Presumptive Taxation Scheme for assessees engaged in eligible profession [Section 44ADA]

Related amendment in section: 44AB

Effective from: A.Y. 2017-18

(i) Section 44AD provides for a presumptive taxation scheme for eligible persons engaged in eligible business in order to reduce compliance burden of small tax payers.

(ii) For reducing the compliance burden of small tax payers having income from profession, the Finance Act, 2016 has introduced a presumptive taxation regime for professionals.

(iii) In this regard, new section 44ADA has been inserted in the Income-tax Act, 1961 providing a presumptive taxation scheme for estimating the income of an assessee:

• who is engaged in any profession referred to in section 44AA(1) such as legal, medical, engineering or architectural profession or the profession of accountancy or technical consultancy or interior decoration or any other profession as is notified by the Board in the Official Gazette; and

• whose total gross receipts does not exceed fifty lakh rupees in a previous year,

at a sum equal to 50% of the total gross receipts, or, as the case may be , a sum higher than the aforesaid sum claimed to have been earned by the assessee.

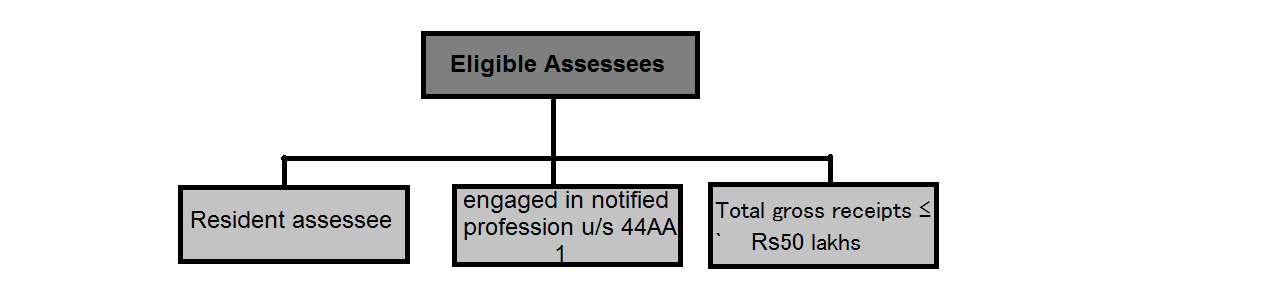

(iv) Meaning of Eligible Assessee:

(v) Under the scheme, the assessee will be deemed to have been allowed the deductions under section 30 to 38. Accordingly, no further deduction under those sections shall be allowed.

(vi) Further, the written down value of any asset used for the purpose of the profession of the assessee will be deemed to have been calculated as if the assessee had claimed and had actually been allowed the deduction in respect of depreciation for the relevant assessment years.

(vii) The eligible assessee opting for presumptive taxation scheme will not be required to keep and maintain books of account under section 44AA(1) and get the accounts audited and furnish a report of such audit as required under section 44AB in respect

of such income unless the assessee claims that:

(a) the profits and gains from the aforesaid profession are lower than the profits and gains deemed to be his income under section 44ADA(1); and

(b) his income exceeds the maximum amount which is not chargeable to income-tax.

(viii) Consequential amendment has been made in section 44AB requiring every person carrying on profession to have his accounts audited by an accountant before the specified date and furnish audit report by that date if such person has claimed lower profits and gains than the deemed profits under section 44ADA and his income exceeds the basic exemption limit.