Input Tax Credit (ITC) :

♦ GST is destination based consumption tax i.e. GST is ultimately payable in the State or Union Territory in which goods and services are consumed.

♦ Input Tax Credit is core aspect of GST, which will ensure this basic goal of GST of avoiding cascading effect of taxes.

♦ Input Tax Credit is available only if included in GSTR-2 return and tax invoice contains all required details.

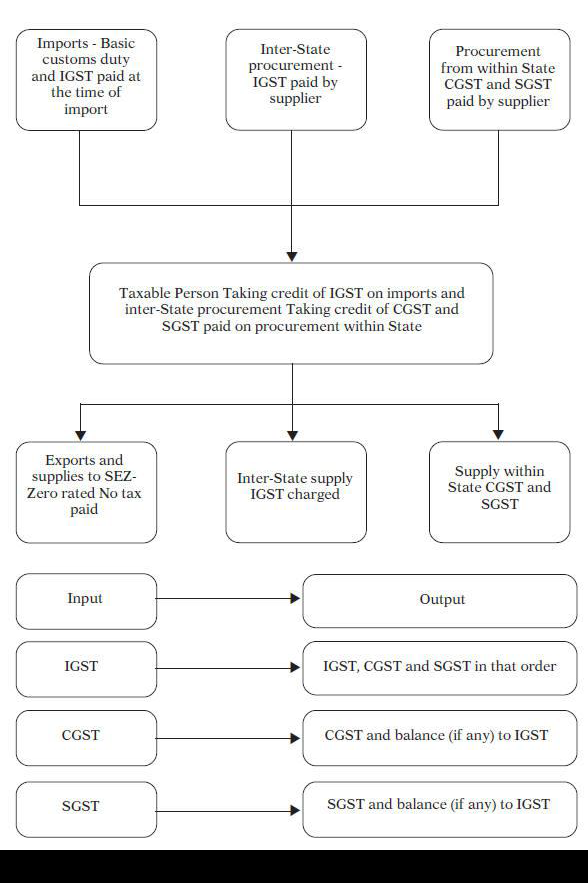

♦ Supplier of goods and services can avail input tax credit of IGST, CGST, SGST and UTGST paid by suppliers on their input goods and services and capital goods.

♦ Input tax Credit of SGST can be utilised for payment of SGST first and balance for payment of IGST on outward supply.

♦ Input tax Credit of UTGST can be utilised for payment of UTGST first and balance for payment of IGST on outward supply.

♦ Input tax Credit of CGST can be utilised for payment of CGST first and balance for payment of IGST on outward supply.

♦ Input tax Credit of IGST can be utilised for payment of IGST, CGST and SGST (in that order) on outward supply.

♦ Input tax credit of CGST and SGST/UTGST is not inter-changeable.

♦ All input goods and services and capital goods used or intended to be used in course or furtherance of business are eligible for availment of input tax credit, except few.

♦ Input goods and services used for construction of office and factory building, rent-a-cab, food and beverages, beauty treatment, health services, cosmetic and plastic surgery, leave travel are not eligible.

♦ Motor vehicles and other conveyances are eligible only if used for further supply, transportation ofpassenger or goods and imparting training for driving or flying.

♦ Input tax credit is available only when supplier of goods and services has paid tax in full.

♦ If payment is not made by recipient to supplier of goods or services or both within 180 days, the input tax credit is required to be reversed. Interest will be payable from date of taking input tax credit [as per rule 2 of Input Tax Credit Rules]. This will create problems and huge compliance costs. It is not clear why Government is acting as ‘recovery agent’ of supplier, as tax element has already been received by Government.

♦ Banking company/NBFC/FI can take only 50% of Input Tax Credit.

♦ Life of capital goods will be taken as five years and reversal of input tax credit on capital goods removed after use shall be as per rule 9 of Input Tax Credit Rules.