Process of consolidation :

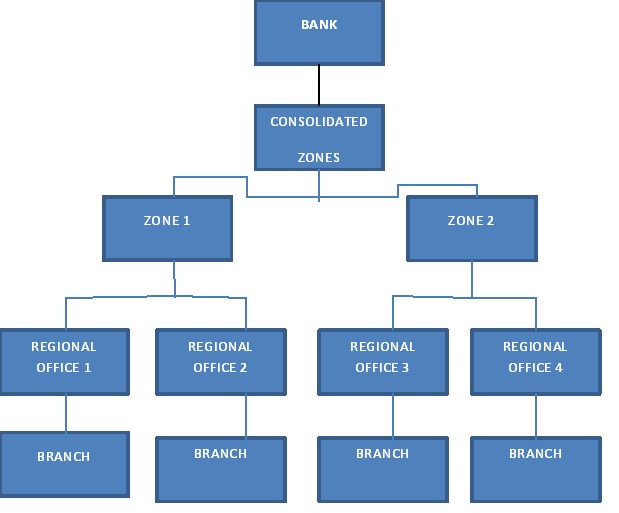

The consolidation process starts from the Branch level and the accounts of branches get consolidated at the respective regional office and all regional offices get consolidated at respective Zonal office and all zonal offices get consolidated at Head Office. The procedures regarding consolidation of accounts vary from bank to bank, in some banks mostly in a private sector the entire consolidation work gets done at the head office.

Bank managements generally follow the below mentioned process for the purpose of consolidation:

Step 1

Back up of the Financial Statements as on 31st March

At the year-end i.e., 31st March, the bank takes the backup of financial data and keeps the same on different software. This data is given for audit purpose to the statutory auditor.

Step 2

Effect of Memorandum of Changes(MOC)

There are two types of financial statements, Pre-MOC, i.e., the original data and Post-MOC, i.e., after giving the effect of accounting entries suggested by the central statutory auditor (which is known as MOC). The MOC are not fed in the live data but are recorded on a different software (e.g., ROSS, ADF) at all levels like Branches, Region, zone and Head office. All MOC suggested at branches get consolidated and recorded at regions and MOC of regions get consolidated at the concerned Zone and MOC of the Zones get consolidated at Head Office.

In this way, the effect of MOC at all levels of bank gets recorded in the parallel software e.g. ROSS, ADF. For making any changes in the financial statement there has to be an MOC approved by the statutory auditor. Therefore, there will be an MOC for difference between Pre-MOC financial statements and Post-MOC financial statements.

Accounting of MOC effect in live data

After the financial statements get approved and signed with all changes the MOC gets accounted in live data. For example, the financial statements for the financial year 2016-17 gets approved and signed on 30th April, 2017, then on that day all MOC will be accounted in the live data. So from that day a particular account will be shown as NPA if the same had been made NPA by way of MOC during the audit.

Step 3:

Regional office Process:

1. Branches depending on the limits prescribed can be either audited branches or unaudited branches.

2. At the branch level the audited financial statements as well as unaudited financial statements signed by Bank manager is uploaded in the system and consolidated data is generated at regional office level.

3. Regional office accounts gets consolidated and also adjustments if any are made at regional level. The Regional Office is a cost centre and the auditor has to certify the financial statements of the Regional Office in addition to the consolidation of the Branches under the relevant Regional Office.

Audit Approach:

1. Regional office Auditor must verify the completeness of the data uploaded by the branches into the system.

2. Auditor on sample basis must also verify the completeness of the data.

3. Auditor Should obtain reasonable assurance and sufficient appropriate audit evidence of the adjustments made if any at the regional office level.

4. Auditor should also check the arithmetic accuracy of the number of financial statements to be uploaded at regional office level.

5. Auditor should ensure on sample basis if all the documents as required by the respective banks have been taken at each level of consolidation i.e. appropriate flow of data along with the required documents.