Extension of scope of concealed income :

Penalty under section 271(1)(c) – If the Assessing Officer or the Commissioner (Appeals) in the course of proceedings under the Act, is satisfied that any person has concealed the particulars of his income or furnished inaccurate particulars of income, then, he may direct that such person shall pay penalty which shall not be less than the tax sought to be evaded, but which shall not exceed three times the amount of tax sought to be evaded. The penalty is in addition to the tax, if any, payable by the assessee. Therefore, section 271(1)(c) is attracted where (a) any person has concealed the particulars of his income, or (b) has furnished inaccurate particulars of such income.

The Explanations to section 271(1) extend the scope of the provisions relating to levy of penalty.

Explanation 1 : For the purpose of levy of penalty for concealment of income the assessee would be deemed to have concealed the particulars of his income or to have furnished false or inaccurate particulars thereof in cases where, in respect of any facts material to the computation of the taxable income of the assessee:

(i) he has failed to offer a satisfactory explanation or the explanation offered by him is found by the Assessing Officer or the Commissioner (Appeals) or the Principal Commissioner or Commissioner to be false; or

(ii) the assessee offers an explanation which he is not able to substantiate and fails to prove that such Explanation is bonafide and that all the facts relating to the same and material to the computation of his total income have been disclosed by him.

Under these circumstances the amount added or disallowed in the computation of the taxable income as a result of the unsatisfactory or the false statement of the assessee would be deemed to represent concealed income in respect of which fake particulars had been furnished by the assessee.

Students may note that the burden to prove that his explanation is bonafide etc. has been specifically placed upon the assessee.

Explanation 2: In case where the source of any receipt, deposit or outgoing or investment in any assessment year is claimed by any assessee to be an amount which had been added in computing his taxable income or deducted in computing the assessable loss in his assessment for any earlier assessment year/years, but in respect of which no penalty under section 271(1)(c)(iii) had been levied, then, that part of the amount which had been so added or deducted in the earlier assessment year immediately preceding the year in which the receipt, deposit, outgoing or investment appears, which is sufficient to cover the amount represented by such receipts, or outgoings or the value of such investments (otherwise known as the utilised amount or value) must be treated as the income of the assessee the particulars of which had been concealed or inaccurate particulars whereof had been furnished for the first preceding year. Where the amount so added or deducted in the first preceding year is not sufficient to cover the utilised amount, then, that part of the sum added or deducted in the year immediately preceding the first preceding year which is sufficient to cover such part of the utilised amount as is not so covered must be treated as the income of the assessee which had been concealed for the year immediately preceding the first preceding year, and so on, until the entire utilised amount is covered by the amount so added to the income or deducted from the loss of such earlier assessment year or years.

Where any penalty is imposable by virtue of this Explanation, proceedings for imposition of penalty may be initiated even if the proceedings in the course of which penalty proceedings could have been initiated have been completed. This is provided for in section 271(1A).

Explanation 3 : Failure to furnish return of income, without reasonable cause, required to be furnished under section 139 in respect of any assessment year within the period specified in section 153(1), would be deemed as concealment of particulars of income in respect of such assessment year where –

(i) no notice has been issued under section 142(1)(i) or section 148 until the expiry of the period specified in section 153(1); and

(ii) the Assessing Officer or Commissioner (Appeals) is satisfied that in respect of such assessment year, such person has taxable income.

The person would be deemed to have concealed the particulars of income in respect of such assessment year, notwithstanding that such person furnishes a return of his income at any time after the expiry of the period specified in section 153(1) in pursuance of a notice under section 148.

Explanation 4 :

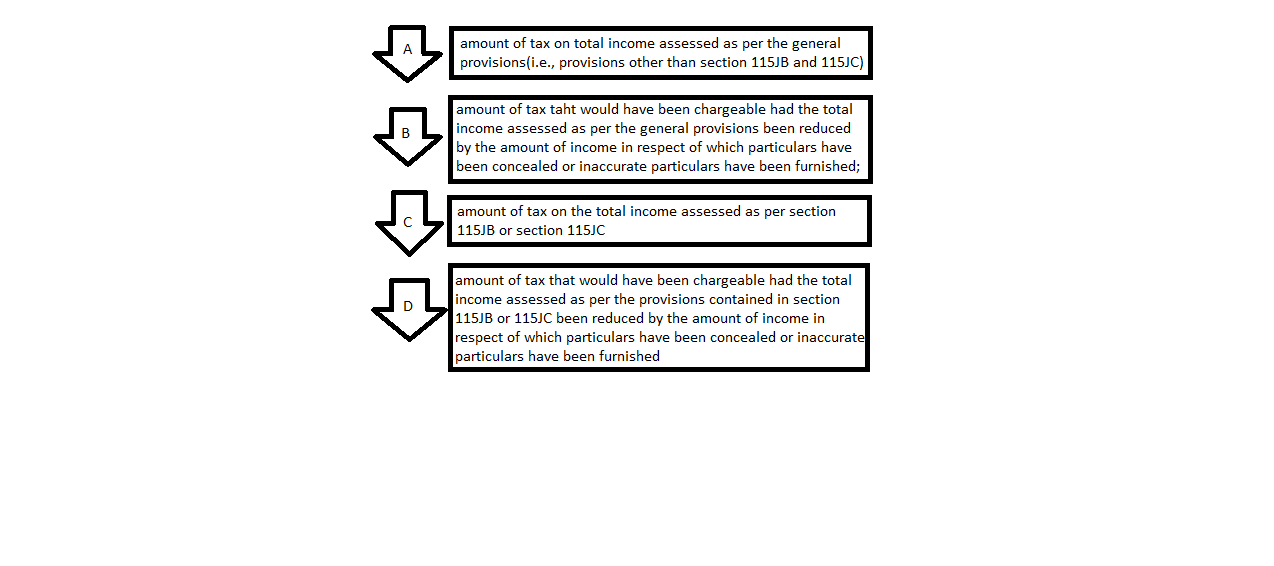

The amount of tax sought to be evaded = (A-B) + (C-D), where

However, where the amount of income in respect of which particulars have been concealed or inaccurate particulars have been furnished on any issue is considered both under section 115JB/115JC and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D

Ignore the portion (C-D) in the formula, where the provisions of section 115JB or section 115JC are not applicable.

In a case where the amount of income in respect of which particulars have been concealed or inaccurate particulars have been furnished has the effect of reducing the loss declared in the return or converting that loss into income,

| Amount of tax sought to be evaded = | |

| The amount of tax that would have been chargeable on the income in respect of which particulars have been concealed or inaccurate particulars have been furnished had such income been the total income | (+) (C – D) |

Where in any case to which Explanation 3 applies,

| Amount of tax sought to be evaded = | ||

| Tax on total income assessed |

(-) {

|

Advance tax

TDS TCS Self-assessment tax paid before issue of notice u/s 148 |

Explanation 5A : Explanation 5A would be applicable in respect of searches conducted on or after 1st June, 2007. This Explanation provides that where an assessee is found to be the owner of any –

– asset and he claims that such assets have been acquired by him by utilizing his income for any previous year; or

– income based on any entry in the books of account or documents or transactions and he claims that such entry represents his income for any previous year,

which has ended before the date of the search and the due date for filing of the return has expired and return has not been filed, such income would be deemed to be concealed income, even if such income is declared in the return of income filed on or after the date of search.

The scope of Explanation 5A has been expanded retrospectively w.e.f. 1st June, 2007 to cover cases where the assessee has filed the return of income for any previous year before the date of search and the income found during the course of search relating the such previous year is not disclosed in the return of income. In such cases also, the assessee would be deemed to have concealed the particulars of income and would be liable for penalty under section 271.

Explanation 6: Penalty for concealment of income shall not be imposed on so much of the income on which additional income tax has been charged under sec tion 143(1)(a).

Explanation 7: In the case of an assessee who has entered into an international transaction under section 92B or a specified domestic transaction under section 92BA, if any amount is added or disallowed in computing the total income under section 92C(4), then the amount so added or disallowed shall be deemed to be income in respect of which particulars have been concealed or inaccurate particulars have been furnished unless the assessee proves to the satisfaction of the Assessing Officer or Commissioner (Appeals) or the Principal Commissioner or Commissioner that the price charged or paid in such transaction was computed in accordance with the provisions of section 92C in the prescribed manner under that section, in good faith and with due diligence.

Section 271(1B) clarifies that where any amount is added or disallowed in computing the total income or loss of an assessee in any order of assessment or reassessment, and such order contains a direction for initiation of penalty proceedings under section 271(1)(c), such an order of assessment or reassessment shall be deemed to constitute satisfaction of the Assessing Officer for initiation of the penalty proceedings.