Ingredients of transaction value :

It would be important to see that the definition of transaction value is an all inclusive definition which seems to extend its scope beyond the normal boundaries of central excise levy.

While it is true that such a definition is necessary when we have a full fledged VAT system, it is rather premature to include so many items within the parameters of excise, more so when the assesses are paying sales tax and service tax.

It is important to note that the Supreme Court has held in the context of customs law in Associated Cement Companies Ltd. v. CC 2000 (121) ELT 21 that the concept of transaction value is quite different from the concept of price and such value can include many items which may classically have been understood to be part of the sale price.

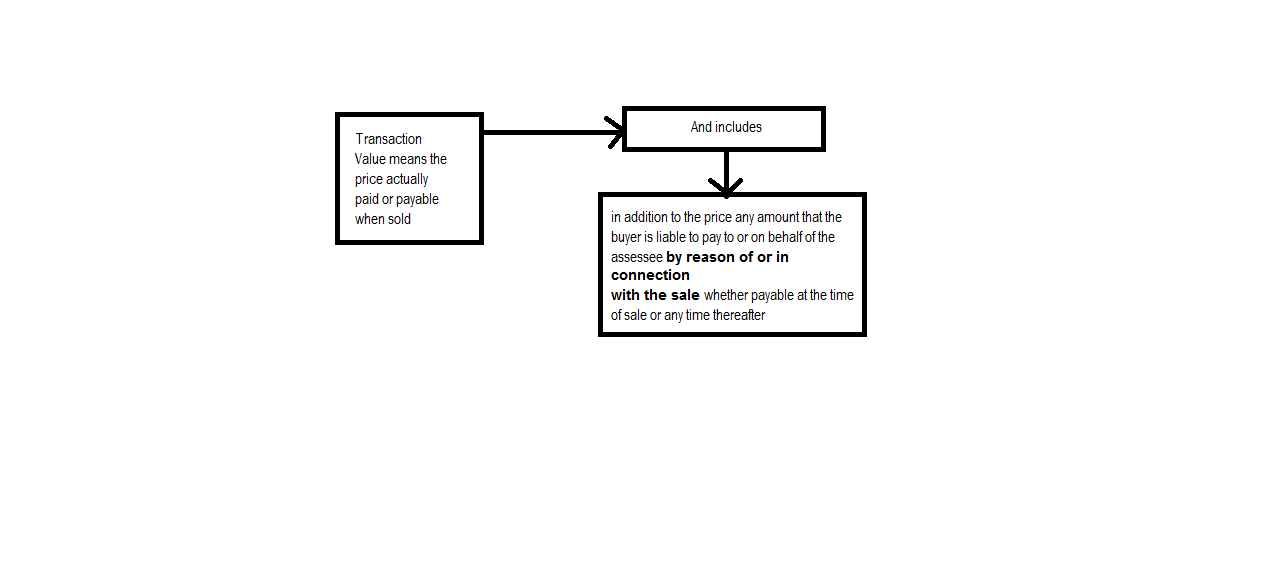

Let us analyse the definition of transaction value through the use of flow charts.

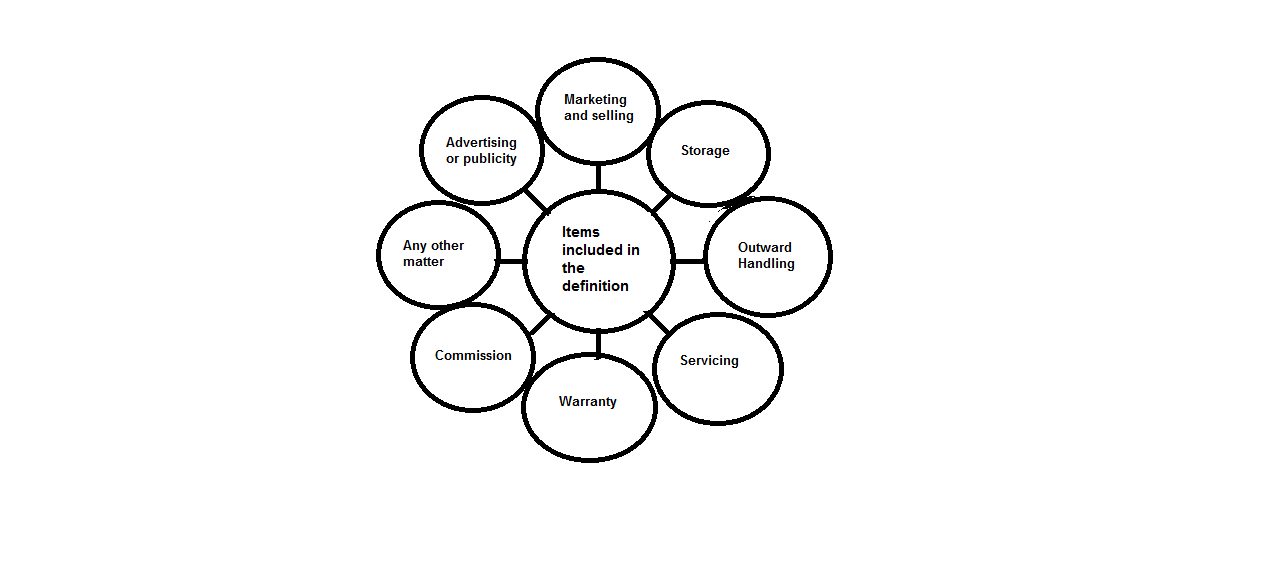

The definition also gives an illustration of what amounts are included as additions to price which the buyer may be liable to pay to or on behalf of the assessee. However, the definition specifically states as “including but not limited to” which clearly means that the items included in the definition are only illustrative and more may be includible.

It is clear that the above are includible only if the buyer is liable to pay for or on behalf of the assessee.

The above are not includible, if actually paid or payable.

It would be worthwhile to examine the issue of includibility or otherwise of certain items.

| S. No | Items of Cost | Includibility or otherwise |

| 1 | Advertising and publicity | Yes |

| 2 | Warranty | Yes |

| 3 | Marketing and selling | Yes |

| 4 | Storage and outward handling | Yes |

| 5 | Servicing | Yes |

| 6 | Commission | Yes |

| 7 | Discounts (Trade and Cash) | No. Since the same is already factored into the definition of transaction value. See also CBEC Circular No. 354/81/2000-TRU, dated 30-6-2000 itself clarifies that reference to discounts in the definition of transaction value is not relevant since duty is to be charged on net price after allowing discounts. However, the Circular states that the discount should be actually passed on to the buyers. |

| 8 | Erection, installation and commissioning | No. The erection, installation and commissioning charges should not be included in the assessable value, if the final product is not excisable. |

| 9 | Packing | Yes. The durable and returnable packing is deductible. |

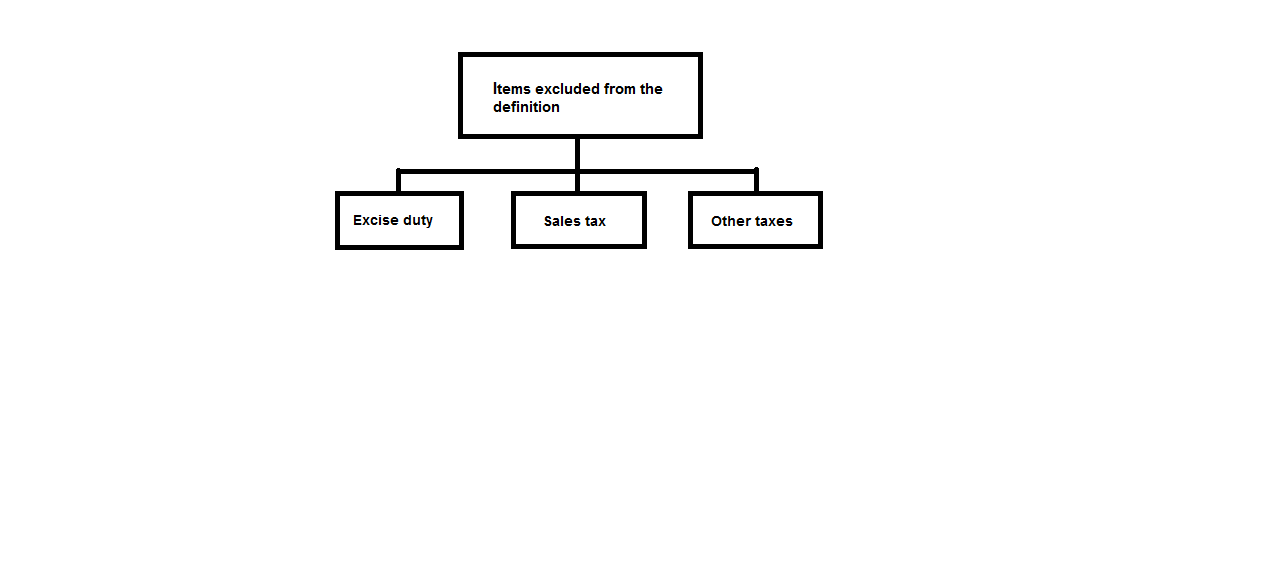

| 10 | Taxes and duties | No. Specifically excluded by section. |

| 11 | Interest on deposits, advances. | No. |

| 12 | Accessories | No. See decision of Supreme Court in Shriram Bearing Ltd v. CCE 1997 (91) E.L.T. 255 |

| 13 | Dharmada | Yes. [CBE&C Circular No. 763/79/2003 C.X. dated 21.11.2003] |

| 14 | Freight | No. |

| 15 | Interest on delayed payment of receivables | No. Interest is nothing but finance charges and cannot be considered as payment by reason of sale. |

| 16 | Warranty | The definition of transaction value itself includes warranty and service charges. It shall form a part of transaction value if it is recovered from buyer. |

| 17 | Design, development and engineering charges | Yes, since it is by reason of sale or in connection with sale. |

| 18 | Transit insurance | No, as it is part of transportation cost [Bombay Tyres International]. However, it should be shown separately in the invoice or can be included in the transportation cost shown separately. |

| 19 | Delayed payment charges | No, as “transaction value” relates to the price paid or payable for the goods and delayed payment charge is nothing but the interest on the price of the goods which is not paid during the normal credit period. However, to be admissible as deduction it should be separately shown or indicated in the invoice and should be charged over and above the sale price of the goods. |

| 20 | Pre-delivery inspection and after sale services | Yes, only if such charges are collected by the manufacturer [Tata Motors Ltd. v. UOI 2012 (286) ELT 161 (Bom.)]. |

However, the above is not conclusive in all cases and would be subject to interpretation of the Courts in future.