Continuous supply of services :

As per Section 2(33) of the CGST Act 2017, continuous supply of services means a supply of services which is provided or agreed to be provided continuously or on recurrent basis under a contract for a period exceeding three months with periodic payment obligations and includes supply of services as the Government may subject to such conditions as it may by notification specify.

This means that there are three important conditions to be satisfied in order to be a continuous supply of services:

a) The services should be provided continuously or on recurrent basis

b) The contract period should be exceeding three months

c) The payment obligations should be periodical

For instance an annual maintenance contract, construction contract etc. may be considered as continuous supply of services if the aforesaid conditions are satisfied.

The date of issuance of invoice in respect of continuous supply of services has been given under Section 31(5) of the CGST Act 2017 as follows:

i. Where the due date of payment is ascertainable from the contract, the invoice will be issued on or before the due date of payment.

ii. Where the due date of payment is not ascertainable from the contract, the invoice will be issued before or at the time when the supplier of services receives the payment iii. When the payment is linked to the completion of an event, the invoice will be issued on or before the date of completion of that event.

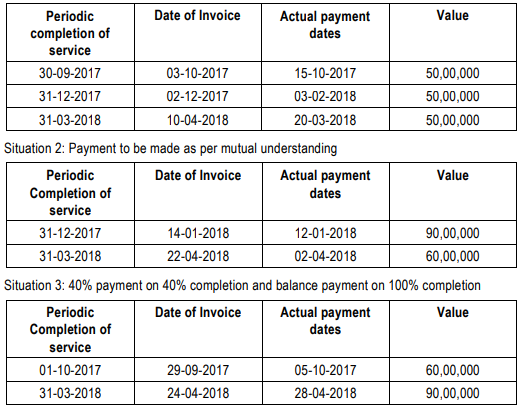

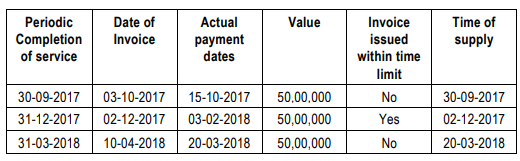

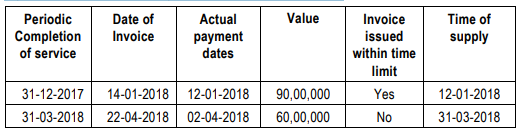

Illustration 6: Mr. X is getting construction services from a developer against buying of an under-construction flat for the period 01/07/2017 to 31/03/2018 for ` 150,00,000. The transactions are structured as follows:

Situation 1: Equal instalments to be paid at the end of every quarter

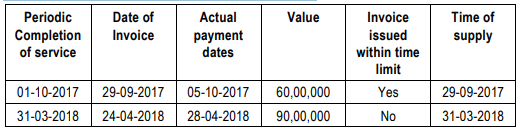

Answer: This is a case of continuous supply of services. The first question that should be determined in these cases is whether the invoice is issued within the prescribed time period. If issued within the prescribed time period, the time of supply will be the date of issue of invoice or the date of receipt of payment whichever is earlier. If the invoice is issued after the prescribed period, then the time of supply will be the date of completion of service or the date of receipt of payment whichever is earlier.

Situation 1: In this situation, the due date of payment can be ascertainable from the contract. So, the last date of issuance of invoice will be the due date of payment. The due date of payment will be end of each quarter. So, the time of supply will be determinable as follows:

Situation 2: In this situation, due date of payment is not ascertainable from the contract. So, the invoice is to be issued before or at the time when the supplier of services receives the payment. So, the time of supply will be determinable as follows:

Situation 3: In this situation, the payment is linked to the completion of event. The invoice should be raised on or before the completion of that event (i.e. 40% or 100% completion as the case may be). So, the time of supply will be as follows: