Manner of recovery of credit distributed in excess

Where the Input Service Distributor distributes the credit in contravention of the provisions contained in section 20 resulting in excess distribution of credit to one or more recipients of credit, the excess credit so distributed shall be recovered from such recipient(s) along with interest, and the provisions of section 73 or 74, as the case may be, shall mutatis mutandis apply for determination of amount to be recovered

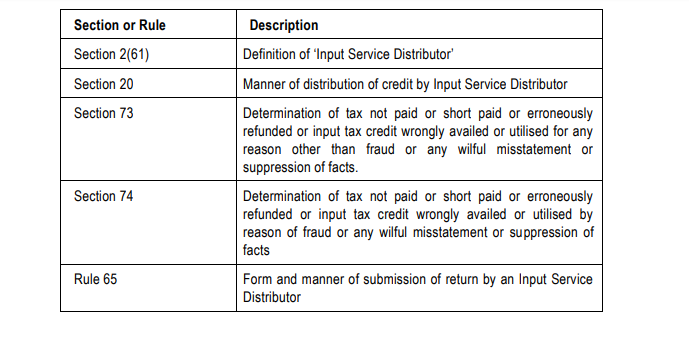

Related Provisions of the Statute :

Relevant circulars, notifications, clarifications issued by Government:

1. Chapter Nineteen of the compilation of the GST Flyers as issued by the CBIC on ‘Input Tax Credit Mechanism in GST’

2. Chapter Ten of the compilation of the GST Flyers as issued by the CBIC on ‘Input Service Distributor in GST’

Introduction

The CGST Act clearly lays down that credit distribution is not ‘to self’, that is, a regis tered taxable person cannot distribute credit to himself. Each registered person being a distinct person u/s 25, must distribute to another registered taxable person but having the same PAN to whom the credit is most accurately attributable. And the consequence of incorrect distribution, due to inadvertence or misapplication of the provisions, are discussed here.

Analysis

(i) Excess Credit distributed in contravention of provision:

Excess credit distributed to one or more recipient of credit in contravention of ISD provision under Section 20 is recoverable from the recipient of such credit along with Interest. The recovery would be under the provisions of Section 73 or 74.

Example-1 Total Credit Available to ISD is 15,00,000/- & the credit distributed to all the units is ` 16,50,000/- (i.e. Delhi 10,00,000, unit Jaipur ` 4,00,000 & unit Gujarat ` 2,50,000). What will be the consequences?

Solution: The excess credit of 1,50,000 (` 16,50,000- ` 15,00,000) distributed would be recovered from the recipient along with interest and the provisions of section 73 or 74 shall apply mutatis mutandis for effecting such recovery.

Example-2 Total Credit Available to ISD is ` 15,00,000/- & the credit should have been distributed equal to all the units as all units had equal turnover, however credit distributed in violation of Section 21, as under:

Delhi ` 7,00,000, Jaipur ` 6,00,000, Gujarat ` 2,00,000.

What will be the consequences?

Solution: The excess credit of ` 2,00,000 (` 7,00,000- ` 5,00,000) shall be recovered from Delhi and ` 1,00,000 (` 600,000 – ` 5,00,000) shall be recovered from Jaipur along with interest and the provisions of section 73 or 74 shall apply mutatis mutandis for effecting such recovery.

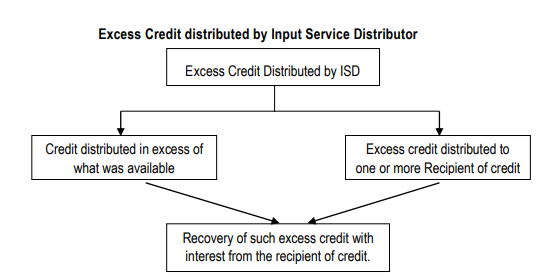

The analysis of above provision in a pictorial form is summarised as follows:

Comparative review

Earlier recovery provision was specified in Rule 14 of CENVAT Credit Rules. The CENVAT credit taken or utilized wrongly or has been erroneously refunded, was recovered along with interest under the provisions of sections 11A and 11AB of the Excise Act or sections 73 and 75 of the Finance Act.

Earlier, there was no specific provision for excess distribution of credit by ISD. Now specific provision is provided in the GST law providing for recovery of amount along with interest. Further, the relevant period for recovery of excess amount distributed is also provided in GST law.