Levy of penalty at a flat rate of 60% on undisclosed income, in search cases where assessee does not admit such income in the course of search nor discloses the same in the return of income for the specified previous year filed on or before the specified date [Section 271AAB(1)(c)]

Relevant from: A.Y.2017-18

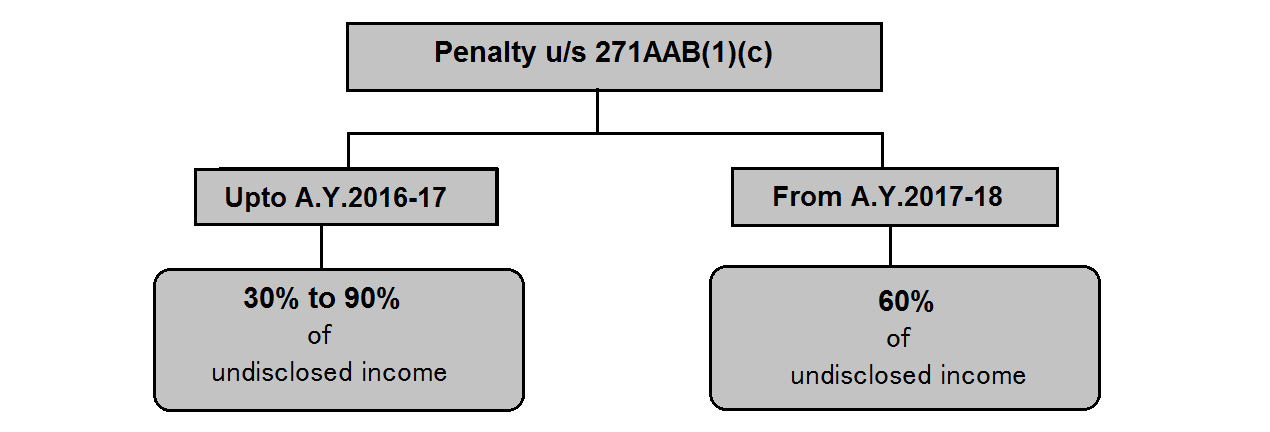

(i) Section 271AAB(1)(c) provides for levy of penalty ranging between 30% to 90% of the undisclosed income, in a case where search has been initiated under section 132 on or after 1st July, 2012, and the assessee neither admits, in a statement under section 132(4), undisclosed income in the course of search nor declares such income in the return of income furnished for the specified previous year and pays tax and interest on such undisclosed income.

(ii) For the purpose of reducing discretionary powers in levy of penalty and rationalizing the rate of penalty, section 271AAB(1)(c) has been amended to provide for levy of penalty on such undisclosed income at a flat rate of 60% of such undisclosed income.