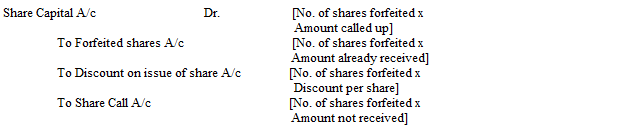

Forfeiture of shares – issued at Discount :

When shares originally issued at discount are forfeited then discount on shares account should be cancelled. This can be done by crediting discount on shares account. The accounting entry passed to record the same is:

Illustration :

Nanda Ltd. issued 10000 shares of Rs.10 each to the public at discount of 10% payable as follows:

on application Rs.2.50;

on allotment Rs.3.00;

on first & final call Rs.3.50.

All money due were received except from one shareholder Mr.Udhay, to whom 100 shares are allotted failed to pay the final call

money. The directors forfeited shares after giving due notice. Pass journal entry for forfeiture.

Solution:

In the Books of Nanda Ltd.

Journal Entry

| Date | Particulars | L.F | Debit | Credit |

| Share Capital A/c [100 x 10] Dr | 1,000 | |||

| To Forfeited shares A/c [100 x 5.50] | 550 | |||

| To Discount on issue of shares A/c [100 x 1] | 100 | |||

| To Final Call A/c [100 x 3.50] | 350 | |||

| (Forfeiture of 100 shares for non payment of final call money) |