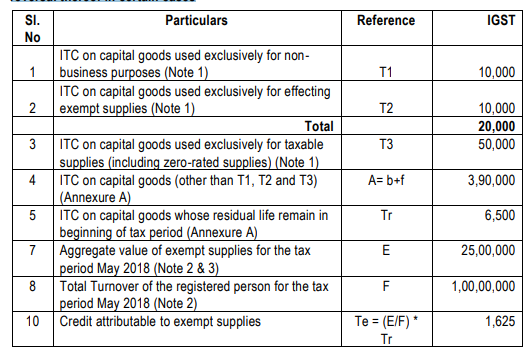

Manner of determination of ITC in respect of capital goods and reversal thereof in certain cases :

Note 1: T1, T2 and T3 should be declared in Form GSTR-2. T3 (being ITC on capital goods used for taxable supplies) and A (being common credit in respect of capital goods) shall only be credited to the electronic credit ledger

Note 2: If the registered person does not have any turnover for May 2018, then the value of E and F shall be considered for the last tax period for which such details are available Note 3: Aggregate value excludes taxes