Extension in period of operation by casual taxable person and non-residenttaxable person

(1) Where a registered casual taxable person or a non-resident taxable person intends toextend the period of registration indicated in his application of registration, anapplication in FORM GST REG-11 shall be submitted electronically through thecommon portal, either directly or through a Facilitation Centre notified by theCommissioner, by such person before the end of the validity of registration granted tohim.

(2) The application under sub-rule (1) shall be acknowledged only on payment of the amount specified in sub-section (2) of section 27.

Relevant circulars, notifications, clarifications, flyers issued by Government: –

1. Chapter one of the compilation of the GST Flyers titled ‘Registration under GST Law’, as issued by the CBIC (erstwhile CBEC).

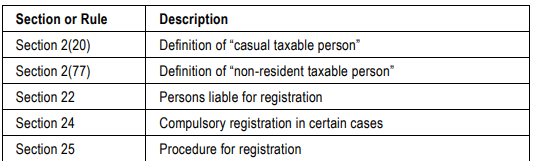

Related provisions of the Statute: