GST TAX RATE CHART FOR FY 2017-2018 (AY 2018-2019),GOODS AND SERVICE TAX

For GST Goods rate chart-click here

For GST Service rate chart- click here

For GST Service Tax Exemption List- click here

For GST Reverse Charge Mechanism Chart –click here

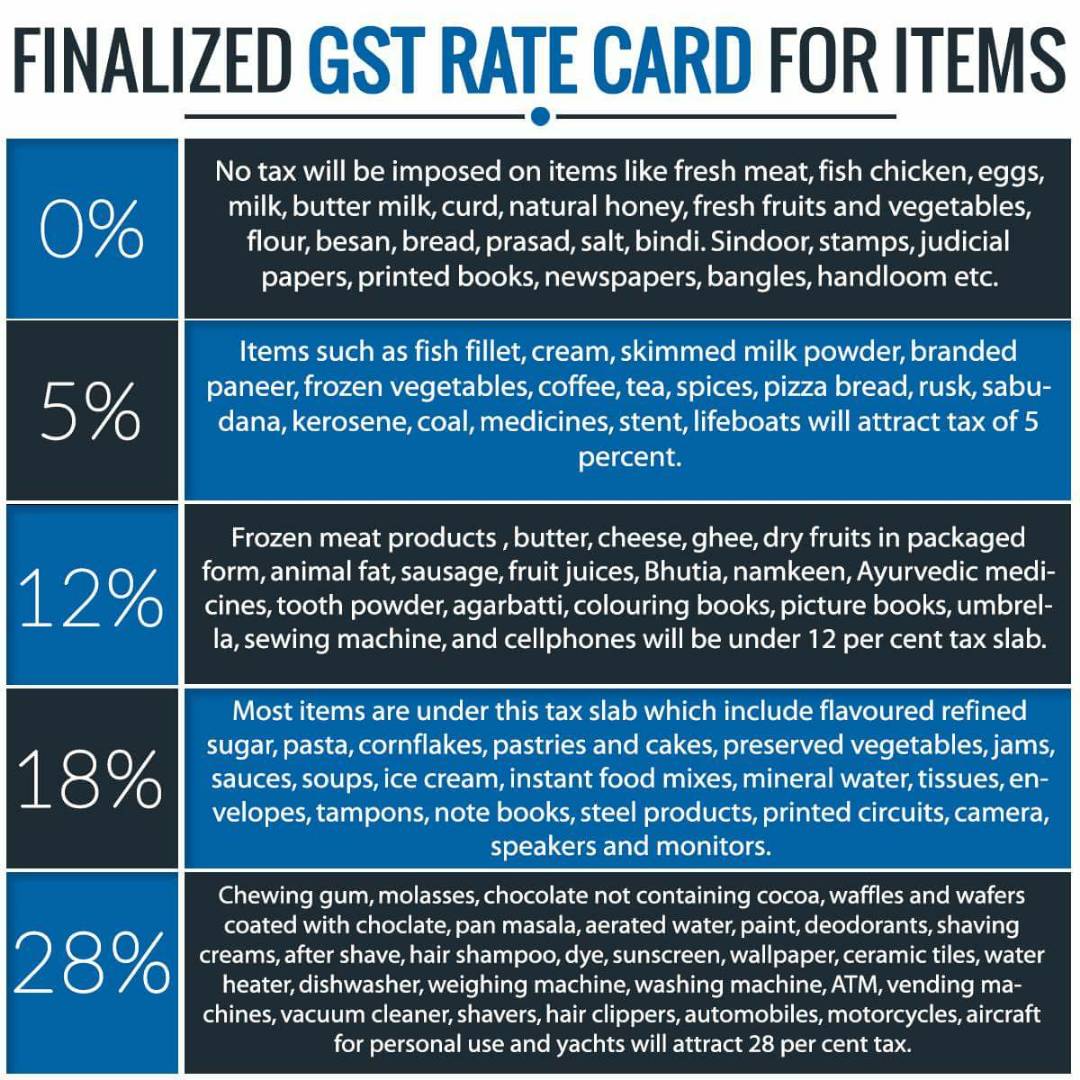

GST Council announces 4 rates for services – 5%, 12%, 18% and 28%;

- 5% rate mostly for transportation services;

- Most of current service tax exemptions grandfathered and may continue under GST;

- Healthcare & Education shall continue to be exempt;

- Rates for Restaurant services will vary as per tariffs charged and facilities provided, ranging from 12-18%;

- Gambling and Cinema services to fall under 28% slab, as entertainment tax merged with service tax under GST;

- Works contract taxable at 12% with full Input Tax Credit;

- Council to meet next on June 3rd to deliberate on rates for gold & precious metals .

Deatiled Chart (Goods) As Finalised on 18th May,2017

[embeddoc url=”https://www.taxdose.com/wp-content/uploads/2016/09/chapter-wise-rate-wise-gst-schedule-18.05.2017.pdf” download=”all”]

Deatiled Chart (Services) As Finalised on 19th May,2017

[embeddoc url=”https://www.taxdose.com/wp-content/uploads/2016/09/schedule-of-gst-rates-for-services.pdf”]

Deatiled Chart (Reverse Charge Mechanism) As Finalised on 19th May,2017

[embeddoc url=”https://www.taxdose.com/wp-content/uploads/2016/09/list-of-services-under-reverse-charge1.pdf”]

Composition Tax criteria

- The taxable persons having Aggregate annual turnover of Rs. 50 lakhs are proposed to be made eligible for Composition levy.

- The amount payable in lieu of tax payable will not be less than 1% of the turnover during the year.

- Taxable persons supplying inter state any goods and / or services will not be eligible for it.

- Such eligible person shall not collect tax on supplies made by him.

- He shall not be entitled to claim any input tax credit.

Exemption Limit

Exemption limit for the indirect tax at Rs 10 lakh for Northeastern states and smaller states and Rs 20 lakh for other states along with decision to subsume all cesses into GST.

Northeastern states and smaller states – Rs 10 Lakh

Other states – Rs 20 Lakh