INTERNATIONAL PAYMENT SYSTEMS :

In today’s fast growing e commercial activities, banks’ role is very important for the success of global e- commerce. e- commerce should be end to end covering various aspects like from the customer’s end, the selection of on line products, placement of orders, and making and settling payments.

An effective global payment channel should be an integral part of global e commerce. Before setting up a global payment channel, an organization should consider certain aspects such as

1. Payment Type: Payments can be made through different modes like credit cards, debit cards, or online transfer. Customers should be allowed to choose any of the method to settle payments. Internal checking and balancing act should be embedded into the system

2. Legal frame work/Regulatory compliance: The system should satisfy the legal and regulatory requirements in the centers

3. Taxes: Taxation laws are different in different countries. The payment system should have the capability to calculate and compute the required taxes, duties as per the local tax laws

4. Banking relationship: Global e commerce involves cross border trade activities and to ensure prompt settlement of payments, the system should be supported by the banks to process these payments. As per the rules and procedures applicable at different centers, the payment system should be supported by well established banks.

5. Risk: Global e commerce is subject to risks. On line payment risks can be classified into:

Credit Risk: The customer may not have sufficient funds to make payment

Fraud: Payments may be made on a misrepresented identify

Repudiation: The customer may refuse to honour payment

Security: Global e commerce is exposed to various cross border nations, hence it is subject to different laws and regulations. Therefore, the payment system should be able to handle the country specific security regulations/ guidelines.

An efficient global payment processing system should have the following features:

(i) A single system should enable national and international payments

(ii) It should be able to support multi=currency and multi=payment types

(iii) The processing facility should be active for 24×7

(iv) The system should be able to handle the high value transactions

(v) Interface facilities should be available in the system to enable the system in switching to one type of payment to another like (Real Time Gross Settlements (RTGS) Automated Clearing House (ACH)

(vi) Inter connectivity with message switching systems like SWIFT should be part of the system

(vii) It should also be able to handle current and future inflow/outflows

(viii) Importantly, it should have the feature and facility to comply with the regulatory requirements

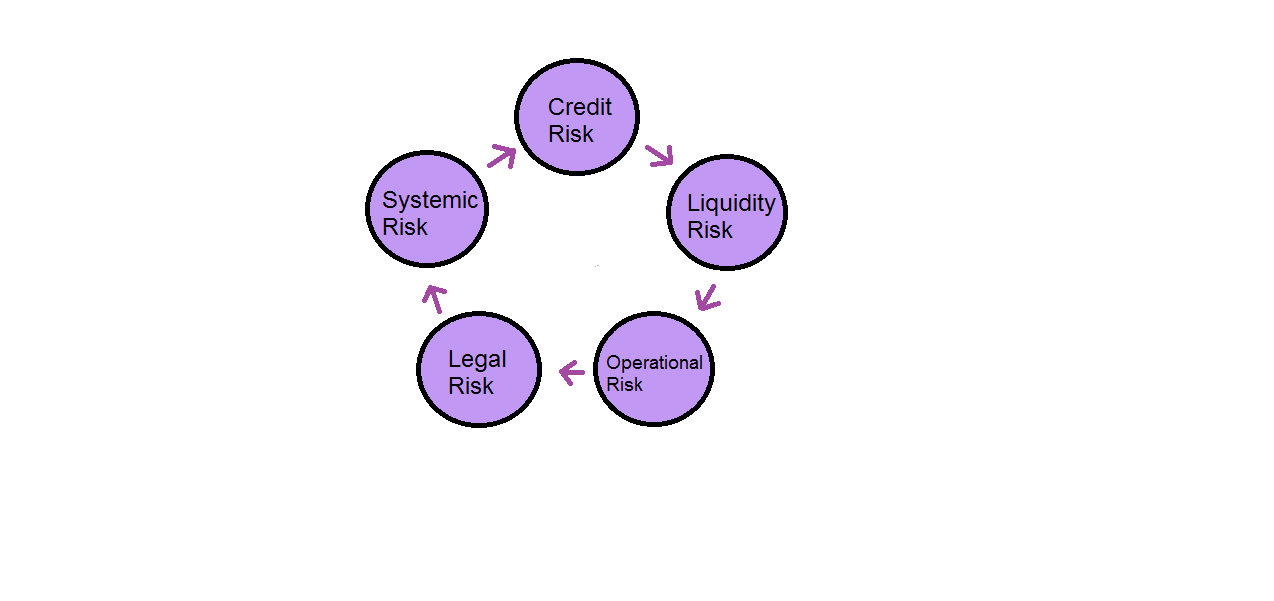

Risks:

Some of the important risks associated with payment systems are:

| Credit Risk: | Failure by a party to meet the financial obligations |

| Liquidity Risk: | A party in the system fails to pay on account of insufficient funds |

| Operational Risk: | A risk can arise on account of human error, system failure, frauds etc. |

| Legal Risk: | Non compliance of legal or regulatory framework can create a legal risk |

| Systemic Risk: | It can have a chain effect into the system due to the default of one of the parties |

Legal frame work:

The following Acts and Regulations handle the payment and settlement in India:

– The Payment and Settlement Systems Act 2007

– The Payment and Settlement Systems Regulation 2008

– Board for Regulation and Supervision of Payment and Settlement Systems Regulations 2008

International Initiatives: Bank for International Settlements (Basel) has taken many international initiatives to ensure global financial stability. It is also taking actions to strengthen the global financial infrastructure. According to the Committee on Payments and Settlement Systems (CPSS), the core principles for a controlled payments and settlement systems are:

1. The system should be based on a clear legal framework under all relevant jurisdictions

2. All participants should be able to clearly understand the system’s rules and procedures. There should be clarity regarding system’s impact on each of the financial risks

3. Credit and liquidity risks are important risks in an e-commerce environment. Hence banks Payment systems should cover the area of credit and liquidity risk management

4. Liquidity management depends upon timely settlement of funds. In view of this, banks’ settlement systems should ensure that settlements take place without fail on the value dates (during the day and/or definitely at the end of the day. In case of multilateral netting, at the minimum, the system should be able to complete daily settlements in case the participant of a single big ticket transaction is unable to make the settlement

5. The system should have an integrated high degree of security and operational reliability

6. The system should have a backup system to handle any contingency situations for timely completion of daily processing