PREVENTION OF MONEY LAUNDERING ACT, 2002 (PMLA) :

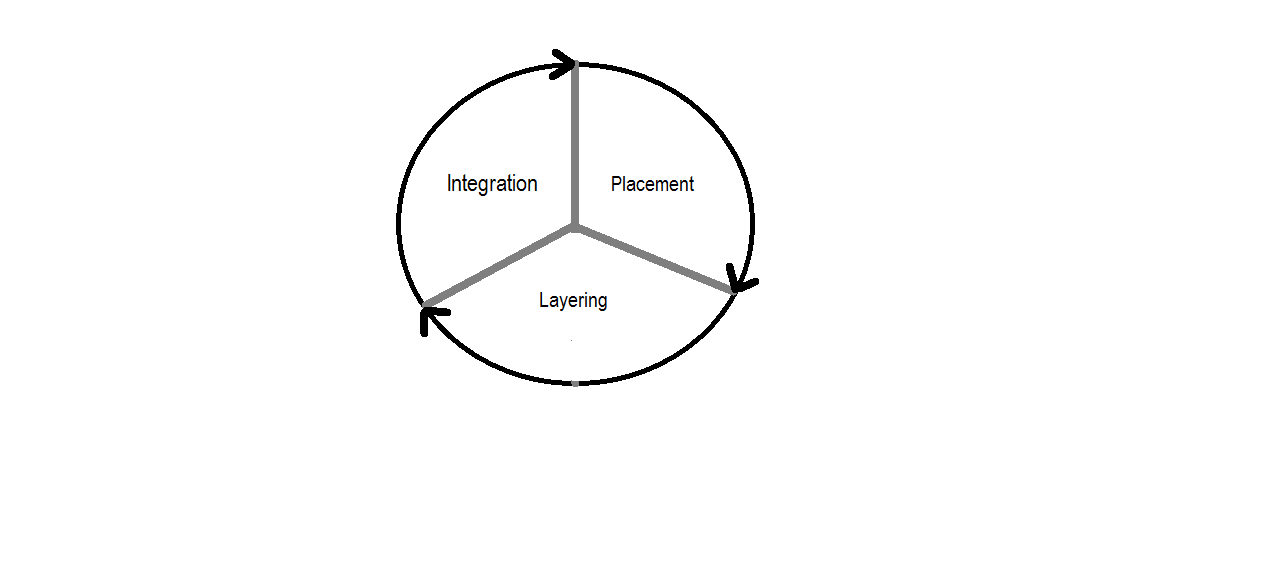

Laundering means acquiring, owning, possessing or transferring any proceeds (money) of crime or knowingly entering into any transaction related to proceeds of the crime either directly or indirectly or concealing or aiding in the concealment of the proceeds or gains of crime, within or outside India. It is a process for conversion of money obtained illegally to appear to have originated from legitimate sources. Invariably, there are three stages through which money laundering takes place.

(a) The first step is called the placement, when the cash is deposited in the domestic banks or is used to buy goods such as precious metals, work of art, etc.

(b) The second step is called the layering, where, the funds are converted by transfers to different destinations. In this, bank accounts are opened at different locations and the funds are transferred as quickly as possible (sometimes breaking into series of small transactions to escape from the limits set up by banks for cash transactions)

(c) The last stage is called the integration. In this stage, the launderer attempts to justify that the money obtained through illegal activities is legitimate. Through different methods attempts are made at this stage, like using front offices of the companies, using the tax haven and off shore units, using these funds as security for loans raised, etc.

The Prevention of Money laundering Act, 2002 (PMLA) aimed at combating money laundering in India with three main objective to prevent and control money laundering to confiscate and seize the property obtained from laundered money, and to deal with any other issue connected with money laundering in India. The Act provides that whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projective it as untainted property should be guilty offences of money laundering. For the purpose of money laundering, the PMLA identifies certain offences under the Indian Penal Code, the Narcotic Drugs and Psychotropic Substances Act, the Arms Act, the Wild Life (Protection) Act, the Immoral Traffic (Prevention) Act and the Prevention of Corruption Act, the proceeds of which are covered under this Act.

All banks (including RRBs and Co-operative banks) are covered under the above Act. The money launderers may open deposit accounts with banks in fake names and banks will be required to be vigilant for not becoming a party to such transactions. With a view to preventing banks from being used, intentionally or unintentionally, by criminal elements for money laundering or terrorist financing, it is clarified that whenever there is suspicion of money laundering or terrorist financing or when other factors give rise to a belief that the customer does not, in fact, pose a low risk, banks should carry out full scale customer due diligence (CDD) before opening an account.

Similarly, they have to observe the norms regarding record keeping, reporting, account opening and monitoring transactions. The Act has made various provisions regarding money laundering transactions which include maintenance of record of all transactions relating to money laundering. Records relating to such transactions should be preserved for 10 years from date of cessation of transactions between the client and the banking company.

Govt. has set up Financial Intelligence Unit (FIU-IND) to track and curb money laundering offences. Banks, financial institutions, stock brokers, etc. are to report non-cash transactions (cheques/drafts) totaling to over `1 crore a month and cash transactions of ` 10 lakh a month, to Financial Intelligence Unit.

Non-adherence of the provision of the Act will be an offence and these offences are cognizable/non-bailable. Punishment would be rigorous imprisonment for not less than 3 years but up to 7 years and fine as per the gravity of the offence. Enforcement Directorate has been made the designated authority to track cases of money laundering.

As per the Act, banking companies, financial institutions and intermediaries should maintain record of transactions, identity of clients etc. A director appointed by the Central Government has the right to call for records and impose penalties in case of failure on the part of the banking companies and other financial intermediaries. Central Government in consultation with the Reserve Bank has framed rules regarding the maintenance of records, retention period of records, verification of the identity of client (KYC norms) and submitting the details and information to the director when called upon to do so.

To ensure compliance under the PMLA, banking companies should strictly comply with the KYC norms without any deviation. KYC norms are applicable for both the new and existing client accounts. One of the objective of KYC norms is the clear identity of the customer. The identity does not end with obtaining the required identity proof like, verification and retaining copies of PAN card, Passport, AADHAR card, and other relevant documents as specified. Further to obtaining the required application forms, the photo identity and address proof documents, banks are required to ensure that all the relevant details like status of the customer, and relevant documentary verification to confirm the status, declaration about the multiple bank account details, source of income, source of funds, and expected income and activities in the accounts etc., are obtained and bank records are updated with these details. Banks should also accordingly set up internal control checking systems, whereby the system can identify and caution the bank officials about unusual transactions, at the time of input stage to enable the officials to take appropriate action. Banks should be very careful to avoid incidents of Money Laundering at the entry level itself. This precautionary action on the part of bank officials and the inbuilt warning system in the computers of banking companies, would go a long way to control the menace of Money Laundering. Banking companies should also ensure that as a part of effective control system, that all the employees at all levels should be informed and trained to practice anti money laundering to safe-guard not only the customers funds, but also to be proactive to avoid incidents of money laundering. The internal auditors, external auditors including the Statutory Auditors and the Reserve Bank of India inspectors should include the verification of the Anti- Money Laundering procedures as part of their audit and inspection of banking companies. They should ensure that all the required guidelines and directives in respect of Anti Money Laundering including the adherence to the KYC norms, monitoring of accounts, maintenance of records, reporting of high volume transactions, suspicious transactions, filing of required returns to the authorities and proper control mechanism are adhered to. The executives should ensure monitoring and controlling of such incidents. Further, the computer systems should be upgraded with the required checking and cautioning of suspicious and un authorized transactions at the input stage.