Issue of Shares at Discount :

When a company issues its shares at a price less than the face value, it is said to be issued at discount. Discount is the difference

between the face value and the issue price. For example a share of Rs.10 (face value) is issued at Rs 9, it is said that shares are issued at discount of Re.1.

A company can issue shares at a discount only when the following conditions are satisfied (Sec. 79).

a. Issue of shares at discount is authorised by an ordinary resolution passed by the company in its general body meeting and sanctioned by Company Law Board.

b. The shares must belong to a class already issued.

c. The maximum amount of discount can not exceed 10%, however, if the Company Law Board is convinced the shares can be issued at a higher discount rate.

d. The company has to be in existence at least for one year.

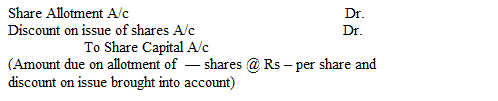

Whenever shares are issued at a discount the amount of discount is brought into account with the instalment due on allotment. The accounting entry passed to record the same is:

The shares will appear at the full face value on the liability side of the Balance Sheet. The amount of discount on issue of shares being

loss of capital nature shown on the asset side and written off against the Profit and Loss account over a period of time. The amount of discount not yet written off will appear in the asset side of the Balance Sheet under the heading ‘Miscellaneous Expenditure’.

Illustration :

Senthil Ltd. issued 1,70,000 shares of Rs.10 each at discount of 10%. The shares were payable as under

on application Rs.3

on allotment Rs.4 (with adjustment of discount)

on first and final call Rs.2

Public applied for 1,60,000 shares and the shares have been duly allotted. All money were duly received. Pass journal entries and prepare ledger accounts and also show the balance sheet.

Senthil Ltd.

Journal Entries

|

Date |

Particulars | LF | Debit Rs. |

Credit |

| Bank A/c Dr |

4,80,000 |

|||

| To Share Application A/c |

4,80,000 |

|||

| (Application money received on 1,60,000 shares @ Rs.3 per share) | ||||

| Share Application A/c Dr |

4,80,000 |

|||

| To Share Capital A/c |

4,80,000 |

|||

| (Application money transferred to share capital) | ||||

| Share Allotment A/c Dr |

6,40,000 |

|||

| Discount on issue of shares A/c Dr |

1,60,000 |

|||

| To Share Capital A/c |

8,00,000 |

|||

| (Allotment money due on 1,60,000 shares with adjustment of discount) | ||||

| Bank A/c Dr |

6,40,000 |

|||

| To Share Allotment A/c |

6,40,000 |

|||

| (Allotment money received) |

| Share First & Final Call A/c Dr. | 3,20,000 | |||

| To Share Capital A/c | 3,20,000 | |||

| (Call money due on 1,60,000 shares @ Rs.2 per share) | ||||

| Bank A/c Dr. | 3,20,000 | |||

| To Share First & Final Call A/c | 3,20,000 | |||

| (Call money received) |

Senthil Ltd.

Ledger Accounts

Dr. Bank Account Cr.

| Particulars | Rs | Particulars | Rs |

| To Share Application A/c | 4,80,000 | By Balance c/d | 14,40,000 |

| To Share Allotment A/c | 6,40,000 | ||

| To Share First and Final Call A/c | 3,20,000 | ||

| 14,40,000 | 14,40,000 | ||

| To Balance b/d | 14,40,000 |

Dr. Share Application Account Cr.

| Particulars | Rs | Particulars | Rs |

| To Share Capital A/c | 4,80,000 | By Bank A/c | 4,80,000 |

| 4,80,000 | 4,80,000 |

Dr. Share Allotment Account Cr.

| Particulars | Rs | Particulars | Rs |

| To Share Capital A/c | 6,40,000 | By Bank A/c | 6,40,000 |

| 6,40,000 | 6,40,000 |

Dr. Discount on issue of shares Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Share Capital A/c To Balance b/d |

1,60,000 |

By Balance c/d |

1,60,000 |

|

1,60,000 |

1,60,000 |

||

|

1,60,000 |

Dr. Share First and Final Call Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Share Capital A/c |

3,20,000 |

By Bank A/c |

3,20,000 |

|

3,20,000 |

3,20,000 |

Dr. Share Capital Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| By Share Application A/c |

4,80,000 |

||

| By Share Allotment A/c |

6,40,000 |

||

| By Discount on Shares A/c |

1,60,000 |

||

| To Balance c/d |

16,00,000 |

By Shares First and Final Call A/c |

3,20,000 |

|

16,00,000 |

16,00,000 |

||

| By Balance b/d |

16,00,000 |

||

Extracts from Balance Sheet of Senthil Ltd.

|

Liabilities |

Rs. | Assets |

Rs. |

| Share Capital | Current Assets: | ||

| Authorised Capital |

—- |

Bank |

14,40,000 |

| Issued Capital | Miscellaneous | ||

| 1,70,000 shares @ | Expenditure: | ||

| Rs.10 each |

17,00,000 |

Discount on issue | |

| Subscribed Capital | of shares |

1,60,000 |

|

| 1,60,000 shares @ | |||

| Rs.10 each |

16,00,000 |

||

| Called-up Capital | |||

| 1,60,000 shares @ Rs.10 each |

16,00,000 |

||

| Paid up Capital | |||

| 1,60,000 shares @ Rs.10 each |

16,00,000 |

|

16,00,000 |

16,00,000 |

Illustration :

Cholan Ltd., issued 1000 shares of Rs.100 each. Pass journal entry in the following cases.

a) Shares are issued at par

b) Shares are issued at a premium of Rs. 20.

c) Shares are issued at a discount of Rs.10.

Solution:

Journal Entries

| Date | Particulars | L.F | Debit | Credit |

| Case a: | ||||

| Bank A/c Dr | 1,00,000 | |||

| To Share capital A/c | 1,00,000 | |||

| (1000 shares issued @ Rs.100 per share) | ||||

| Case b: | ||||

| Bank A/c Dr | 1,20,000 | |||

| To Share capital A/c | 1,00,000 | |||

| To Securities premium A/c | 20,000 | |||

| (1000 shares issued @ Rs.100 per share with premium of Rs.20) | ||||

| Case c: | ||||

| Bank A/c Dr | 90,000 | |||

| Discount on issue of shares A/c Dr | 10,000 | |||

| To Share capital A/c | 1,00,000 | |||

| (1000 shares issued @ Rs.100 per share and discount Rs.10 brought into account) |