Input Tax credit system to implement concept of VAT

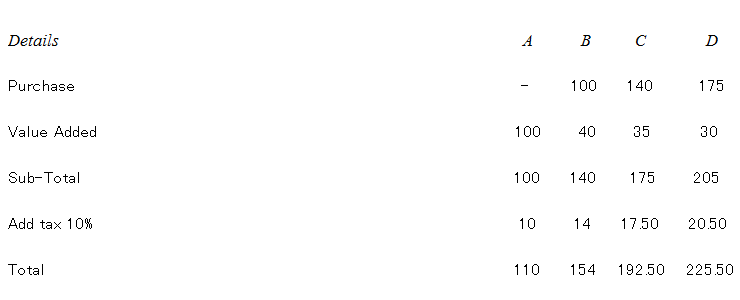

VAT (Value Added Tax) removes the cascading effect of taxes by ‘input tax credit’ system. Under this system, input tax credit is given at each stage of tax paid at earlier stage. For example, B will get input tax credit of tax paid by A, C will get credit of tax paid by B and so on. Thus, aforesaid example will be re-worked as follows in Vat.

Note – ‘B’ is purchasing goods from ‘A’. His purchase price is Rs 100 as he is entitled to input tax credit of Rs 10 i.e. tax paid on purchases. His invoice shows tax paid as Rs 14. However, since he has got input tax credit of Rs 10, effectively he is paying only Rs 4 as tax, which is 10% of Rs 40, i.e. 10% of ‘value added’ by him. Similarly, you will find that C is actually paying tax of Rs 3.50 (17.50 – 14) which is 10% of Rs 35 and D is actually paying tax of Rs 3 on his ‘value added’ of Rs 30.

If you see the invoice of D, it shows tax of Rs 20.50, which is the total tax on that Government paid as follows – Rs 10 by A, Rs 4 by B, Rs 3.50 by C and Rs 3 by D.

Thus, if D is granted exemption of Rs 20.50, the product can be made tax free, which was not possible earlier.

Exemption to D from total tax can be granted by any of the following ways—

(a) Allow him not to charge Vat on his sale and to take input tax credit of his inputs and utilize it for payment of taxes on his other sales (thus, indirect refund of input taxes)

(b) Allow him to charge Vat (sales tax) on his sales and grant him rebate of that tax on his sales

(c) Allow him not to charge Vat on his sale and grant him rebate of taxes paid by him on his inputs [If majority of his final products or output services are exempt from tax]

‘D’ can opt for any one of the benefits which suits him.