Issue of Shares at Premium :

The shares of many successful companies which offer attractive rates of dividend on their existing capitals fetch a higher price than their face value in the market. When shares are issued at a price higher than the face value, they are said to be issued at a premium. Thus, the excess of issue price over the face value is the amount of premium. For example, if a share of Rs. 10 is issued at Rs. 12, Rs. (12 – 10) = Rs. 2 is the premium.

The premium on issue of shares must not be treated as revenue profits. On the contrary, it must be regarded as capital receipt. The Companies Act requires that when a company issues shares at a premium whether for cash or otherwise, a sum equal to the aggregate amount of the premium collected on shares must be credited to a separate account called “Securities Premium Account”. There are no restrictions in the Companies Act on the issue of shares at a premium, but there are restrictions on its disposal. Under Section 52(2) of the

Companies Act 2013, the Securities Premium Account may be applied by the company—

(a) towards the issue of unissued shares of the company to the members of the company as fully paid bonus shares;

(b) in writing off the preliminary expenses of the company;

(c) in writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company;

(d) in providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company; or

(e) for the purchase of its own shares or other securities under section 68.

It is to be noted here that utilization of the amount of Securities Premium Account except in any of the modes specified above, will attract the provisions relating to the reduction of share capital of a company under the section 66 of the Companies Act 2013.

The Securities Premium Account must be shown as “Securities premium reserves” separately in the liabilities side of the balance sheet under the head “Reserves & Surplus”.

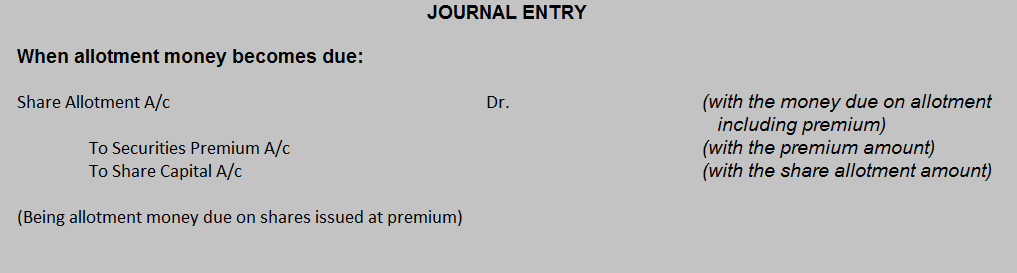

The premium is usually payable with the installment due on allotment. However, some companies may charge premium with share application money or partly with share application money and partly at the time of allotment of shares. It may be included in call money also.