Interest on delayed payment of tax analysis

Section 50 of CGST Act makes it mandatory for a tax payer to pay interest on belated payment of tax i.e. when he fails to pay tax (or any part of tax) to the Government’s account within the due date/s.

Interest – When Payable

Interest under section 50 of CGST Act is payable in the following three circumstances

1. Sub-section (1):period for which there is a delay in payment of tax, in full or in part

2. Sub-section (3): Undue or excess claim of input tax credit under section 42 (10) contravening the provisions of section 42(7)

3. Sub-section (3): Undue or excess reduction in output tax liability under section 43 (10) contravening the provisions of section 43(7)

It may be recalled that –

a) section 42 (10) CGST/SGST Act deals with contravention of provisions for matching of claims for input tax credit by a recipient and

b) section 43 (10) CGST/SGST Act deals with contravention of provisions for matching of claims for reduction in output tax liability by a supplier Section 42(7) and 43(7) only deals with discrepancies in matching of credits & reduction in output tax liability against credit notes issued, between a supplier / recipient. All other discrepancies that do not relate to matching would attract interest at the higher rate of 24%.

For instance if the supplier discloses output taxes in respect of a particular invoi ce – say after the 30th of September (which is technically the due date for availment of all credits) then the recipient would not be in a position to avail the entire credit in the first place while the supplier would need to pay the output taxes as well as interest. In this situation what would be the rate of interest – 18% pa or at 24% pa. The readers may debate this issue.

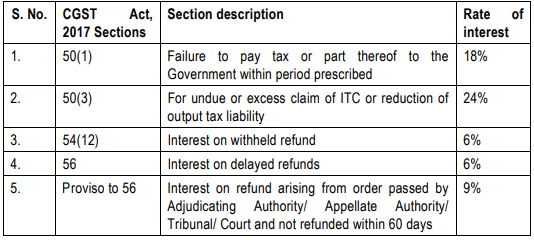

Rate of Interest

The actual rate of interest notified by the Government vide Notification no. 13/ 2017 Central tax Dated 28 June 2017 are as follows: