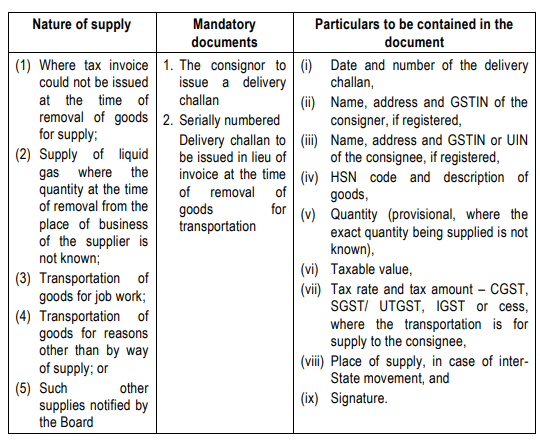

Delivery challan: Rule 55 of the CGST Rules, 2017 provides for issuance of delivery allan, and also the mandatory contents in a delivery challan. A delivery challan is required to be issued by a registered person every time he moves any goods for any reasons other than by way of supply (say supply for jobwork, goods sent for sale on approval basis, dispatch of demo-goods, disposal by way of gift or free samples, shipment of goods for an exhibition, etc.)

a. Please note that a delivery challan is a document required for movement of goods, and not “supply of goods”. This means, even where goods that are otherwise chargeable to tax as services, are moved, this document would be required. E.g. Goods moved for works contract purposes, goods sent for hire, etc.

b. It has been clarified vide Circular No.10/2017 dated 18.10.2017 that where the goods are removed for line sales or for supply on approval basis, the person removing the goods either for intra-State supplies or inter-State supplies shall raise a delivery challan along with e-way bill (if applicable) since the supplier would be unable to ascertain the actual supply at the time of removal. It is also clarified that the person removing the goods shall carry the invoice book during the movement which shall enable him to issue an invoice once the supply is complete.

c. Circular No. 22/2017 dated 21.12.2017 has been issued clarifying the same procedure for removal of goods by artists and supply of such goods by artists from galleries.

d. While the law only provides for movement in general, a corollary can be, that a delivery challan may be for movement-outward or / and movement-inward.

e. A delivery challan would also be required to be prepared in triplicate, as applicable in case of tax invoices for goods (explained supra).

f. The Rules also specifies the nature of other documents to be carried along with the goods under transportation. Please note that this list is illustrative and not exhaustive.