OVER-SUBSCRIPTION OF SHARES :

When the number of shares applied for exceeds the number of shares issued, the shares are said to be oversubscribed. In such a situation, the directors allot shares on some reasonable basis because the company can allot only that number of shares which has been actually offered for subscription. Moreover, as per the guidelines issued by SEBI, the company cannot reject out-rightly any application for shares unless it has incomplete information or absence of signature(s) or insufficient application money and so on. In short, the following procedure is adopted:

(i) Total rejection of some applications;

(ii) Acceptance of some applications in full; and

(iii) Allotment to the remaining applicants on pro-rata basis.

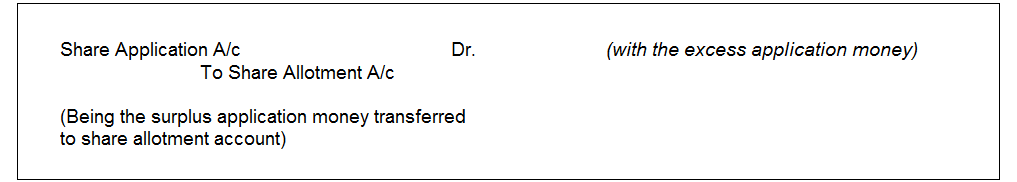

The shares should be issued in tradable lot. In case of pro-rata allotment, no applicant for shares is refused and no applicant is allotted the shares in full. Each applicant receives the shares in some proportion. In such cases, the excess amount of application money (i.e. overpaid amount) is not refunded but retained and treated as a payment towards allotment money. The following journal entry is made to transfer excess application money to allotment account.

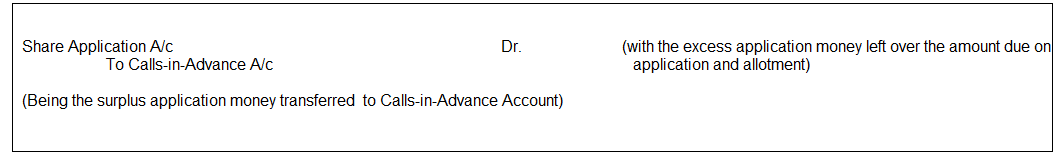

Surplus money exceeding that due on allotment should be refunded to the allottees. However, the company may transfer this to Calls-in-Advance Account if:

(i) Acceptance of calls in advance is permitted by the company’s Articles.

(ii) The consent of the applicant has been taken either by a separate letter or by inserting a clause in the company’s prospectus.

The company can retain the calls in advance at the most so much amount as is sufficient to make the allotted shares fully paid up ultimately.

The journal entry will be as follows: