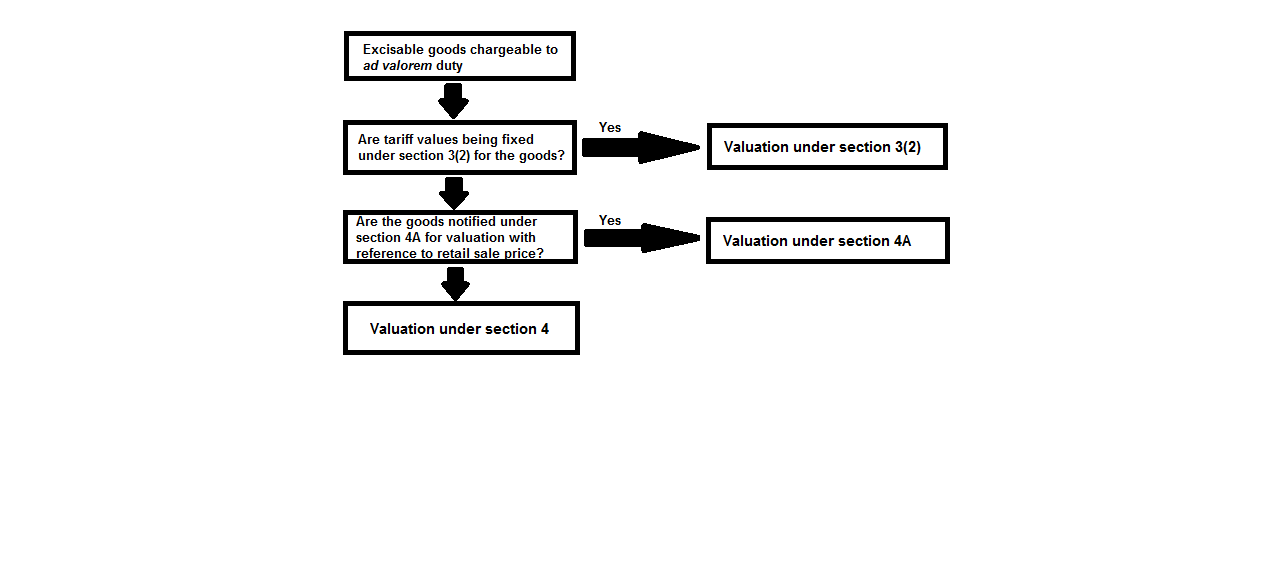

Duty based on value (Ad valorem duty):

In the case of duties charged on the basis of value, such value may be charged on either of the following basis:

(a) Duty as a percentage of Tariff value fixed by the Central Government u/s 3(2) of the Central Excise Act, 1944: The Central Government is empowered to notify the values of goods which will be chargeable to ad valorem duty as per Central Excise Tariff Act, 1975. In such a case, the task is easy since the value is already fixed. For example, Central Government has fixed tariff value for jewellery (other than sliver jewellery) under heading 7113 and branded readymade garments under Chapter 61 and 62. The Central Government has also got the power to alter the tariff value once fixed.

The Central Government may fix different tariff values for different classes or descriptions of the same excisable goods. The Central Government can also fix different tariff values for same class or description of the goods but produced or manufactured by different classes of producers or manufacturers or sold to different classes of buyers. Such tariff values may be fixed on the basis of wholesale price or average price of various manufacturers as the Government may consider appropriate.

(b) Duty as a percentage of Assessable Value determined in accordance with section 4 of the Central Excise Act, 1944 (Ad valorem duty): Section 4 deals with the valuation of goods which are chargeable to duty on the basis of ad valorem. Prior to 1st July 2000 the valuation under this section was based on the principle of ‘normal price‘ which was based on the prices at which manufacturer sold the goods. Since 1st July 2000, the new concept of transaction value has been brought in to the central excise law.

(c) Duty may also be fixed on the basis of maximum retail price after giving permissible deductions: This has been done under section 4A on many mass consumption products where the retail price and wholesale price of goods are at wide variance and the Government wants to raise revenues knowing that the manufacturer has shifted much of the overheads away from the manufacturing location.

Valuation under section 4 and also section 4A (MRP valuation) are discussed in detail in the coming paragraphs. The scheme of ad valorem valuation in general is summarised below: