Items Requiring Special Consideration

Tax Implications of Valuation of Investments

The RBI has issued various circulars on valuation of investments, according to which the difference between the market value/value as per yield to maturity method (YTM) will have to be provided in the books of accounts for certain types of investments. The various judicial decisions on the allowability of depreciation in valuation of investments should be considered while provisioning.

Notional Gain/Loss on Foreign Exchange Translations

Banks are required to translate their foreign exchange balances / obligations in foreign currency as per FEDAI Guidelines. The following decisions may be considered by the auditor while recognising gains or loss for tax purposes:

The Madras High Court in the case of Indian Overseas Bank Vs. Commissioner of Income-tax (1990) 183 ITR 200 has held that notional profits on translation of foreign exchange forward contracts is not taxable.

The Madras High Court in the case of Commissioner of Income-tax Vs. Indian Overseas Bank (1985) 151 ITR 446 has held that notional loss on translations of foreign exchange contracts is not tax deductible.

Broken Period Interest

The RBI, vide its Master Circular No. DBR No.BP. BC. 6/ 21.04.141 / 2015-16 on, “Prudential Norms for Classification, Valuation and Operation of Investment Portfolio by Banks” dated July 1, 2015, advised that banks should not capitalise the Broken Period Interest paid to seller as part of cost, but treat

it as an item of expenditure under P&L Account in respect of investments in Government and other approved securities. It is to be noted that the above accounting treatment does not take into account the tax implications and, hence, the banks should comply with the requirements of Income Tax Authorities in the manner prescribed by them. .

However, a number of judicial decisions support the view that the interest is allowable as a business deduction consequent to deletion of sections 18 to 21 of the Income tax Act, 1961.Honourable Bombay High Court in case of American Express International Banking vs. CIT [2002] 258 ITR 601 (Bom) supports this view. The said judgement has been followed in case of CIT vs. Citi Bank N.A. [2003] 264 ITR 18 (Bom), CIT vs. Nedungadi Bank Ltd [2003] 264 ITR 545 (Ker) and by Honourable Bombay High Court in case of Union Bank of India in judgement dated October 9, 2002 in I.T.R. No.28 of 1998. The Special Leave Petition (SLP) filed by the Department against the judgement in case Union Bank of India has been dismissed by the Supreme Court. [Refer 268 ITR (St) 216]

Disallowance of expenditure incurred in earning income which is exempt from tax

Section 14A has been inserted by the Finance Act, 2001, with retrospective effect from 1-4-1962, to provide that no deduction shall be allowed in respect of expenditure incurred by an assessee in relation to income which does not form part of the total income under the Income-tax Act, 1961. This principle will have application in the matter of exempted income earned by banks also, e.g., income from tax-free securities and dividend from shares of domestic companies.

Section 14A(2) empowers the Assessing Officer to determine the amount of expenditure incurred in relation to such income which does not form part of the total income in accordance with such method as may be prescribed. The method for determining expenditure in relation to exempt income is to be prescribed by the CBDT for the purpose of disallowance of such expenditure under section 14A. Such method should be adopted by the Assessing Officer if he is not satisfied with the correctness of the claim of the assessee, having regard to the accounts of the assessee. Further, the Assessing Officer is empowered to adopt such method, where an assessee claims that no expenditure has been incurred by him in relation to income which does not form part of total income [section 14A(3)].

The CBDT has, vide Notification No.45/2008 dated 24.3.2008, inserted a new Rule 8D which lays down the method for determining amount of expenditure in relation to income not includible in total income.

If the Assessing Officer, having regard to the accounts of the assessee of a previous year, is not satisfied with –

(a) the correctness of the claim of expenditure by the assessee; or

(b) the claim made by the assessee that no expenditure has been incurred in relation to exempt income for such previous year, he shall determine the amount of expenditure in relation to such income in the manner provided hereunder –

The expenditure in relation to income not forming part of total income shall be the aggregate of the following:

(i) the amount of expenditure directly relating to income which does not form part of total income;

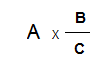

(ii) in a case where the assessee has incurred expenditure by way of interest during the previous year which is not directly attributable to any particular income or receipt, an amount computed in accordance with the following formula, namely :

Where,

A = amount of expenditure by way of interest other than the amount of interest included in clause (i) incurred during the previous year;

B= the average of value of investment, income from which does not or shall not form part of the total income, as appearing in the balance sheet of the assessee, on the first day and the last day of the previous year;

C= the average of total assets as appearing in the balance sheet of the assessee, on the first day and the last day of the previous year;

(iii) an amount equal to one-half per cent of the average of the value of investment, income from which does not or shall not form part of the total income, as appearing in the balance sheet of the assessee, on the first day and the last day of the previous year. ‘Total assets’ means total assets as appearing in the balance sheet excluding the increase on account of revaluation of assets but including the decrease on account of revaluation of assets.

The various judicial decisions on disallowance of expenses U/s.14A should be considered while making a provision for Income-tax. Reference may also be made to the “Guidance Note on Tax Audit under Section 44AB of the Income-tax Act, 1961” issued by ICAI for detailed discussion.