Interest on capital:

Interest on capital is allowed to partners only, if the partnership deed specifically allows it. Interest is usually calculated on the opening capital and on the capital introduced during the year. If the date of additional capital introduced during the year is not given, the interest is to be calculated for six months.

Journal Entries:

(a) To adjust interest on capital

Interest on capital A/c Dr.

To Partners’ Capital A/c

(In case of fluctuating capital)

or

To Partners’ Current A

(In case of fixed capital)

(b) To close the interest on capital account

Profit & Loss Appropriation A/c Dr.

To Interest on capital A/c

Illustration :

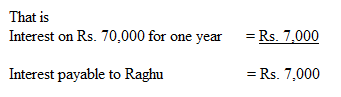

Ravi and Raghu started business on April 1, 2003 with capitals of Rs.90,000 and Rs.70,000 respectively. Ravi introduced Rs.10,000 as additional capital on July 1, 2003. Interest on capital is to be allowed @ 10%. Calculate the interest payable to Ravi and Raghu for the year ending March 31,2004.

Solution:

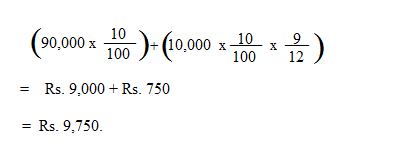

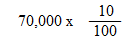

a) Interest on Ravi’s capital:

That is

Interest on Rs.90,000 for one year = Rs. 9,000

Interest on Rs.10,000 for nine months = Rs. 750

Total Interest payable to Ravi = Rs. 9,750