Methods of valuation of goodwill:

There are three methods of valuation of goodwill. They are:

1) Average Profit method

2) Super Profit method

3) Capitalisation method

However, we are discussing only the first two methods in this chapter.

a) Average profit method:

In this method, past profits of a number of years are taken into account. Such profits are added and the average profit is found out.

The average profit is multiplied by a certain number of years to arrive at the value of goodwill.

The steps involved under this method are:

Step 1 ➙ Calculate total profits by adding each years profit and deducging loss, if any.

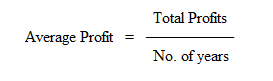

Step 2 ➙ Calculate the average profit by applying the following formula.

Step 3 ➙Calculate the Goodwill by applying the following formula.

Goodwill = Average Profit x No. of years’ purchase

Illustration :

The Goodwill is to be valued at two years’ purchase of last four years average profit. The profits were Rs.40,000, Rs.32,000, Rs.15,000 and Rs.13,000 respectively. Find out the value of goodwill.

Solution:

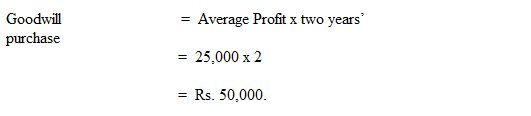

a) Calculation of average profit:

b) Calculation of Goodwill:

Illustration :

Three years’ purchase of the last four years average profits is agreed as the value of goodwill. The profits and losses for the last four years are: I year Rs.50,000, II year Rs.80,000; III year Rs.30,000(Loss); IV year Rs.60,000.

Calculate the amount of goodwill.

Solution:

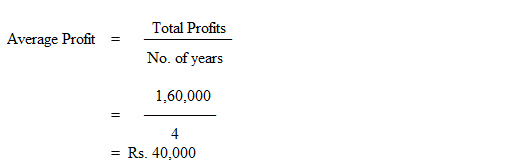

a) Calculation of average profit:

Rs.

I year 50,000

II year 80,000

IV year 60,000

Profit of 3 years 1,90,000

III year loss 30,000

Total profit 1,60,000

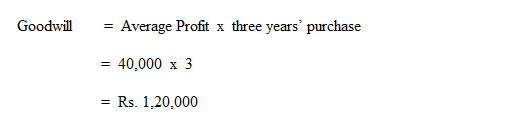

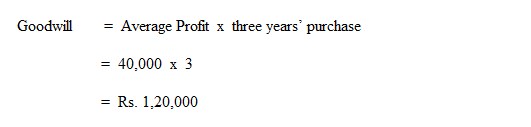

b) Calculation of goodwill:

b) Super Profit method:

The excess of average profit over normal profit is called super profit. The goodwill under the Super profits method is calculated by

multiplying the super profits by certain number of years purchase.

The steps involved under this method are:

Step 1 ➙ Calculate the average profit – it may be adjusted for partners remuneration.

Step 2 ➙Calculate the normal profit on capital employed by applying the following formula.

Normal Profit = Capital employed x Normal rate of return

Step 3 ➙ Calculate the super profit.by applying the following formula.

Super profit = Average Profit – Normal profit

Step 4➙ Calculate the value of goodwill by multiplying the amount of super profit by the given number of years’ purchase

Goodwill = Super Profit x No. of years of purchase

Illustration :

A firm’s net profits during the last three years were Rs.90,000 Rs.1,00,000 and Rs.1,10,000. The capital employed in the firm is

Rs.3,00,000. A normal return on the capital is 10%. Calculate the value of goodwill on the basis of two years’ purchase of super profit.

Solution :

a) Calculation of Average Profit:

Rs.

I year 90,000

II year 1,00,000

III year 1,10,000

Total Profit 3,00,000

b) Calculation of Normal Profit:

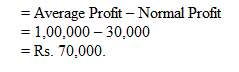

c) Calculation of Super Profit:

d) Goodwill at two years’ purchase of super profit:

Goodwill = Super Profit x No. of years of purchase

= 70,000 x 2

= Rs. 1,40,000.