Documents required to be issued in respect of supplies liable to tax under reverse charge mechanism

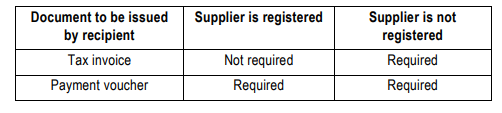

a. Where tax is payable on reverse charge basis in terms of Section 9(3) or 9(4), or the corresponding provisions of the IGST Act, 2017, the recipient of supply is required to pay tax on reverse charge basis. In this regard, the following may be noted:

b. The law makes a provision for the issuance of a consolidated tax invoice for every month, to be issued at the end of the month, where the aggregate value of the supplies liable to tax under reverse charge mechanism exceeds Rs.5,000. This apart, a mirrored set of all the particulars specified under Rule 46 would be required to be contained in a tax invoice issued by a registered recipient (commonly referred to a as ‘self-invoice’ by trade and industry).

c. All cases of inward supplies on which tax is payable on reverse charge basis, require the recipient of supply to issue a payment voucher, at the time of making payment to the supplier, containing all the applicable particulars specified in Rule 52 of the CGST Rules, 2017.

d. It is relevant to note here that payment of tax by registered recipients on effecting inward supplies from unregistered, in terms of Section 9(4) of the Act, has been exempted up to 30.06.2018. (Refer Notification No. 38/2017 – Central Tax (Rate) dated 13.10.2017 read with Notification No. 10/2018 –Central Tax (Rate) dated 23.03.2018.)