Government grant or subsidy, for the purpose of the corpus of a trust or institution established by the Central Government or State Government not to be included in the definition of income [Section 2(24)] :

Effective from: A.Y.2017-18

(i) The Central Government had, vide Notification dated 31.3.2015, in exercise of the powers conferred under section 145(2), notified ten income computation and disclosure standards (ICDSs) to be followed by all assessees, following the mercantile system of accounting, for the purposes of computation of income chargeable to income-tax under the head “Profit and gains of business or profession” or “Income from other sources”.

(ii) ICDS VII deals with the treatment of government grants. It recognizes that government grants are sometimes called by other names such as subsidies, cash incentives, duty drawbacks etc.

(1) This ICDS requires Government grants relatable to depreciable fixed assets to be reduced from actual cost/WDV.

(2) Where the Government grant is not directly relatable to the asset acquired, then, a pro-rata reduction of the amount of grant should be made in the same proportion as such asset bears to all assets with reference to which the Government grant is so received.

(3) Grants relating to non-depreciable fixed assets have to be recognized as income over the same period over which the cost of meeting such obligations is charged to income.

(4) Government grants receivable as compensation for expenses or losses incurred in a previous financial year or for the purpose of giving immediate financial support to the person with no further related costs to be recognized as income of the period in which it is receivable.

(5) All other Government Grants have to be recognized as income over the periods necessary to match them with the related costs which they are intended to compensate.

(iii) Thus, except in case of government grant relating to a depreciable fixed asset, which has to be reduced from written down value or actual cost, all other grants had to be recognized as upfront income or as income over the periods necessary to match them with the related costs which they are intended to compensate.

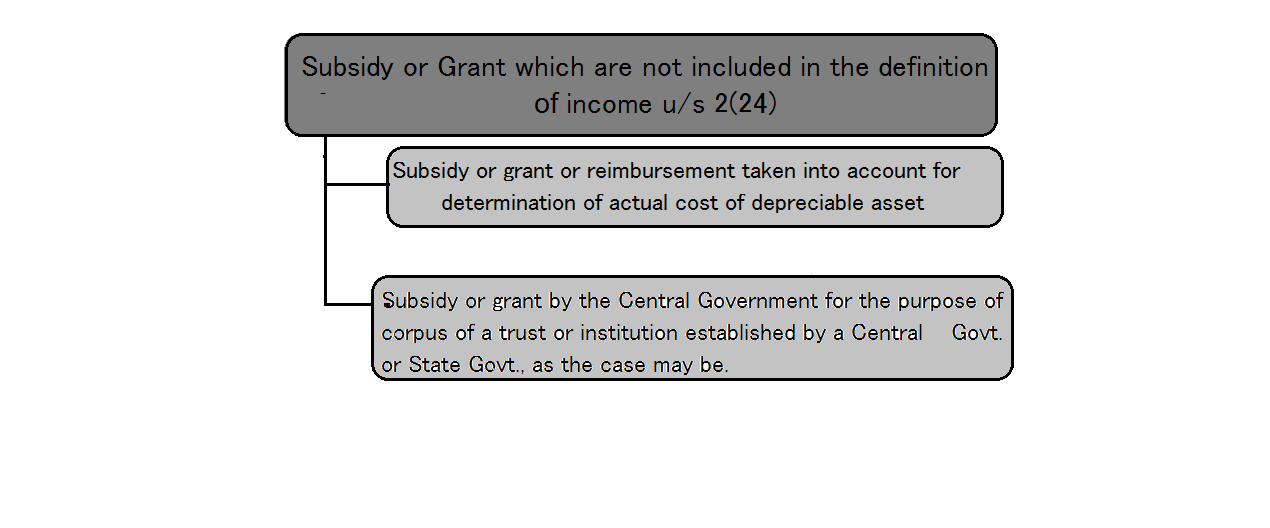

(iv) Further, in line with the requirement in ICDS VII, the Finance Act, 2015 had included sub-clause (xviii) in the definition of income under section 2(24). Accordingly, assistance in the form of a subsidy or grant or cash incentive or duty drawback or waiver or concession or reimbursement, by whatever name called, by the Central Government or a State Government or any authority or body or agency in cash or kind to the assessee is included in the definition of income. The only exclusion was the subsidy or grant or reimbursement which has been taken into account for determination of the actual cost of the asset in accordance with Explanation 10 to section 43(1).

(v) Consequently, grant or cash assistance or subsidy etc. provided by the Central Government for budgetary support of a trust or any other entity formed specifically for operationalizing certain government schemes would become taxable in the hands of trust or any other entity.

(vi) In order to avoid genuine hardship in such cases, section 2(24) has been amended to provide that subsidy or grant by the Central Government for the purpose of the corpus of a trust or institution established by the Central Government or State Government shall not be included in the definition of income.