DU PONT MODEL :

The Du Pont Company of US introduced a system of financial analysis considered as one of the important tool for financial analysis. The usefulness of the Du Pont model is that it presents a picture of the overall performance of a company to enable the management to identify the factors relating to the company’s profitability.

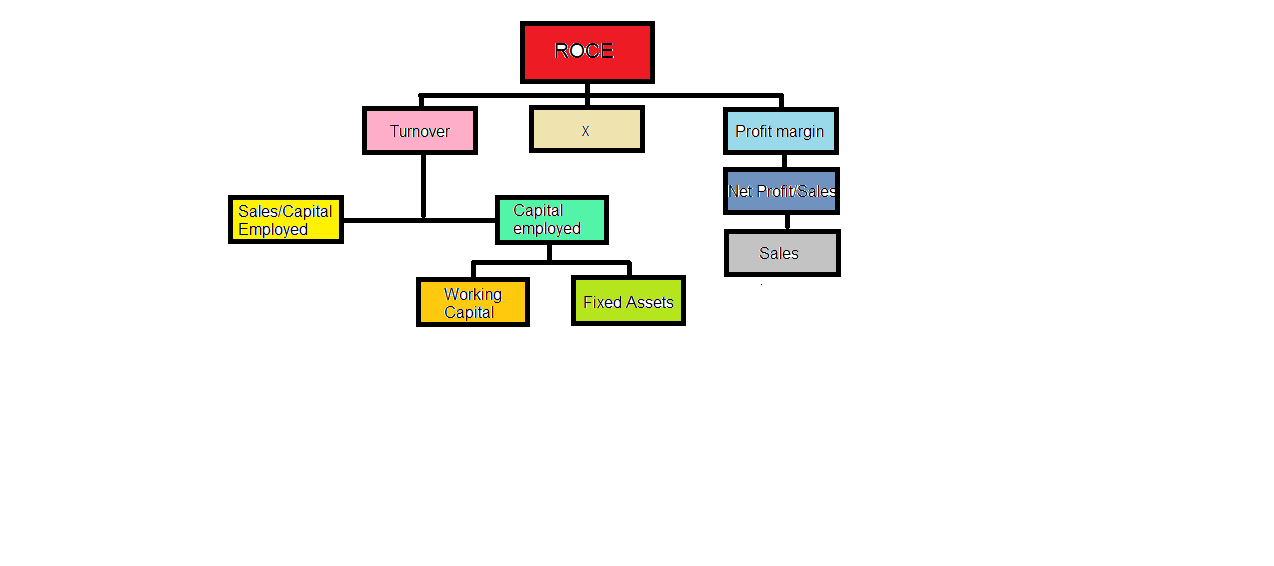

The Du Pont identifies that the earning power of a firm is represented by (Return on Capital Employed) ROCE. ROCE shows the combined effect of the profit margin and the capital turnover. A change in any of these ratios would change the company’s earning power. These two ratios are affected by many factors. Any change in these factors would bring a change in these two ratios.

The two components of this ratio: profit margin and investment turnover ratio individually cannot give the overall view because the profit margin ratio ignores the profitability of investments and the investment turnover ratio ignores the profitability on sales.

ROCE = Turnover x Profit Margin

Turn over = Sales/ Capital Employed

Capital Employed = Working Capital + Fixed Assets

Working Capital = Stock + Bills Receivable + Debtors + Cash

Profit Margin: Net Profit/ Sales

Net Profit = Sales – (Manufacturing costs + Selling costs + Administrative costs)

Special issues in financial analysis – Banking Industry:

The primary business of the banks is to deposit funds and pay interest that is expenditure for them and the source of income in lending these funds to business, agriculture and industry etc. and charge interest to meet the expenses and earn reasonable profit for growth and survival.

Banks are financial intermediaries playing a crucial role of connecting the depositors (who save money) and the borrowers (who need money). Banks borrow money in the form of acceptance of deposits both from retail and wholesale customers (depositors) as well as banks and financial institutions. The funds are deployed as assets. Bank assets can be broadly classified into (i) Loan assets (ii) Investments and (iii) Other assets (fixed assets)

In both capacity as lending banker and investing banker, a banker needs to be careful. He needs to carry out as due diligence exercise for various reasons:

• Safety and security is the concern of a lending and investing banker, since he also acts as trustee for the depositor’s money.

• While lending as well as investing, banks are exposed to many risks.

• Banks needs to balance their assets and liabilities, and also ensure proper liquidity management.

• Banks should carefully handle their assets portfolio to ensure that their NPA levels remain at minimum possible levels.

In view of the above, a banker’s financial analysis would be different from other category of persons and entities that use the financial statements for various purposes and reasons.