ISSUE OF SHARES TO PROMOTERS :

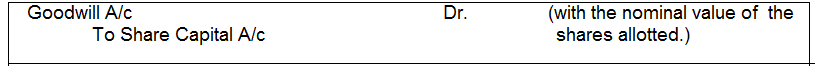

A company may allot fully paid shares to promoters or any other party for the services rendered by them by way of furnishing technical information, engineering services, plant layout, drawing and designing, etc. without payment. This type of issue of shares to promoters is called issue of shares for consideration other than cash. As the amount paid to promoters for services rendered by them is supposed to be utilised by the company over a long period of time, such expenditure should be treated as capital expenditure and debited to Goodwill Account. The accounting entry in such a case will be as follows:

Illustration:

Bright Ltd. was registered with a share capital of Rs.10,00,000 in equity shares of Rs.10 each. The company acquired factory building worth Rs.1,00,000 and plant and machinery worth Rs.80,000 from Delite Ltd. and issued 18,000 equity shares of Rs. 10 each to the vendors as fully paid-up. The directors also decided to allot 2,000 equity shares credited as full paid to the promoters for their services. Further capital was issued to the public for cash to the extent of Rs 3,00,000 payable in full with the application. All the shares were taken up by the public and fully paid for. Show the necessary journal entries and the balance sheet.

Solution:

Journal Entries

| Particulars | Dr. (Rs.) | Cr. (Rs.) |

| Factory Building A/c Dr. | 1,00,000 | |

| Plant and Machinery A/c Dr. | 80,000 | |

| To Delite Ltd. | 1,80,000 | |

| (Purchase of assets from Delite Ltd. as per agreement dated…..) | ||

| Delite Ltd. Dr. | 1,80,000 | |

| To Equity Share Capital A/c | 1,80,000 | |

| (Allotment of 18,000 equity shares of ` 10 each to vendors as fully paidup for consideration other than cash as per Board’s resolutions dated…..) | ||

| Goodwill A/c Dr. | 20,000 | |

| To Equity Share Capital A/c | 20,000 | |

| (Allotment of 2,000 equity shares ofRs.10 each to promoters as fully paidup for consideration other than cash as per Board’s Resolution dated…..) | ||

| Bank Dr. | 3,00,000 | |

| To Equity Share Application and Allotment A/c | 3,00,000 | |

| (Application money on 30,000 equity shares Rs.10 each per share) | ||

| Equity Share Application and Allotment A/c Dr. | 3,00,000 | |

| To Equity Share Capital A/c | 3,00,000 | |

| (Allotment of 30,000 equity shares of Rs. 10 each as fully paid as per Board’s resolution dated…..) |

Balance Sheet of Bright Ltd., as at…..

|

Particulars |

Note No. |

Amount (Rs.) |

|

|

I |

Equity and Liabilities | ||

| Shareholders’ Funds | |||

| Share Capital |

1 |

5 ,00, 000 |

|

|

Total |

5, 00,000 |

||

|

II |

Assets | ||

| Non-current Assets | |||

| Fixed Assets | |||

| Tangible Assets |

2 |

1,80,000 |

|

| Intangible Assets |

3 |

20,000 |

|

| Current Assets | |||

| Cash and Cash Equivalents |

4 |

3 00 000 |

|

|

Total |

5 00 000 |

| Notes: | |||

|

1. |

Share Capital | ||

| Authorised | |||

| 1,00,000 Equity Shares of Z 10 each |

10,00,000 |

||

| Issued, Subscribed and Paid-up : | |||

| 50,000 Equity Shares of Z 10 each, fully paid-up |

5,00,000 |

||

| (Of the above shares, 20,000 equity shares have been issued to vendors and promoters for consideration other than cash) | |||

|

2. |

Tangible Assets | ||

| Factory Building |

1,00,000 |

||

| Plant and Machinery |

80,000 |

||

|

1 80 000 |

|||

|

3. |

Intangible Assets | ||

| Goodwill |

20,000 |

||

|

4. |

Cash and Cash Equivalent | ||

| Balance with Bank |

3,00,000 |