Goods sent or taken on approval for sale or return basis

As per this system, certain goods are sent to the recipient without supplying/selling the same at its outset. These goods can be examined or tested by the recipient as to whether his requirements are fulfilled. The recipient can at per his behest, approve the said supply or return the said goods. If the goods are returned, no supply will be deemed to have taken place. If the goods are approved by the supplier, then it will amount to a supply. The las t date of issuance of invoice in such cases as per Section 31(7) of the CGST Act 2017 has been given as earlier of:

a) Before at the time of supply

b) Six months from the date of removal

Here, time of supply refers to the time when the confirmation is given by the recipient that he is willing to accept the goods. The last date of issuance of invoice in such cases will be the confirmation of acceptance subject to the fact that this acceptance should not take place after six months from the date of removal. If the approval does not come within the time frame of six months /comes after the period of six months from the date of removal, then the last date of invoice arises on the date when this period of six months from the date of removal expires.

Unlike the case of VAT law where an invoice is required to be issued when ‘transfer of property’ takes place and invoice does not have to be kept pending until they are physically removed, GST requires issuance of an invoice at the time of their ‘removal’ or ‘delivery’, as t he case may be, notwithstanding any delay in transfer of property. As explained earlier, an invoice does not by itself prove anything except that it is a record of the terms of understanding of the underlying transaction. Accordingly, referring back to our brief mention about person and taxable person’, the tests requiring examination under section 31 must be administered not only in a transaction between two persons but even on all the transactions between two taxable persons even if they belong to the same person.

It is only upon undertaking a detailed enquiry into the questions of fact determined under section 31 in the respective cases, will we be able to determine one of the two elements prescribed to be the ‘time of supply’ under section 12. Time of supply therefore, is earlier of date of invoice as per section 31 or date of receipt of payment with respect to the supply.

Exceptions:

(i) When an amount is received in excess of tax invoice up to `1,000/-, the time of supply in respect of such excess at the option of the supplier shall be the date of such invoice.

(ii) Supply shall be deemed to have been made to the extent of the value of supply indicated in the invoice or the value of payment received by the supplier.

(iii) Date of receipt of payment shall be the date on which the payment is accounted in the books of the supplier or the date reflected in the bank account of the supplier, whichever is earlier.

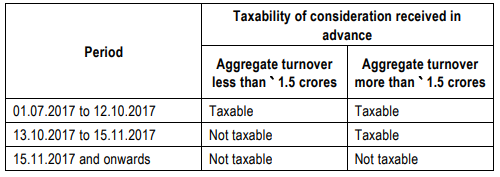

(iv) The registered person who did not opt for the composition levy under section 10 shall pay the central tax on the outward supply of goods at the time of supply as specified in section 12(2)(a) i.e. the date of issue of invoice by the supplier or the last date on which he is required, under section 31(1), to issue the invoice with respect to the supply.Therefore, no GST is payable on advances received against supply of goods. (NN66/2017-Central Tax dated 15-Nov-17)). Earlier by Notification No.40/2017- Central Tax dtd.13-Oct-17, the benefit was granted to only small assesses whose turnover in the preceding financial year or in the year in which he obtain registration does not exceed or is not likely to exceed `150 Lakhs. However subsequently the scope was enhanced to include all registered persons making supply of goods except the persons who have opted for composition under section 10. In summary, the taxability of the consideration received in advance would be as follows:

The above notifications also refer to the situations attracting the provisions of Section 14 (change in rate of tax in respect of supply of goods or services). Accordingly, the date of receipt of advances would not be relevant for the purpose of ascertaining appropriate rate of tax in case of change. In other words, the applicable rate of tax in case of change in rate of tax would be ascertained based on the date of issuance of invoice and date of supply of goods only.

(v) The provisions relating to job-work provides for supply of capital goods / inputs to the job-worker without payment of tax (section 143). The intention of the law is not to tax capital goods / inputs sent to job-worker as supply since in such an arrangement the goods are received back by the principal. However, if such goods are not received back within three years and one year respectively, it would qualify as supply by way of operation of deeming fiction provided under section 143(2) and section 143(3). In such a scenario, the date of sending the goods to the job-worker would be deemed to be the date when the goods were sent to the job-worker originally. It is important to understand here that the incidence of tax falls back on the date when the goods were sent to the and the operation of deeming fiction dictates the date of supply of goods as the time of supply. This would be in deviation to the general principles of ascertaining the time of supply viz., date of removal of goods on which the principal ought to have issued the invoice. In this regard, the Central Government has issued a Circular No. 38/12/2018 dated 26.03.2018 wherein it is clarified that the principal should issue an invoice on expiry of three years / one year and should declare such supplies in the return filed for the month in which the time period of three years / one year is expired.

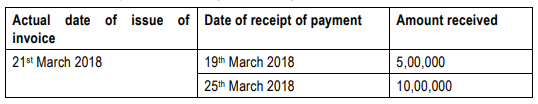

Illustration 9: Assuming the circumstances given under the illustrations 3, 4, 5 and 6, please find the time of supply after considering the following additional information:

Answer: Since, the date of receipt of payment will be immaterial in considering the time of supply of goods, the earlier of the two dates i.e. the last date of issue of invoice and actual date of issue of invoice will be considered as the time of supply. So, the time of supply will be as follows:

Illustration 10: A cement manufacturing company generates certain waste materials which are supplied to a recycling factory through a pipeline on a continuous basis.

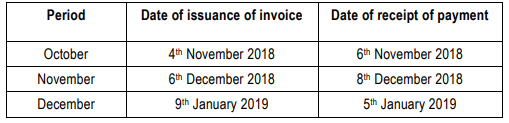

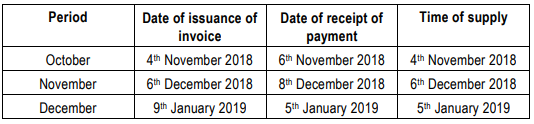

a) Situation 1: Monthly payments of ` 5,00,000 are to be made by 7th of the next month as per the contract. For the period October – December, following were the date of issuance of invoices and payments:

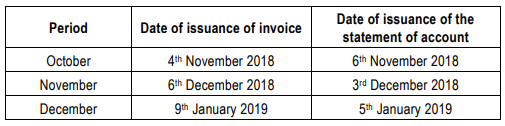

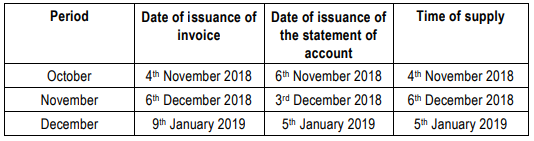

b) Situation 2: Monthly statement of accounts are to be prepared by 5th of the next month as per the contract. For the period October, following were the dates of issuance of the successive statement of account and the date of issuance of invoices:

Answer:

Situation 1: Where there are successive payments involved, the last date of issuance of invoice is the date of receipt of such payment. As per Section 12(2), the time of supply should be the earlier of the date of issuance of invoice or the last date of issuance of the invoice. It may be noted that as per Notification no. 66/2017-CT dated 15th November 2017, only these two events are to be considered and the date of receipt of payment as mentioned under Section 12(2)(b) may be ignored. The due date when the payment should be received Is also immaterial as it has not been specified in either the time of supply provisions or the provisions of the last date of issuance of invoice. Thereby, the time of supply in the given case will be the earlier of the date of receipt of successive payment (last date of issuance of invoice) of the actual date of issuance of invoice.

Situation 2: Where there are successive statements of accounts that are to be prepared, the last date of issuance of invoice will be the date of issuance of such successive statement. As per Section 12(2), the time of supply should be the earlier of the date of issuance of invoice or the last date of issuance of the invoice. It may be noted that as per Notification no. 66/2017 – CT dated 15th November 2017, only these two events are to be considered and the date of receipt of payment as mentioned under Section 12(2)(b) may be ignored. The due date when the successive statement should be prepared is immaterial as it has not been specified in either the time of supply provisions or the provisions of the last date of issuance of invoice. Only the actual date of the preparation of the statement needs to be considered. Thereby, the time of supply will be the earlier of the date of issuance of successive statement of account (last date of issuance of invoice) and the date of invoice.

Illustration 11: Certain goods are sent by Mr. X on sale on approval or return basis to Mr. Y on 22nd April 2018. The supply gets confirmed and invoice is issued on:

Case 1: 20th August 2018

Case 2: 23rd October 2018.

Payment in each of the cases is made on 23rd November 2018.

Answer: Date of receipt of payment is immaterial for the purpose of calculating time of supply u/s 12(2) of the CGST Act 2017. So, 23rd November 2018 should be ignored altogether. The time of supply should be earlier of the date of issuance of invoice or the last date of issuance of invoice. The last date of issuance of invoice will be the earlier of the confirmation of supply or six months from the date of removal.

In case 1, the confirmation of supply occurred before 6 months from the date of removal. So, the last date of issuance of invoice was 20th August 2018. On this date, the invoice was issued. So, the time of supply will be 20th August 2018.

In case 2, the confirmation of supply happened after 6 months from the date of removal. Six months expired on 21st September 2018. So, the invoice was required to be issued by this date. Since the invoice was issued on 23rd October 2018, the actual date of issue of invoice will be considered as falling after the last date of issuance of invoice. So, the time of supply will be the last date of issuance of invoice i.e 21st September 2018.