Input Service Distributor – Sec. 20 :

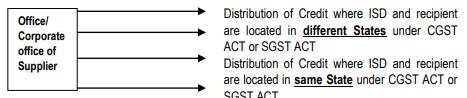

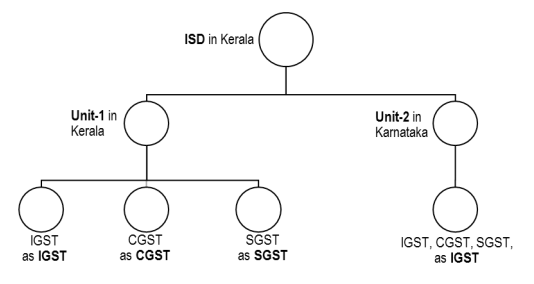

ITC is distributed to supplier of goods or services or both of same entity having the same PAN as the ISD

Common Services used at for

Input Service Distributor

Illustration 3: Consider an example where a Company has a Branch-M in Mumbai and a Branch-D in Delhi. This Company is also incorporated in Delhi. Branch-M incurs various expenses that are supply of services in Delhi where CGST-SGST is liable to be charged in Delhi by that supplier. Obviously, credit of this tax cannot be availed by Branch-D because the underlying expense is not ‘in relation to business’ of Branch-D because it is exclusively in relation to business of Branch-M. When credit cannot be claimed by Branch-D and Branch-M does not want to forego this credit, the option available is for Branch-M to obtain ISD registration in Delhi. Now, in exactly, the same manner, if Branch-M incurs expenses in Maharashtra (say in Nasik), the implications would be that credit not allowable to Branch -M for these supplies and Branch-D is eligible to obtain ISD registration in Maharashtra, if credit is not to be foregone.

From this example, the following questions arise for careful consideration:

| Question | Response |

| (i) Is ISD registration required in ‘all but one’ States for a registered taxable person? (All but one may all States/UT other than Home State) | Yes. If tax charged by the supplier is not IGST but CGST-SGST of the host-State where supplies are taking place, then a registered taxable person would require ISD registration in each those host-States except home-State |

| (ii) Is ISD registration an entity-level office in a given State or is it a registered taxable persons-specific office in other States (outside the home State of that registered taxable person)? | Yes, ISD is an entity-level office because section 2(61) defines ISD as “…. means an office of the supplier …. which receives tax invoice….” It does not say it is an “office of the registered taxable person which receives tax invoice….” |

| (iii) Will ISD registration be required for each registered taxable person in ‘all but one’ States? (All but one may all States/UT other than Home State) | No. One entity-level ISD registration in all States will suffice for credit distribution requirement of all registered taxable persons having same PAN |

| (iv) Can an ISD distribute credit of taxes paid in that State alone (whether IGST or CGST-SGST) to registered taxable persons in all other States or only to that State for whose benefit the ISD registration was obtained? | Since ISD is an entity-level registration, one ISD in a State can distribute credit to all registered taxable persons in all other States having same PAN. Further, this ISD can also distribute credit to separately registered business verticals in that same State |

| (v) When GSTIN registration is obtained in one State, is there any need to also obtain ISD in the same State or is GSTIN and ISD registrations mutually exclusive in a given State? | Yes, GSTIN registration does not permit distribution of credit. If taxes are paid that is not related to the business of that registered taxable person in that State, then for want of ‘nexus’, credit cannot be availed by him.

And to save from loss of credit, ISD registration is the only option to distribute this credit whichever registered taxable person (called ‘recipient of credit’) satisfies this nexus test. |

| (vi) Can a Company who has independent operations in all 29 States and 2 UTs and is therefore registered in all 31 ocations also be required to have 31 ISD registrations? | Yes, the Company could opt to do so.. This is because each registered taxable person stated to be truly independent of other business (of registered taxableersons) and receives supplies in those host-States where CGST-SGST paid in those hostStates is to be distributed to the elevant home-State |

| (vii) Is it possible, when GSTIN registration is already available in any given State, for the Company to completely avoid ISD registration? | No, for the reasons stated in (vi) & (i) above, it would not be possible to avoid ISD registration |

| (viii) If a Company, to avoid ISD compliances, decides to avoid ISD registration in every State where it is already having GSTIN registration? | It is possible that a Company may consider the possibility of doing so subject to loss of legitimate credits which could have been availed as an ISD |

| (ix) If a Company were to instruct all registered taxable persons in a State who may have credit loss in other States misdirect the suppliers into issuing tax invoice with GSTIN of that State? | Yes, it is possible for a Company to misdirect a supplier. This supplier would only look for genuine GSTIN and similarity of name. It is not the supplier’s responsibility to examine ‘nexus’ while issuing tax invoice |

| (x) Is ISD registration, therefore, necessary in every State where this ‘nexus’ test cannot be fulfilled by each registered taxable person? | Yes, as explained in (vii) above, ISD registration is necessary in every State where ‘nexus’ test is not fulfilled |

| (xi) Therefore, if multiple ISD registrations or GSTIN-plus-ISD registrations are unavoidable (as explained above), is there any solution to resolve this multiplicity of monthly and quarterly compliances? | Yes, only if ‘link is established between the ‘no nexus’ supplies in a State and the registered taxable person in that same State. If no such ‘nexus’ exists, credit claim by registered taxable person becomes improper. If nexus is established, please examine valuation of inter-branch supply of services is as per proviso to Rule 28 or as per Rule 30 of Central Goods and Service Tax Rules, 2017 relating to Valuation. |

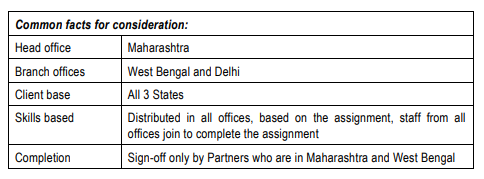

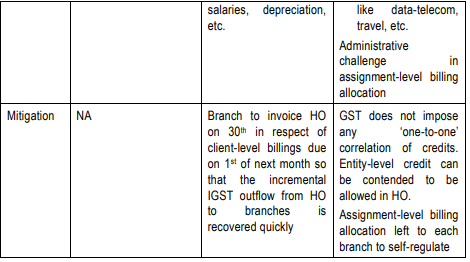

ISD is not merely a matter of compliance but involves great revenue implications to a registered taxable person. Compliance would also not be nominal. So, this is yet another indicator that the business model that has been in place until now has reached end-of-life and a new model needs to be examined. Please consider the following example of a CA in practice with branches in 3 States where the facts are as follows:

Business models and their comparison are as follows:

There is no doubt that the above are not recommendations but case for comparative illustration regarding application of the law to a business and to highlight that it is impossible to continue the erstwhile business model in GST, at least in many sectors.

The illustrations considered in this section are matters to be considered for discussion/ deliberations only and are not views envisaged. The reader may or may not agree with the views in the discussion in this Chapter/section.