Guidance for Arriving at Fair / Market Value

As a general rule, for an instrument that is actively traded on a recognized public exchange, the price quoted by the exchange where the instrument is traded is used as an appropriate valuation price to arrive at the fair value of the instrument.

In case of instruments that are actively traded over the counter, the quoted bid price for long positions and quoted offer price for short positions is used as an appropriate indicative valuation price. These may be obtained through relevant market makers or brokers.

In case of thinly traded instruments/non-traded OTC derivatives, various techniques are used to determine the best estimate of a market price. This synthetic market price may be derived through use of market data (such as interest/ exchange rates) in appropriate models/systems designed for this purpose.

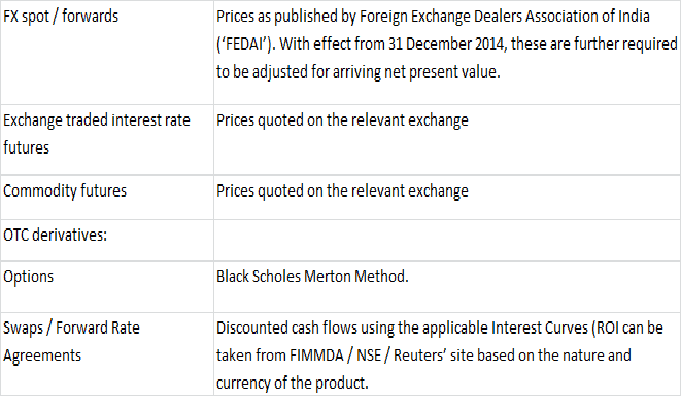

In case of the following instruments, fair value can be arrived at using the market data as mentioned there against:

The valuation of derivatives is based on exchange rate and the swap rate prevailing on the valuation date. Various banks use different in-house/ vendor developed model for valuation of their derivative products. However, the general benchmarks used for valuation are OIS/MIBOR, MIFOR, MITOR, LIBOR and INBMK as per the end of the day quotes appearing on the Bloomberg or Reuters page.

In case of hedge swaps, the income/ expense is accounted for on an accrual basis except the swap designated with an asset or liability that is marked to market or lower of cost or market value in the financial statements. In that case, the swap should be marked to market with the resulting gain or loss recorded as an adjustment to the market value of designated asset or liability. Whereas, the trading swaps are marked to market as per the instructions contained in the RBI circular NO. MPD. BC. 187/07.01.279/1999-2000 dated July 7, 1999.

The market to market gain/ loss on forward financial derivatives contract is derived from the difference between the agreed-upon contract price of an underlying item and the current market price (or market price expected to prevail) of that item, times the notional amount, approximately discounted. The notional amounts – sometimes described as the nominal amount – is the amount underlying a financial derivatives contract that is necessary for calculating payments or receipts on the contract. This amount may or may not be exchanged.

In the specific case of a swap contract, the market value is derived from the difference between the expected gross receipts and gross payments, appropriately discounted; that is, its net present value.

The market value for a forward contract can therefore be calculated using available information – market and contract prices for the underlying item, time to maturity of the contract, the notional value, and market interest rates. From the viewpoint of the counter parties, the value of a forward contract may become negative (liability) or positive (asset) and may change both in magnitude and direction over time, depending on the movement in the market price for the underlying item. Forward contract settled on a daily basis, such as those traded on organized exchanges – and known as futures – have a market value, but because of daily settlement it is likely to be zero value at each end-period.

The price of an option depends on the potential price volatility of the price of the underlying item, the time to maturity, interest rates, and the difference between the contract price and the market price of the underlying item.

For traded options, whether they are traded on an exchange or not, the valuation should be based on the observable price. At inception the market value of a non-traded option is the amount of the premium paid or received. Subsequently, non-traded options can be valued with the use of mathematical models, such as the Black-Scholes formulae, that take account of the factors mentioned above that determine option prices. In the absence of a pricing model, the price reported for accounting or regulatory purposes might be used. Unlike forwards, options cannot switch from negative to positive value, or vice versa, but they remain an asset for the owner and a liability for the writer of the option.

It may be mentioned that counter party wise netting is only allowed where specific legally enforceable bilateral netting arrangement such as International Swaps and Derivative Association (ISDA) master agreement, etc., exists.