Determination of value of services involved in the execution of a works contract [Rule 2A] :

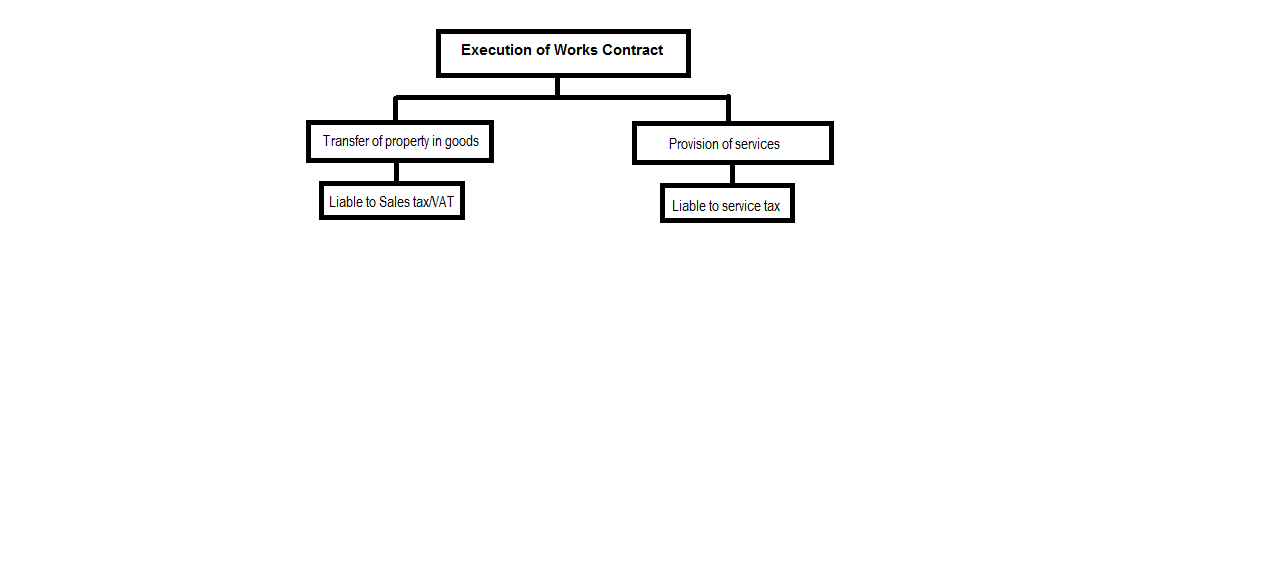

Works contract is a contract for the provision of service as well as supply of materials. As decided by Apex Court in BSNL v. UOI 2006 (2) S.T.R. 161 (S.C.), a works contract can be segregated into a contract of sale of goods and contract of provision of service.

Subject to the provisions of section 67, the value of service portion in the execution of a works contract shall be determined in the following manner, namely:-

A. Determination of value of service portion on the basis of value of property in goods transferred, adopted for State VAT purposes

Value of service portion in the execution of a works contract shall be equivalent to the gross amount charged for the works contract less the value of property in goods transferred in the execution of the said works contract.

| Particulars | Rs |

| Gross amount charged for the works contract | xxxx |

| Less: Value of transfer of property in goods transferred, computed for State VAT purpose** | xxxx |

| Less: VAT/Sales tax, paid or payable, if any, on transfer of property in goods involved in the execution of the said works contract. | xxxx |

| Value of the works contract service | xxxx |

**Note: Value of transfer of property in goods involved in the execution of the said works contract in case VAT/sales tax is paid/payable on their actual value: Where VAT/sales tax has been paid/payable on the actual value of property in goods transferred in the execution of the works contract (and not using standard rate of deduction) then, such value adopted for the purposes of payment of VAT/sales tax, shall be taken as the value of property in goods transferred in the execution of the said works contract for determination of the value of service portion in the execution of works contract under this clause.

Inclusions

Value of works contract service shall include –

(i) labour charges for execution of the works;

(ii) amount paid to a sub-contractor for labour and services;

(iii) charges for planning, designing and architect‟s fees;

(iv) charges for obtaining on hire or otherwise, machinery and tools used for the execution of the works contract;

(v) cost of consumables such as water, electricity, fuel used in the execution of the works contract;

(vi) cost of establishment of the contractor relatable to supply of labour and services;

(vii) other similar expenses relatable to supply of labour and services; and

(viii) profit earned by the service provider relatable to supply of labour and services.

B. Simplified scheme for determining the value of service portion in a works contract

Where the value has not been determined as per the aforementioned method, the person liable to pay tax on the taxable service involved in the execution of the works contract shall determine the value of service portion in the following manner, namely:-

| S. No. | Works contract | Value of service portion |

| (A) | in case of works contracts entered into for execution of original works | 40% of the total amount charged for the works contract |

| (B) | in case of works contract, not covered under subclause

(A), including works contract entered into for,- (i) maintenance or repair or reconditioning or restoration or servicing of any goods; or (ii) maintenance or repair or completion and finishing services such as glazing or plastering or floor and wall tiling or installation of electrical fittings of immovable property |

70% of the total amount charged for the works contract |

Points which merit consideration

1. Original works means

(i) all new constructions;

(ii) all types of additions and alterations to abandoned or damaged structures on land that are required to make them workable;

(iii) erection, commissioning or installation of plant, machinery or equipment or structures, whether pre-fabricated or otherwise.

2. Meaning of total amount

| Particulars | Rs | Rs | |

| Gross amount charged for the works contract | xxxx | ||

| Add: Value of all goods and services supplied by the service receiver in /in relation to the execution of the works contract (whether or not supplied under the same contract or any other contract) | FMV of such goods & services (determined in accordance with the generally accepted accounting principles) | xxxx | |

| Less:

(i) the amount charged for such goods or services, if any, by service receiver; and |

xxxx | ||

| (ii) VAT/sales tax, if any, levied thereon | xxxx | xxxx | |

| Total amount | xxxx | ||

3. No credit on inputs: It is clarified that the provider of taxable service shall not take CENVAT credit of duties or cess paid on any inputs, used in or in relation to the said works contract, under the provisions of CENVAT Credit Rules, 2004.

Illustration: Mahavir Enterprises (ME) has entered into a contract for construction of a building with Sambhav Constructions Ltd (SCL). As per the agreement, the amount payable (excluding all taxes) by ME to SCL is Rs 95,00,000 in addition to the steel and cement to be supplied by ME for which it charged Rs 5,00,000 from SCL. Fair market value of the steel and cement (excluding VAT) is Rs 10,00,000. Compute the „total amount charged‟ pertaining to the said works contract for execution of “original works‟.

| Particulars | Rs |

| Gross amount received excluding taxes (A) | 95,00,000 |

| Fair market value of steel and cement supplied by ME excluding taxes (B) | 10,00,000 |

| Amount charged by service receiver for steel and cement (C) | 5,00,000 |

| Total amount charged [(A) + (B) – (C)] | 1,00,00,000 |

| Value of service portion (40% of total amount charged in case of original works) | 40,00,000 |

Note: When the service provider pays partially or fully for the materials supplied by the service receiver, gross amount charged would inevitably go higher by that much amount.