Goods & Excisable goods :

Before we examine the question of what amounts to manufacture, it must be understood that unless the goods that are manufactured are excisable goods, there will be no question of attracting excise duty.

Section 2 (d) of the Act defines excisable goods to be “goods which are specified in the Tariff as being subject to a duty of excise and includes salt”.

Explanation to section 2(d) provides that “goods “includes any article, material or substance which is being capable of brought and sold for a consideration and such goods shall be deemed to be marketable.

Therefore, the following two conditions have to be satisfied to be excisable goods:

(i) Firstly, the goods must be specified in the First or Second Schedule to the Central Excise Tariff Act, 1985.

(ii) Secondly, the goods so specified must be subject to duty as per the Tariff. The goods which are not covered in the schedules are referred to as non-excisable goods.

The First Schedule to CETA 1985 is the main schedule containing 96 chapters under which the goods are arranged and this arrangement is based on HSN. Chapters are grouped under Sections and are further sub-divided into headings and sub-headings. Each chapter handles a different category of item as compared to the preceding and succeeding chapters. The duty rates for the various items are specified in such chapters and the duty would be charged on the goods at the specified rates.

Hence, excise duty would be levied when the items which are subject to duty are goods, are specified in the Tariff and have come into existence as a result of manufacture.

The word “goods” has not been defined in the Central Excise Act. The word “goods” is defined in Article 366(12) of the Constitution of India as “goods include all materials, commodities and articles”.

Sale of Goods Act, 1930 in section 2(7) defines goods to mean “every kind of movable property other than actionable claims and money; and includes stocks and shares, growing crops, grass and things attached to and forming part of the land which are agreed to be severed before sale or under the contract of sale”. To be “goods” the article concerned must be movable. In other words, immovable property cannot be goods. Any movable property whether visible, tangible, corporeal or not will constitute goods.

Black‟s Law Dictionary define “goods” as a term of variable content and meaning. It may include every species of personal property or it may be given a very restricted meaning.

In U.O.I. v. DCM 1997(1) E.L.T. J199, the Supreme Court has held that in order to be goods the articles must be capable of coming to the market to be bought and sold. Therefore, to be called goods, the items must be moveable and marketable.

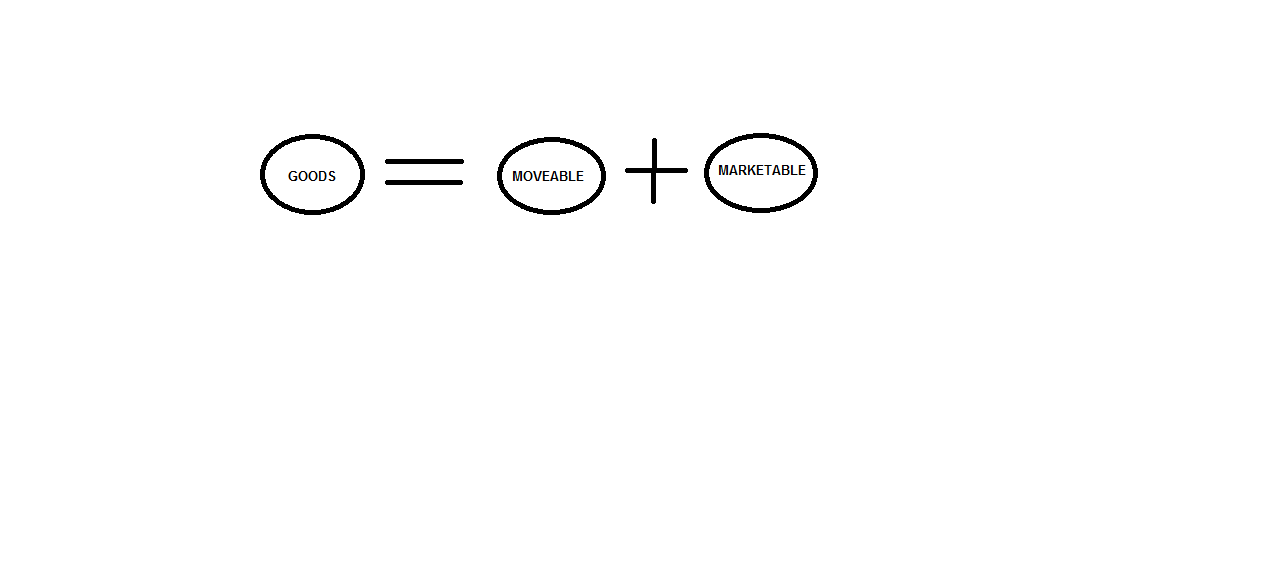

From the above, two fundamental aspects of the term “goods” arise that they should be “moveable‟ and “marketable‟.