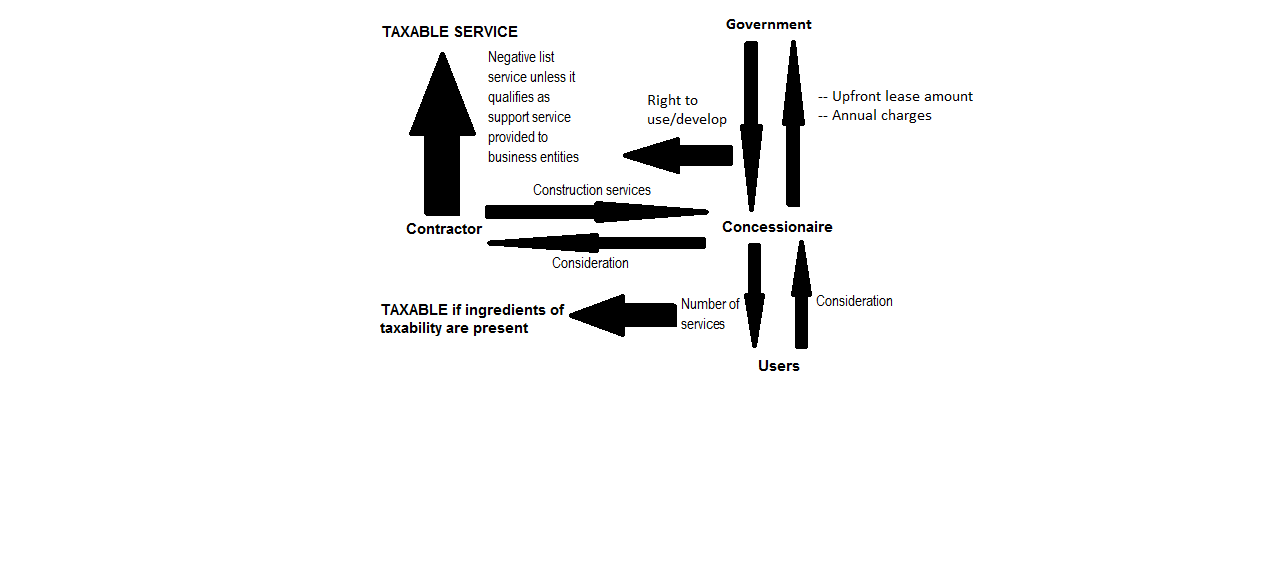

(e) Model-V-Build- Operate – Transfer (BOT) Projects: Generally under BOT model, transactions involving taxable service take place usually at three different levels: Firstly, between Government and the concessionaire; secondly, between concessionaire and the contractor and thirdly, between concessionaire and users, all in terms of specific agreements.

First level: Government transfers the right to use and/or develop the land, to the concessionaire, for a specific period, for construction of a building for furtherance of business or commerce (partly or wholly). Consideration for this taxable service may be in the nature of upfront lease amount or annual charges paid by the concessionaire to the Government. Such services provided by the ‘Government‘ would be in the negative list entry contained in clause (a) of section 66D unless these services qualify as ‘support services provided to business entities‘ under exception sub -clause (iv) to clause (a) of section 66D. Support services have been defined in clause (49) of section 65B as infrastructural, operational, administrative, logistic marketing or any other support of any kind comprising functions that entities carry out in the ordinary course of operations themselves but may obtain as services by outsourcing from others for any reason whatsoever and shall include advertisement and promotion, construction or works contract, renting of movable or immovable property, security, testing and analysis. If the nature of concession is such that it amounts to ‘renting of immovable property service‘ then the same would be taxable. The tax is required to be paid by the government as there is no reverse charge for services relating to renting of immovable property.

In this model, though the concessionaire is undertaking construction of a building to be used wholly or partly for furtherance of business or commerce, he will not be treated as a service provider since such construction has been undertaken by him on his own account and he remains the owner of the building during the concession period.

Second level: In case an independent contractor is engaged by a concessionaire for undertaking construction for him, then service tax is payable on the construction service provided by the contractor to the concessionaire.

Third level: Concessionaire enters into agreement with several users for commercially exploiting the building developed/constructed by him, during the lease period. At this level, concessionaire is the service provider and user of the building is the service receiver. The concessionaire may provide to the users, taxable services such as ‘renting of immovable property service‘, ‘business support service‘, ‘management, maintenance or repair service‘, ‘sale of space for advertisement‘, etc. Service tax is leviable on t he taxable services provided by the concessionaire to the users.

(g) Model-VI: This covers the case where the builder instead of receiving consideration for the sale of an apartment receives a fixed deposit, which it converts after the completion of the building into sales consideration.

This may be a colorable device wherein the consideration for provision of construction service is disguised as fixed deposit, which is unlikely to be returned. In any case, the interest earned by the builder on such fixed deposits will be a significant amount received prior to the completion of the immovable property. Interest in such cases would be considered as part of the gross amount charged for the provision of service and the service of construction will be taxable.

(h) Model-VII: In this model, the person who has entered into a contract with the builder for a flat for which payments are to be made in 12 installments depending on the stage of construction and the person transfers his interest in the flat to a buyer after paying 7 installments.

Such transfer does not fall in this declared service entry as the said person is not providing any construction service. In any case transfer of such an interest would be transfer of a benefit to arise out of land which as per the definition of immoveable property given in the General Clauses Act, 1897 is part of immoveable property. Such transfer would therefore be outside the ambit of ‘service‘ being a transfer of title in immoveable property. Needless to say that service tax would be chargeable on the seven installments paid by the first allottee and also on subsequent installments paid by the transferee.