Outward Supplies :

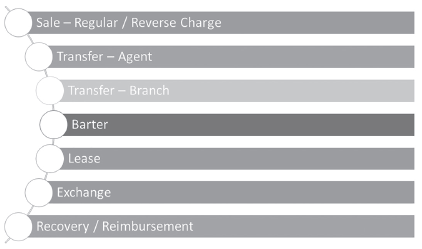

Supply as defined in section 7, sub-section 1, “all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;”

As per provisions of Schedule I, some transactions are required to be considered supply under GST even though there is no consideration being received on such transactions like transfer of goods to agents, or stock transfer etc.,

In the erstwhile tax regime, we did not have requirement to provide a reconciliation statement for the tax returns filed and the financial statements, the intent of the government is to ensure that there is difference in reporting in the financial statements, direct tax returns and the indirect tax returns and at the same timeensure that there is no revenue leakage. This has put more responsibility on the taxpayers as well as the tax professionals.

In GST when we use the term “outward supply” it changes based on the context of movement of goods or provision of service or receipt of payment before supply or after supply etc. or based on the related party or unrelated party or supply of goods or services based on the provisions of the Second Schedule of the CGST Act. All these cases are explained pictorially for ease of understanding. Basis on it, the requirements for audit verification and reporting will change.

Whenever there is any transaction related to the sale, a tax invoice is required to be issued as per the provisions of Section 12, 13, & 14 and in conjunction with the provisions of section 31 and Rule 46 of the CGST Rules.