Payments to contractors and sub-contractors [Section 194C] under Deduction of Tax at Source :

(1) Section 194C provides for deduction of tax at source from the payment made to resident contractors and sub-contractors.

(2) Any person responsible for paying any sum to a resident contractor for carrying out any work (including supply of labour for carrying out any work) in pursuance of a contract between the contractor and the Central Government, a State Government, local authority, statut ory corporation, a company, co-operative society, any statutory authority dealing with housing accomodation, any society registered under the Societies Registration Act, 1860, any trust or any university or any firm or any Government of a foreign State or foreign enterprise or any association or body established outside India or an individual, HUF, AOP or BOI subject to tax audit under section 44AB in the immediately preceding financial year must deduct income – tax at the prescribed rate from such sum at the time of credit or payment, whichever is earlier.

Payments made by Individuals, HUFs, AOPs and BOIs to a contractor would attract TDS if their total sales/turnover exceeds Rs 100 lakh (in case of business) and gross receipts exceed Rs 25 lakh (in case of profession) in the immediately preceding financial year. However, relief has been provided in respect of payments made by individuals/HUFs to a contractor exclusively for personal purposes.

(3) The rate of TDS under section 194C on payments to contractors would be 1%, where the payee is an individual or HUF and 2% in respect of other payees. The same rates of TDS would apply for both contractors and sub-contractors.

(4) The applicable rates of TDS under section 194C are as follows –

| Payee | TDS rate |

| Individual / HUF contractor/sub-contractor | 1% |

| Other than individual / HUF contractor/sub-contractor | 2% |

| Contractor in transport business (if PAN is furnished) | Nil |

| Sub-contractor in transport business (if PAN is furnished) | Nil |

(5) No deduction will be required to be made if the consideration for the contract does not exceed Rs 30,000. However, to prevent the practice of composite contracts being split up into contracts valued at less than Rs 30,000 to avoid tax deduction, it has been provided that tax will be required to be deducted at source where the amount credited or paid or likely to be credited or paid to a contractor or sub-contractor exceeds Rs 30,000 in a single payment or Rs 75,000 [ wef from 1st June 2016 – amount limit has been increased to Rs 100,000/- (FY 2016-2017 / AY 2017-2018 )] in the aggregate during a financial year.

Therefore, even if a single payment to a contractor does not exceed Rs 30,000, TDS provisions under section 194C would be attracted where the aggregate of the amounts of such sums credited or paid or likely to be credited or paid to the contractor during the financial year exceeds Rs 75,000.

| Illustration

ABC Ltd. makes the following payments to Mr. X, a contractor, for contract work during the P.Y.2015-16 – Rs 15,000 on 1.5.2015 Rs 25,000 on 1.8.2015 Rs 30,000 on 1.12.2015 On 1.3.2016, a payment of RS 28,000 is due to Mr. X on account of a contract work. Discuss whether ABC Ltd. is liable to deduct tax at source under section 194C from payments made to Mr. X. Solution In this case, the individual contract payments made to Mr. X does not exceed Rs 30,000. However, since the aggregate amount paid to Mr. X during the P.Y.2015-16 exceeds Rs 75,000 (on account of the last payment of Rs 28,000, due on 1.3.2016, taking the total from Rs 70,000 to ` 98,000), the TDS provisions under section 194C would get attracted. Tax has to be deducted@1% on the entire amount of 98,000 from the last payment of ` 28,000 and the balance of Rs 27,020 (i.e. Rs 28,000 – Rs 980) has to be paid to Mr. X. |

(6) Work includes –

(a) advertising;

(b) broadcasting and telecasting including production of programmes for such broadcasting or telecasting;

(c) carriage of goods or passengers by any mode of transport other than by railways;

(d) catering;

(e) manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer.

However, “work” shall not include manufacturing or supplying a product according to the requirement or specification of a customer by using raw material purchased from a person, other than such customer, as such a contract is a contract for ‘sale‘. However, this will not be applicable to a contract which does not entail manufacture or supply of an article or thing (e.g. a construction contract).

It may be noted that the term “work” would include manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer. In such a case, tax shall be deducted on the invoice value excluding the value of material purchased from such customer if such value is mentioned separately in the invoice. Where the material component has not been separately mentioned in the invoice, tax shall be deducted on the whole of the invoice value.

(7) No deduction is required to be made from the sum credited or paid or likely to be credited or paid during the previous year to the account of a contractor, during the course of the business of plying, hiring or leasing goods carriages, if he furnishes his PAN to the deductor.

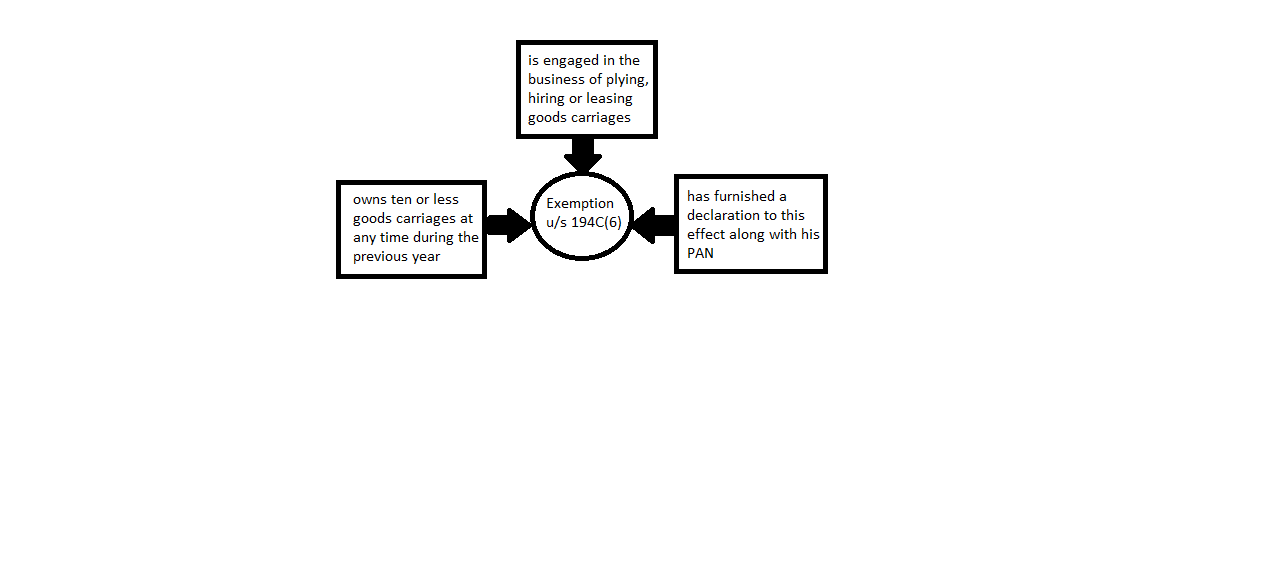

In order to convey the true intent of law, it has been clarified that this relaxation from the requirement to deduct tax at source shall only be applicable to the payment in the nature of transport charges (whether paid by a person engaged in the business of transport or otherwise) made to a contractor, who fulfills the fol lowing three conditions cumulatively –

(8) Goods carriage means –

(i) any motor vehicle constructed or adapted for use solely for the carriage of goods; or

(ii) any motor vehicle not so constructed or adapted, when used for the carriage of goods.

The term “motor vehicle” does not include vehicles having less than four wheels and with engine capacity not exceeding 25cc as well as vehicles running on rails or vehicles adapted for use in a factory or in enclosed premises.

(9) The substance of the provisions is explained hereunder:

(i) The deduction of income-tax at source from payments made to non-resident contractors will be governed by the provisions of section 195.

(ii) The deduction of income-tax will be made from sums paid for carrying out any work or for supplying labour for carrying out any work. In other words, the section will apply only in relation to ‘works contracts‘ and ‘labour contracts‘ and will not cover contracts for sale of goods.

(iii) Contracts for rendering professional services by lawyers, physicians, surgeons, engineers, accountants, architects, consultants etc., cannot be regarded as contracts for carrying out any “work” and, accordingly, no deduction of income -tax is to be made from payments relating to such contracts under this section. Separate provisions for fees for professional services have been made under section 194J.

(iv) The deduction of income-tax must be made at the time of credit of the sum to the account of the contractor, or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

(10) Deduction of tax at source on payment of gas transportation charges by the purchaser of natural gas to the seller of gas [Circular No. 9/2012 dated 17.10.2012]

In response to the representations received by CBDT, on the difficulties being faced in the matter of tax deduction at source on Gas Transportation Charges paid by the purchasers of Natural gas to the owners/sellers of gas, CBDT has, through this Circular, clarified that in case the Owner/Seller of the gas sells as well as transports the gas to the purchaser till the point of delivery, where the ownership of gas to the purchaser is simultaneously transferred, the manner of raising the sale bill (whether the transportation charges are embedded in the cost of gas or shown separately) does not alter the basic nature of such contract which remains essentially a ‘contract for sale‘ and not a ‘works contract‘ as envisaged in section 194C. Therefore, in such circumstances, the provisions of Chapter XVIIB are not applicable on the component of Gas Transportation Charges paid by the purchaser to the Owner/Seller of the gas. Further, the use of different modes of transportation of gas by Owner/Seller will not alter the position.

However, transportation charges paid to a third party transporter of gas, either by the Owner/Seller of the gas or purchaser of the gas or any other person, shall continue to be governed by the appropriate provisions of the Act and tax shall be deductible at source on such payment to the third party at the applicable rates.