Deduction in respect of investment made under an equity savings scheme [Section 80CCG] :

(i) Deduction under this section would be available to a new retail investor, being a resident individual with gross total income of up to Rs 12 lakh, for investment in listed equity shares or listed units of equity oriented fund, in accordance with a notified scheme.

The deduction is 50% of amount invested in such equity shares or Rs 25,000 whichever is lower. The maximum deduction of Rs 25,000 is available on investment of Rs 50,000 in such listed equity shares.

Further, the deduction shall be allowed for three consecutive assessment years, beginning with the assessment year relevant to the previous year in which the listed equity shares or listed units of equity oriented fund were first acquired.

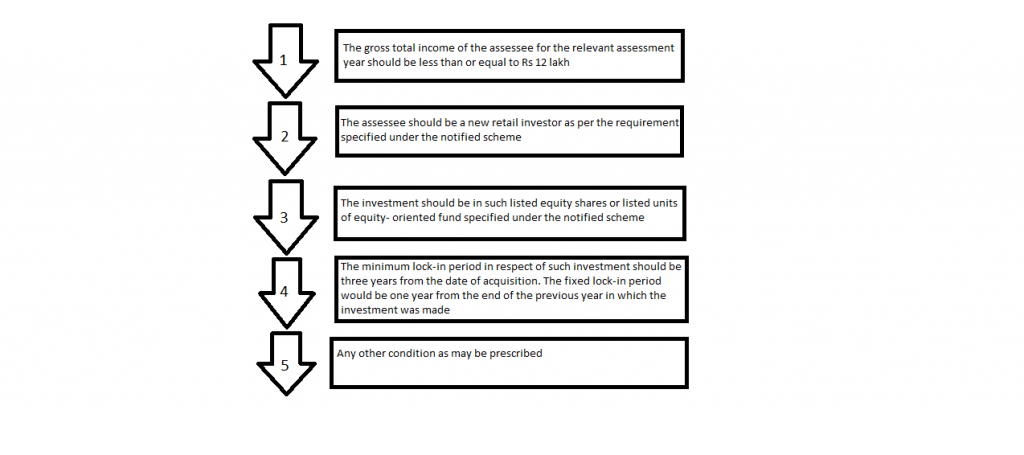

(ii) Therefore, the conditions under section 80CCG for claiming deduction would be –

(iii) If the resident individual, after having claimed such deduction, fails to comply with any of the conditions in any previous year, say, he sells the shares or units within one year, then, the deduction earlier allowed shall be deemed to be the income of the previous year in which he fails to comply with the condition. The income shall, accordingly, be liable to tax in the assessment year relevant to such previous year.

Rajiv Gandhi Equity Savings Scheme, 2013 :

The Central Government has, in exercise of the powers conferred by section 80CCG(1), notified the Rajiv Gandhi Equity Savings Scheme, 2013. The said scheme provides for eligibility criteria, procedure for investment, period of holding and other conditions.

| S. No. | Particulars | Content | ||||||||||

| 1. | Eligibility | The deduction under this scheme shall be available to a new retail investor who complies with the conditions of the Scheme and whose gross total income for the financial year in which the investment is made under the Scheme is less than or equal to Rs 12 lakh. | ||||||||||

| New retail investor means a resident individual,:

(i) who has not opened a demat account and has not made any transactions in the derivative segment before – – the date of opening of a demat account; or – the first day of the initial year, However, an individual who is not the first account holder of an existing joint demat account shall be deemed to have not opened a demat account for the purposes of this Scheme; (ii) who has opened a demat account but has not made any transactions in the equity segment or the derivative segment before – – the date he designates his existing demat account for the purpose of availing the benefit under the Scheme; or – the first day of the initial year. Initial year means – (a) the financial year in which the investor designates his demat account as Rajiv Gandhi Equity Savings Scheme account and makes investment in the eligible securities for availing deduction under the Scheme; or (b) the financial year in which the investor makes investment in eligible securities for availing deduction under the Scheme for the first time, if the investor does not make any investment in eligible securities in the financial year in which the account is so designated. |

}whichever is later

}whichever is later

|

|||||||||||

| 2. | Procedure for investment under the Scheme | A new retail investor shall make investments under the Scheme in the following manner, namely:-

1. the new retail investor may invest in one or more financial years in a block of three consecutive financial years beginning with the initial year; 2. the new retail investor may make investment in eligible securities in one or more than one transaction during any financial year during the three consecutive financial years beginning with the initial year in which the deduction has to be claimed; 3. the new retail investor may make any amount of investment in the demat account but the amount eligible for deduction under the Scheme shall not exceed fifty thousand rupees in a financial year; 4. the new retail investor shall be eligible for the tax benefit under the Scheme only for three consecutive financial years beginning with the initial year, in respect of the investment made in each financial year; 5. if the new retail investor does not invest in any financial year following the initial year, he may invest in the subsequent financial year, within the three consecutive financial years beginning with the initial year, in accordance with the Scheme; 6. the new retail investor who has claimed a deduction under subsection (1) of section 80CCG of the Act in any assessment year shall not be allowed any deduction under the Scheme for the same investment for any other assessment year; 7. the new retail investor shall be permitted a grace period of seven trading days from the end of the financial year so that the eligible securities purchased on the last trading day of the financial year also get credited in the demat account and such securities shall be deemed to have been acquired in the financial year itself; 8. the new retail investor can make investments in securities other than the eligible securities covered under the Scheme and such investments shall not be subject to the conditions of the Scheme nor shall they be counted for availing the benefit under the Scheme; 9. the deduction claimed shall be withdrawn if the lock-in period requirements of the investment are not complied with or any other condition of the Scheme is contravened by the new retail investor. |

||||||||||

| 3. | Period of

holding |

The period of holding of eligible securities invested in each financial year shall be under a lock-in period of three years to be counted in the following manner:

|

||||||||||

| 4. | Other Conditions | (i) While making initial investments up to Rs 50,000, the total cost of acquisition of eligible securities shall not include brokerage charges, securities transaction tax, stamp duty, service tax and any other tax, which may appear in the contract note.

(ii) Where the investment of the new retail investor undergoes a change as a result of involuntary corporate actions including demerger of companies, amalgamation and such other actions, as may be notified by SEBI, resulting in debit or credit of securities covered under the Scheme, the deduction claimed by such investor shall not be affected. (iii) In the case of voluntary corporate actions, including buy-back resulting only in debit of securities where new retail investor has the option to exercise his choice, the same shall be considered as a sale transaction for the purpose of the Scheme. |

||||||||||

| 5. | Consequence of failure to comply with the prescribed conditions | If the new retail investor fails to fulfill any of the provisions of the Scheme, the deduction originally allowed to him under section 80CCG(1) for any previous year, shall be deemed to be the income of the assessee of the previous year in which he fails to comply with the provisions of the Scheme and shall be liable to tax for the assessment year relevant to such previous year. | ||||||||||

| 6. | Savings | A new retail investor who has invested in accordance with the Rajiv Gandhi Equity Savings Scheme, 2012 shall continue to be governed by the provisions of that Scheme to the extent it is not in contravention of the provisions of this Scheme and such investor shall also be eligible for the benefit of investment made in accordance wi th this Scheme for the financial years 2013-14 and 2014-15. | ||||||||||

Example

Mr. X and Mr. Y, new retail investors, have made the following investments in equity shares/units of equity oriented fund of Rajiv Gandhi Equity Savings Scheme for the P.Y.2013 – 14, P.Y.2014-15 & P.Y.2015-16 as below :

| Particulars | P.Y.2013-14 | P.Y.2014-15 | P.Y.2015-16 | |

| Mr. X | Rs | Rs | Rs | |

| (i) | Investment in listed equity shares | 20,000 | 45,000 | 32,000 |

| (ii) | Investment in units of equity-oriented fund | 40,000 | – | 11,000 |

| (iii) | Gross Total Income (comprising of salary income and bank interest) | 11,25,000 | 11,15,000 | 12,50,000 |

| Deduction u/s 80CCG | 25,000 | 22,500 | Nil | |

| Remark | (Restricted to 50% of Rs 50,000) | (50% of Rs 45,000) | (Not eligible since GTI> 12,00,000) | |

| Mr. Y | Rs | Rs | Rs | |

| (i) | Investment in listed equity shares | 25,000 | – | 30,000 |

| (ii) | Investment in units of equity-oriented fund | 15,000 | 40,000 | 25,000 |

| (iii) | Sale of all units of equity oriented fund purchased in P.Y.2014-15 | – | – | 70,000 |

| (iv) | Gross Total Income (comprising of Salary income and bank interest) | 10,50,000 | 12,15,000 | 11,50,000 |

| Deduction under section 80CCG | 20,000 | Nil | 25,000 | |

| Remark | (50% of Rs 40,000) | (Since GTI > 12,00,000) | (Restricted to 50% of Rs 50,000) | |

| Amount liable to tax (on account of violation of condition) [See Note below] | NIL | |||

Note – Since the deduction under section 80CCG was not allowed during the P.Y.2014-15 on account of the Gross Total Income exceeding Rs 12 lakhs, no amount relating to that year can be subject to tax in the P.Y.2015-16 being the year of violation of condition, even though the units were sold within 1 year from the end of P.Y. 2014-15.