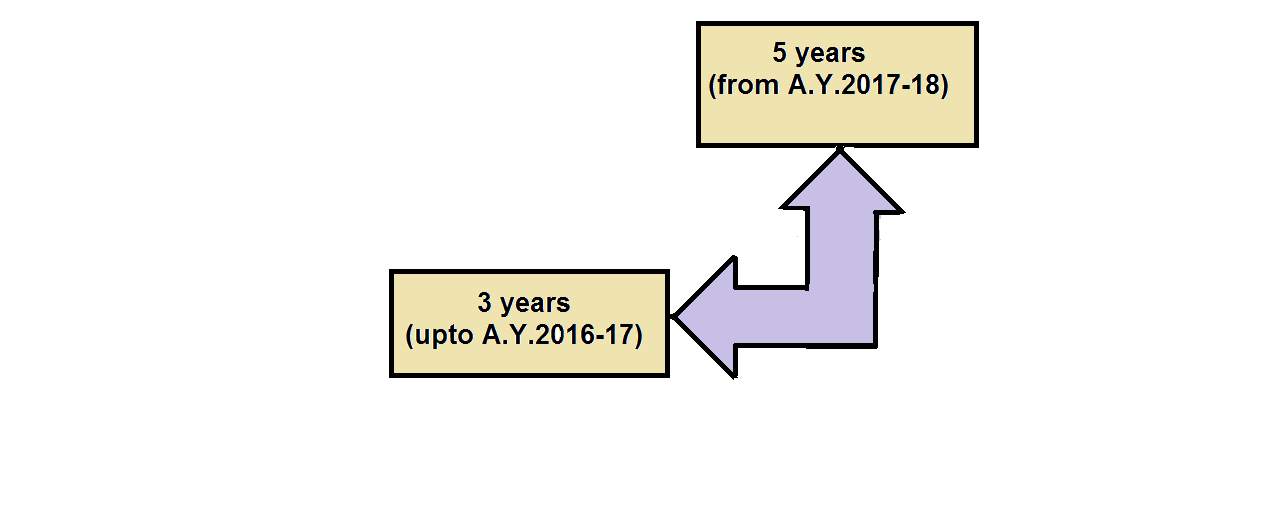

Extension of period for completion of construction from 3 years to 5 years, for claiming higher deduction of upto ` 2 lakh in respect of interest on capital borrowed for construction of self-occupied house property

Effective from: A.Y.2017-18

(i) Section 24(b) provides that interest payable on capital borrowed for acquisition or construction of a house property shall be deducted while computing income from house property.

(ii) In case of self-occupied house property, the annual value is Nil as per section 23(2).

(iii) However, a deduction of an amount of upto ` 2 lakh is allowed under section 24 in respect of interest on capital borrowed on or after 1st April, 1999 for acquisition or construction of a house property for the purpose of self-occupation, where such acquisition or construction is completed within three years from the end of the financial year in which capital was borrowed.

(iv) Since housing projects are taking a longer time for completion, a higher deduction of upto ` 2 lakh on account of interest paid on capital borrowed for acquisition or construction of a self-occupied house property shall be available if the acquisition or construction is completed within five years from the end of the financial year in which capital was borrowed.

Time period for completion of construction (from the end of the financial year

in which capital was borrowed)