Penalties:

The penalties for various defaults under service tax law can be summarised as under:-

| Sl. No. | Section | Nature of Default | Quantum of penalty |

| 1. | 76 | Failure to pay service tax |

|

| 2. | 77 | Contravention of any provision/rules for which no penalty is specified elsewhere | See point (2) below |

| 3. | 78 | Failure to pay service tax for reasons of fraud etc. |

|

| 4. | 78A | Personal penalty on director, manager, secretary, or other officer | Quantum of penalty

Penalty upto Rs 1 lakh in case of certain specified contraventions committed by the company |

Each of the above penalty is now discussed in detail hereunder:

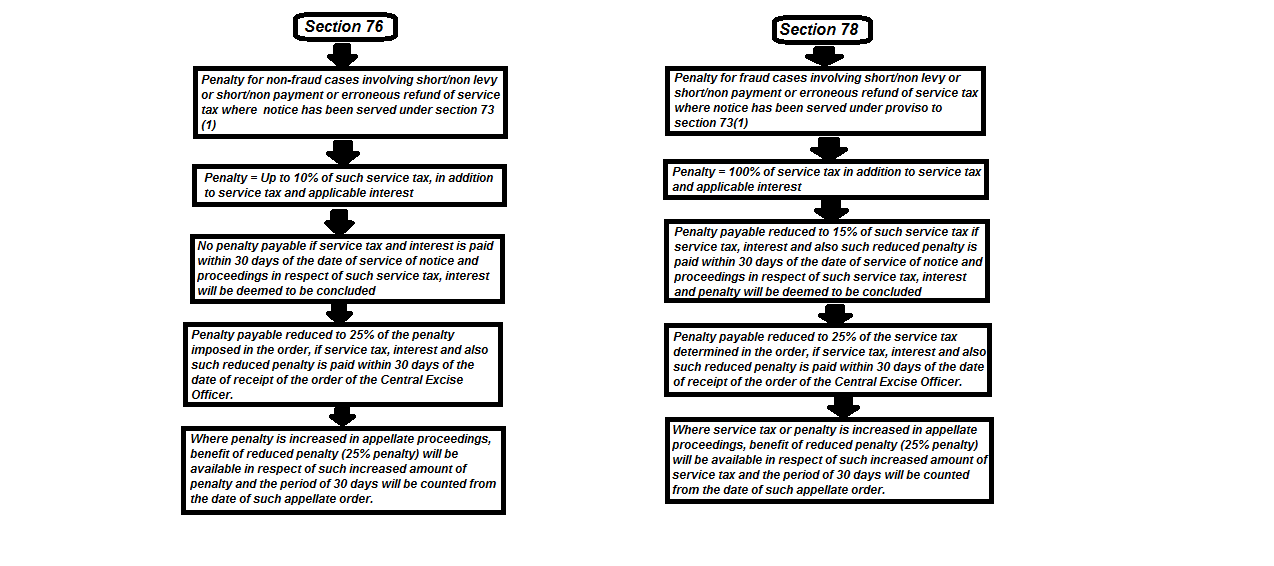

I. Penalty for failure to pay service tax [Section 76]: Prior to 14.05.2015, penalty for failure to pay service tax was ` 100 for every day during which such failure continues or at the rate of 1% of such tax per month, whichever is higher, subject to a maximum of 50% of service tax payable. The said penalty was payable from the first day after the due date till the date of actual payment of the outstanding amount of service tax.

The Finance Act, 2015 has substituted section 76. The new provisions of section 76 are explained hereunder:

(i) Where service tax has not been levied/paid, or has been short levied/paid, or erroneously refunded for any reason other than fraud/ collusion/ wilful misstatement/ suppression of facts/ contravention of any of the provisions of service tax law with the intent to evade payment of service tax, the person

who has been served notice under section 73(1) will be liable to pay a penalty not exceeding 10% of such service tax. The above penalty is payable in addition to the service tax and interest specified in the notice [Sub-section 1].

(ii) No penalty: However, if service tax and interest is paid within 30 days of the date of service of notice under section 73(1), no penalty will be payable and proceedings in respect of such service tax and interest will be deemed to be concluded [Clause (i) of proviso to sub-section (1)].

(iii) 25% penalty: However, if service tax and interest is paid within 30 days of the date of receipt of the order of the Central Excise Officer determining the amount of service tax under section 73(2), the penalty payable will be 25% of the penalty imposed in that order, only if such reduced penalty is also paid within such period [Clause (ii) of proviso to sub-section (1)].

(iv) Where the amount of penalty is increased by the Commissioner (Appeals)/ the Appellate Tribunal/ the court over and above the amount as determined under section 73(2), the time within which the reduced penalty is payable under clause (ii) of the proviso to section 76(1) in relation to such increased amount of penalty will be counted from the date of the order of the Commissioner (Appeals)/ the Appellate Tribunal/ the court, as the case may be [Sub-section (2)].

II. Penalty for contravention of rules and provisions of Act for which no penalty is specified elsewhere [Section 77]: Provisions of this section provides for a general penalty where any person contravenes any of the provisions set out in the Finance Act, 1994 or rules made hereunder, for which no penalty has been specifically mentioned elsewhere.

| S.No. | Nature of offence | Maximum penalty leviable |

| 1. | Failure to take registration in accordance with the provisions of section 69 | upto Rs 10,000. |

| 2. | Failure to:-

(a) furnish information called by an officer (b) produce documents called for by a Central Excise Officer (c) appear before the Central Excise Officer, when issued with a summon for appearance to give evidence or to produce a document in an inquiry |

Rs 200 for every day during which such failure continues, starting with the first day after the due date, till the date of actual compliance

or Rs 10,000 whichever is higher |

| 3. | Failure to make e-payment of service tax | Rs 10,000 |

| 4. | Issue of invoice with incorrect or incomple te details or fails to account for an invoice in his books of account | |

| 5. | Any contravention of any provisions/rules for which no penalty is separately provided in this Chapter | |

| 6. | Failure to keep, maintain or retain books of account and other documents as required as per the provisions |

III. Penalty for failure to pay service tax for reasons of fraud etc. [Section 78]: With effect from 14.05.2015, section 78 has been substituted by a new section. The new penalty provisions under section 78 are explained hereunder:

(i) Where any service tax has been short/non levied or short/non paid or erroneously refunded, by reason of fraud/collusion/wilful mis-statement/ suppression of facts/contravention of any of the provisions of service tax law with intent to evade payment of service tax, the person who has been served notice under the proviso to section 73(1) [fraud cases invoking extended period of limitation] be liable to pay a penalty which shall be equal to 100% of such service tax. The above penalty is payable in addition to the service tax and interest specified in the notice [Sub-section (1)].

(ii) 50% penalty: In respect of the cases where the details relating to such transactions are recorded in the specified record for the period beginning with 08.04.2011 upto 14.05.2015 (both days inclusive), the penalty will be 50% of the service tax so determined [First proviso to sub-section (1)].

(iii) Specified records: “Specified records” means records including computerised data as are required to be maintained by an assessee in accordance with any law for the time being in force or where there is no such requirement, the invoices recorded by the assessee in the books of accounts shall be considered as the specified records [Explanation to sub-section (1)].

(iv) 15% penalty: However, if service tax and interest is paid within 30 days of the date of service of notice under the proviso section 73(1), the penalty payable will be 15% of such service tax and proceedings in respect of such service tax, interest and penalty will be deemed to be concluded [Clause (i) of second proviso to sub-section (1)].

(v) 25% penalty: However, if service tax and interest is paid within 30 days of the date of receipt of the order of the Central Excise Officer determining the

amount of service tax under section 73(2), the penalty payable will be 25% of the service tax so determined [Clause (ii) of second proviso to sub-section (1)].

(vi) The benefit of reduced penalty under clause (i) [15%] or clause (ii) [25%] of second proviso to section 78(1) will be available only if the amount of such reduced penalty is also paid within such period [Third proviso to sub-section (1)].

(vii) Where the Commissioner (Appeals)/ the Appellate Tribunal/ the court modifies the amount of service tax determined under section 73(2), then the amount of penalty payable under section 78(1) and the interest payable thereon under section 75 will stand modified accordingly. The person who is liable to pay such modified amount of service tax, will also be liable to pay the amount of penalty and interest so modified [Sub-section (2)].

(viii) Where the amount of service tax or penalty is increased by the Commissioner (Appeals)/ the Appellate Tribunal/ the court over and above the amount as determined under section 73(2), the time within which the interest and the reduced penalty is payable under clause (ii) of the second proviso to section 78(1) in relation to such increased amount of service tax will be counted from the date of the order of the Commissioner (Appeals)/ the Appellate Tribunal/ the court, as the case may be [Sub-section (3)]

The penalties payable under sections 76 and 78 are illustrated with the help of the following example:

| Section 76 – Non-fraud cases | |||||

| Service tax short/ nonlevied or short/ non paid or erroneously refunded | Penalty leviable | Date of service of show cause notice | Date of receipt of the order | Date of payment of service tax and interest | Penalty payable, if any |

| Rs1,00,000 | Up to Rs10,000 | 20.05.2015 | NA | 10.06.2015 | No penalty as service tax and interest is paid within 30 days of 20.05.2015 (date of service of show cause notice) |

| Rs1,00,000 | Up to Rs10,000 | 20.05.2015 | 20.08.2015 | 10.09.2015 | 25% of penalty imposed in the order, if such reduced penalty is also paid within 30 days of 20.08.2015 (date of receipt of the order) |

| Rs1,00,000 | Up to Rs10,000 | 20.05.2015 | 20.08.2015 | 25.09.2015 | 100% of penalty imposed in the order as service tax and interest is paid after 30 days of 20.08.2015 (date of receipt of the order |

| Section 78 – Fraud cases | |||||

| Service tax short/nonlevied or short/non paid or erroneously refunded | Penalty leviable | Date of service of show cause notice | Date of receipt of order | Date of payment of service tax and interest | Penalty payable, if any |

| Rs1,00,000 | Rs1,00,000 | 20.05.2015 | NA | 10.06.2015 | 15% of service tax, if such reduced penalty is also paid within 30 days of 20.05.2015 (date of service of show cause notice) |

| Rs1,00,000 | Rs1,00,000 | 20.05.2015 | 20.08.2015 | 10.09.2015 | 25% of service tax determined in the order, if such reduced penalty is also paid within 30 days of 20.08.2015 (date of receipt of the order) |

| Rs1,00,000 | Rs1,00,000 | 20.05.2015 | 20.08.2015 | 25.09.2015 | 100% of the service tax determined in the order as service tax and interest is paid after 30 days of 20.08.2015 (date of receipt of the order) |

The provisions of sections 76 and 78 are summarized in a comparative diagram in the page after the next page.

IV. Transition provisions for applicability of new penalty provisions under sections 76 and 78 [New section 78B]: New section 78B which is effective from 14.05.2015 prescribes, by way of a transition provision, that-

(a) Amended provisions of sections 76 and 78 will apply to cases where either no notice has been served, or notice has been served under section 73(1) [nonfraud case] or proviso thereto [fraud cases] but no order has been issued under section 73(2), before 14.05.2015.

(b) In cases where show cause notice has been issued under section 73(1) or under the proviso thereto, but no order has been passed under section 73(2)

before 14.05.2015, the period of 30 days for the purpose of closure of proceedings on payment of service tax and interest under clause (i) of the proviso to section 76(1) or on the payment of service tax, interest and penalty (15% penalty) under clause (i) of the second proviso to section 78(1), will be counted from 14.05.2015.

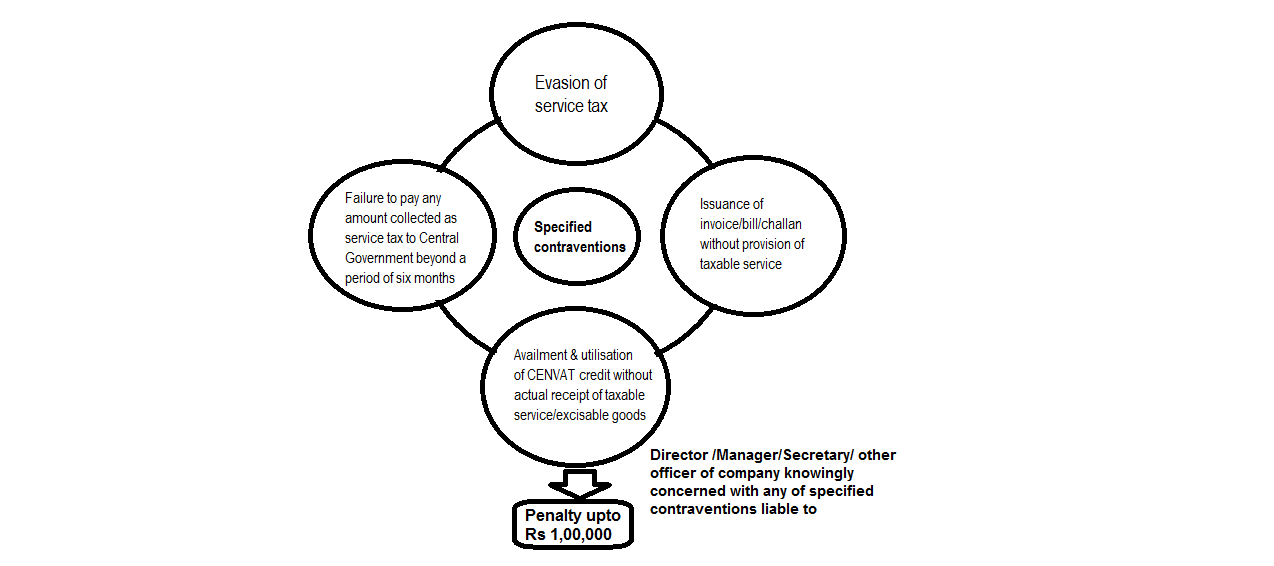

V. Imposition of personal penalty on director, manager, secretary, or other officer found to be knowingly concerned with specified contraventions [Section 78A]: Section 78A makes a director, manager, secretary or other officer of the company personally liable to a penalty upto ` 1 lakh in case of certain specified contraventions committed by the company. Such penalty would be leviable if the director, manager, secretary or other officer of the company was in charge of, and was responsible to, the company for the conduct of business of such company at the time of commitment of any of the specified contraventions and was knowingly concerned with such contravention.

The specified contraventions are:

(a) evasion of service tax; or

(b) issuance of invoice, bill or, as the case may be, a challan without provision of taxable service in violation of the rules made under the provisions of Chapter V; or

(c) availment and utilisation of credit of taxes or duty without actual receipt of taxable service or excisable goods either fully or partially in violation of the rules made under the provisions of Chapter V; or

(d) failure to pay any amount collected as service tax to the credit of the Central Government beyond a period of six months from the date on which such payment becomes due.

Comparative Presentation of Provisions of Section 76 and Section 78