Purchase of Retiring Partner’s Share by Remaining Partners

The retiring partner’s share may be purchased by the remaining partners in an agreed ratio. In such a case, retiring partner’s capital account is closed by transfer to the remaining partners’ capital accounts in the ratio in which they agree to purchase his share. When the remaining partners purchase the retiring partner’s share, the retiring partner has to look to the remaining partners’ in individual capacities for the satisfaction of his claim; the new firm as such will not be responsible.

Note: In the examination, if the question states that the remaining partners purchase the retiring partner’s share but does not specify the proportion in which they purchase his share, the candidate should assume that it is done in the relative profit sharing ratio between the remaining partners; and if the new profit sharing ratio is given, the purchase should be taken to be in the ratio of gain.

Illustration :

On 31st March, 2013 the following was the balance sheet of A, B and C who were equal partners:

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 89,400 | Cash in hand | 1,800 |

| General Reserves | 1,50,000 | Cash at Bank | 39,700 |

| A’s Capital Account | 2,40,000 | Investments | 50,000 |

| B’s Capital Account | 1,90,000 | Debtors 2,10,000 | |

| C’s Capital Account | 1,75,000 | Less: Provision for Bad debts 2,200 | 2,07,800 |

| tock | 3,70,100 | ||

| ________ | Furniture and Fittings | 1,75,000 | |

| 8,44,400 | 8,44,400 |

On that date, A decided to retire due to ill health and the following adjustments were agreed upon by the partners:

– Investments be appreciated by Rs.15,000

– Provision for bad debts be brought upto 5% of debtors.

– Furniture be depreciated by 10%

– Stock be depreciated by Rs. 7,200

A was paid the amount due to him by means of cheque, the bank agreed to allow the necessary overdraft. Pass journal entries to record the above mentioned transactions and show the balance sheet of the firm immediately after A’s retirement.

| Solution:

JOURNAL ENTRIES |

||

|

Particulars |

Dr. R) |

Cr. (Z) |

| General Reserve Dr. |

1,50,000 |

|

| To A’s Capital Account |

50,000 |

|

| To B’s Capital Account |

50,000 |

|

| To C’s Capital Account |

50,000 |

|

| (Transfer to general reserve to capital accounts) | ||

| Investments Dr. |

15,000 |

|

| To Revaluation Account |

15,000 |

|

| (Increase in the value of investments) | ||

| Revaluation Account Dr. |

33,000 |

|

| To Provision for Bad Debts |

8,300 |

|

| To Furniture |

17,500 |

|

| To Stock |

7,200 |

|

| (Various adjustments as agreed upon by partners) | ||

| A’s Capital Account Dr. |

6,000 |

|

| B’s Capital Account Dr. |

6,000 |

|

| C’s Capital Account Dr. |

6,000 |

|

| To Revaluation Account |

18,000 |

|

| (Transfer of loss on revaluation to partners’ capital

account) |

||

| A’s Capital Account Dr. |

2,84,000 |

|

| To Bank |

2,84,000 |

|

| (Payment of the amount due to A on his retirement) | ||

Balance Sheet of B and C as on 1st April, 2013

|

Liabilities |

Rs. |

Assets |

Rs. |

| Bank Overdraft |

2,44,300 |

Cash in Hand |

1,800 |

| Sundry Creditors |

89,400 |

Investment Z |

65,000 |

| B’s Capital Account |

2,34,000 |

Debtors 2,10,000 | |

| C’s Capital Account |

2,19,000 |

Less: | |

| Provision for Bad | |||

| Debts 10,500 |

1,99,500 |

||

| Stock |

3,62,900 |

||

| Furniture and Fittings |

1 57 500 |

||

|

7 86 700 |

7 86 700 |

||

Alternative Method:

If the values of assets and liabilities were not being changed, the following would have been the journal entries:

JOURNAL ENTRIES

|

Particulars |

Dr. (Rs.) |

Cr. (Rs.) |

| General Reserve Dr. |

1,50,000 |

|

| To A’s Capital Account |

50,000 |

|

| To B’s Capital Account |

50,000 |

|

| To C’s Capital Account |

50,000 |

|

| (Transfer of general reserve to capital accounts) | ||

| A’s Capital Account Dr. |

6,000 |

|

| B’s Capital Account Dr. |

6,000 |

|

| C’s Capital Account Dr. |

6,000 |

|

| To Memorandum Revaluation Account |

18,000 |

|

| (Transfer of loss on revaluation to all the partners’ capital accounts) | ||

| A’s Capital Account Dr. |

2,84,000 |

|

| To Bank |

2,84,000 |

|

| (Payment to A on his retirement) | ||

| Memorandum Revaluation Account Dr. |

18,000 |

|

| To B’s Capital Account |

9,000 |

|

| To C’s Capital Account |

9,000 |

|

| (Transfer to memorandum revaluation account to remaining partners’ capital accounts in new profit sharing ratio) |

Balance Sheet of B and C as on 1st April, 2013

|

Liabilities |

Rs. | Assets |

Rs. |

| Bank Overdraft |

2,44,300 |

Cash in Hand |

1,800 |

| Sundry Creditors |

89,400 |

Investments Rs. |

50,000 |

| B’s Capital Account |

2,43,000 |

Debtors 2,10,000 | |

| C’s Capital Account |

2,28,000 |

Less: Provision for | |

| Bad Debts 2,200 |

2,07,800 |

||

| Stock |

3,70,100 |

||

| Furniture and Fittings |

1 75 000 |

||

|

8, 04, 700 |

8 ,04 ,700 |

||

Illustration :

Following is the balance sheet of A, B and C who share profits and losses in the ratio of 7: 5: 3 respectively.

Balance Sheet of A, B and C as on 31st March, 2013

| Liabilities ` | Rs. | Assets ` | Rs. |

| Sundry Creditors | 15,400 | Furniture and Fittings | 12,000 |

| Capital Accounts: | Sundry Debtors | 16,000 | |

| A | 40,000 | Stock | 44,000 |

| B | 25,000 | Cash at Bank | 18,400 |

| C | 10,000 | _______ | |

| 90,400 | 90,400 |

On 31st March, 2013 C retires on the condition that he be immediately paid the amount due to him after making adjustment for goodwill which is valued at Rs.22,500. A and B agree to share profits and losses in the ratio of 8:7 respectively in future.

Show journal entries and balance sheet in each of the following cases:

(a) Goodwill Account is raised only with C’s share of goodwill.

(b) No Goodwill account is raised but adjustments are made in the capital accounts with retiring partner’s share of goodwill.

(c) A and B pay privately to C for goodwill.

Solution:

Case (i)

Journal Entries

| PARTICULARS | Dr. (Rs.) | Cr. (Rs.) |

| Goodwill Account Dr. | 4,500 | |

| To C’s Capital Account | 4,500 | |

| (Credit given to C for his share of goodwill) | ||

| C’s Capital Account Dr. | 14,500 | |

| To Bank | 14,500 | |

| (Payment to C) | ||

| A’s Capital Account Dr. | 1,500 | |

| B’s Capital Account Dr. | 3,000 | |

| To Goodwill Account | 4,500 | |

| (Transfer of Goodwill Account to the remaining partners in the ratio of gain which turns out to be 1:2)* | ||

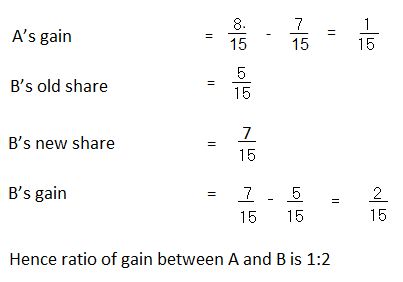

| *The ratio of gain in this case has been calculated as under: | ||

| A’s old share = 7 | ||

| 15 | ||

| A’s new shares = 8 | ||

| 15 | ||

Balance Sheet of A and B as on 1st April, 2013

|

Liabilities |

Rs. | Assets |

Rs. |

| Sundry Creditors |

15,400 |

Furniture and Fittings |

12,000 |

| A’s Capital Account |

38,500 |

Sundry Debtors |

16,000 |

| B’s Capital Account |

22,000 |

Stock |

44,000 |

| Cash at Bank |

3,900 |

||

|

75,900 |

75,900 |

Case (ii)

Journal Entries

| PARTICULARS | Dr. (Rs.) | Cr. (Rs.) |

| A’s Capital Account Dr. | 1,500 | |

| B’s Capital Account Dr. | 3,000 | |

| To C’s Capital Account | 4,500 | |

| (Retiring partner being credited with his share of goodwill which is debited to remaining partners in the ratio of gain 1:2) | ||

| C’s Capital Account Dr. | 14,500 | |

| To Bank | 14,500 | |

| (Payment to C) |

Balance Sheet will be the same as in cases (i).

Case (iii)

Journal Entries

| PARTICULARS | Dr. (Rs.) | Cr. (Rs.) |

| C’s Capital Account Dr. | 10,000 | |

| To Bank | 10,000 | |

| (Payment to C) |

Balance Sheet of A and B as on 1st April, 2013

| Liabilities ` ` | Rs. | Assets | Rs. |

| Sundry Creditors | 15,400 | Furniture and Fittings | 12,000 |

| A’s Capital Account | 40,000 | Sundry Debtors | 16,000 |

| B’s Capital Account | 25,000 | Stock | 44,000 |

| ______ | Cash at Bank | 8,400 | |

| 80,400 | 80,400 |

Illustration :

The balance sheet of Anil, Bashin and Chaman who were sharing profits in proportion to their capitals stood as follows on 31st March, 2013.

| Liabilities ` ` | Rs. | Assets | Rs. |

| Sundry Creditors | 69,000 | Cash in Bank | 55,000 |

| General Reserve | 1,80,000 | Sundry Debtors 50,000 | |

| Capital Accounts: | Less : Provision for Bad Debts 1,000 | 49,000 | |

| Anil | 2,00,000 | Stock | 2,60,000 |

| Bashin | 1,50,000 | Plant and Machinery | 1,35,000 |

| Chaman | 1,00,000 | Land and Buildings | 2,00,000 |

| 6,99,000 | 6,99,000 |

Bashin retired on the above date and the following was agreed upon:

– That the provision for bad debts be brought upto 5% on debtors.

– That land and buildings be appreciated by 25%.

– That a provision of ` 350 be made in respect of outstanding legal charges.

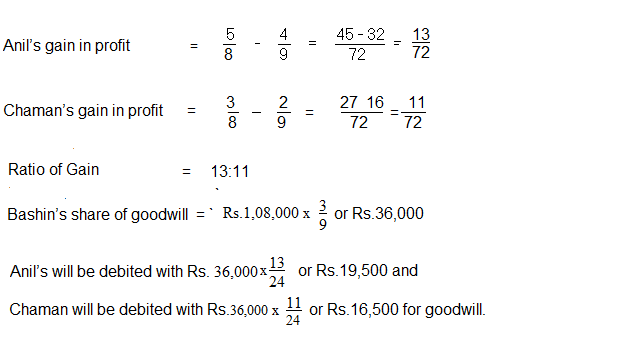

– That the goodwill of the entire firm be fixed at Rs.1,08,000 and Bashin’s share of it be adjusted into the accounts of Anil and Chaman who are going to share future profits in the ratio of 5:3 respectively.

– That the entire capital of the new firm be fixed at Rs.4,80,000 and the capital accounts of the partners be made in their new profit sharing ratio; actual cash to be brought in or paid off as the need be. Pass journal entries, show profit and loss adjustment account and capital accounts and prepare balance sheet of Anil and Chaman.

Solution:

Journal Entries

| Particulars | Rs. | Rs. |

| General Reserve Dr. | 1,80,000 | |

| To Anil’s Capital Account | 80,000 | |

| To Bashin’s Capital Account | 60,000 | |

| To Chaman’s Capital Account | 40,000 | |

| (Transfer of general reserve to capital accounts) | ||

| Profit and Loss Adjustment Account Dr. | 5,000 | |

| To Provision for Bad Debts | 1,500 | |

| To Outstanding Legal Expenses | 3,500 | |

| (Increase in provision for bad debts and record of outstanding legal expenses) | ||

| Land and Building Dr. | 50,000 | |

| To Profit and Loss Adjustment Account | 50,000 | |

| (Appreciation in the value of land and buildings) | ||

| Profit and Loss Adjustment Account Dr. | 45,000 | |

| To Anil’s Capital Account | 20,000 | |

| To Bashin’s Capital Account | 15,000 | |

| To Chaman’s Capital Account | 10,000 | |

| (Transfer of profit on revaluation) | ||

| Anil’s Capital Account Dr. | 19,500 | |

| Chaman’s Capital Account Dr. | 16,500 | |

| To Bashin’s Capital Account | 36,000 | |

| (Bashin’s share of goodwill debited to Anil and Chaman in ratio of gain which is 13:11 respectively) | ||

| Bashin’s Capital Account Dr. | 2,61,000 | |

| To Bashin’s Loan Account | 2,61,000 | |

| (Transfer of Bashin’s Capital Account to his Loan Account) | ||

| Bank Dr. | 66,000 | |

| To Anil’s Capital Account | 19,500 | |

| To Chaman’s Capital Account | 46,500 | |

| (Cash brought in by Anil and Chaman) |

Dr. Profit and Loss Adjustment Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Provision for Bad Debts A/c | 1,500 | By Land and Buildings | 50,000 |

| To Outstanding Legal Expenses A/c | 3,500 | ||

| To Anil’s Capital A/c (4/9 profit) | 20,000 | ||

| To Bashin’s Capital A/c (3/9 profit) | 15,000 | ||

| To Chaman’s Capital A/c (2/9 profit) | 10,000 | ________ | |

| 50,000 | 50,000 |

Dr. Capital Accounts Cr.

| Particulars | Anil (Rs.) | Bashin (Rs.) | Chaman (Rs.) | Particulars | Anil (Rs.) | Bashin (Rs.) | Chaman (Rs.) |

| To Bashin’s Capital A/c | 19,500 | 16,500 | By Balance b/fd | 2,00,000 | 1,50,000 | 1,00,000 | |

| To Bashin’s Loan A/c | 2,61,000 | By General Reserve | 80,000 | 60,000 | 40,000 | ||

| To Balance c/d | 3,00,000 | 1,80,000 | By P & L Adjustment A/c | 20,000 | 15,000 | 10,000 | |

| By Anil’s Capital | – | 19,500 | – | ||||

| By Chaman’s Capital | – | 16,500 | – | ||||

| By Bank | _19,500 | 46,500 | |||||

| 3,19,500 | 2,61,000 | 1,96,500 | 3,19,500 | 2,61,000 | 1,96,500 | ||

| By Balance b/d | 31,950 | 26,100 | 1,96,500 |

Balances Sheet of Anil and Chaman

as on 1st April, 2013

| Liabilities ` ` ` | Rs. | Assets | Rs. |

| Sundry Creditors | 69,000 | Cash in Bank | 1,21,000 |

| Outstanding Legal Expenses | 3,500 | Sundry Debtors 50,000 | |

| Bashin’s Loan Account | 2,61,000 | Less: Provision for Bad Debts 2,500 | 47,500 |

| Capital Accounts: ` | |||

| Anil 3,00,000 | Stock | 2,60,000 | |

| Chaman 1,80,000 | 4,80,000 | Plant and Machinery | 1,35,000 |

| _________ | Land and Buildings | 2,50,000 | |

| 8,13,500 | 8,13,500 |

Working Notes:

Illustration :

On 31st March, 2013 the balance sheet of M/s. Ashok, Basu, and Chauhan, who were sharing profits and losses in proportion to their capitals, stood as follows:

| Liabilities ` ` ` | Rs. | Assets | Rs. |

| Capital Accounts: | Land and Buildings | 2,00,000 | |

| Ashok 3,00,000 | Machinery | 2,00,000 | |

| Basu 2,00,000 | Closing Stock | 1,00,000 | |

| Chauhan 1,00,000 | 6,00,000 | Sundry Debtors | 2,00,000 |

| Sundry Creditors | 2,00,000 | Cash and Bank Balances | 1,00,000 |

| 8,00,000 | 8,00,000 |

On 31st March, 2013, Ashok desired to retire from the firm and the remaining partners decided to carry on. They agreed on the following terms and conditions:

(i) Land and buildings be appreciated by 30%

(ii) Machinery be depreciated by 20%

(iii) Closing stock to be valued at ` 80,000.

(iv) Provision for bad debts be made at 5%.

(v) Old credit balances of sundry creditors amounting to Rs10,000 be written back.

(vi) Joint Life Policy of the partners be surrendered. Cash received was ` 60,000.

(vii) Goodwill of the entire firm be valued at ` 1,80,000 and Ashok’s share of the goodwill be adjusted in the

accounts Basu and Chauhan who would share the future profits equally.

(viii) The total capital of the firm was to be the same as before retirement. Individual capitals of

partners were to be in their profit sharing ratio.

(ix) Amount due to Ashok was to be settled on the following basis:

50% on retirement and balance 50% within one year.

Prepare Revaluation Account, Capital Accounts of the Partners, Loan Account of Ashok, Cash Book and

Balance Sheet as on 1st April 2013 of M/s. Basu and Chauhan.

Solution:

Dr. Revaluation Account Cr.

|

Particulars |

Rs. |

Particulars |

Rs. |

|||||

| To | Machinery A/c |

40,000 |

By | Land and Building |

60,000 |

|||

| To | Closing Stock |

20,000 |

By | Sundry Creditors |

10,000 |

|||

| To | Provision for Bad | By | Bank A/c (Joint Life Policy) |

60,000 |

||||

| Debts A/c |

10,000 |

|||||||

| To | Capital Accounts: | |||||||

| Ashok |

30,000 |

|||||||

| Basu |

20,000 |

|||||||

| Chauhan |

10,000 |

60,000 |

||||||

|

1,3,0 000 |

1,30, 000 |

|||||||

Dr. Capital Accounts Cr.

|

Particulars |

Basu

RS. |

Chauhan

RS. |

Particulars | Basu

RS. |

Chauhan RS. |

| To Ashok | By Balance b/fd |

2,00,000 |

1,00,000 |

||

| Capital A/c | |||||

| (Goodwill) |

30,000 |

60,000 |

By Revaluation A/c |

20,000 |

10,000 |

| To Balance c/d |

3,00,000 |

3,00,000 |

By Bank (Additional | ||

|

————– |

capital) |

1 10 000 |

2 50 000 |

||

|

3 30 000 |

3 60 00

|

3 30 000 |

3 60 000 |

||

| By Balance b/d |

3,00,000 |

3,00,000 |

Dr. Ashok’s Capital Account Cr.

|

Particulars |

Rs. |

Particulars |

Rs. |

| To Bank |

2,10,000 |

By Balance b/d |

3,00,000 |

| To Ashok’ Loan A/c |

2,10,000 |

By Revaluation A/c |

30,000 |

| By Basu’s Capital A/c | |||

| (Goodwill) |

30,000 |

||

| By Chauhan’s Capital A/c | |||

| (Goodwill) |

60,000 |

||

|

4 20 000 |

4 20 000 |

||

Dr. Ashok’s Loan Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

|||

| To Balance c/d |

|

2,10,000 |

By Ashok’s Capital A/c |

2, 10 ,000 |

||

| By Balance b/d | 2,10,000 |

Dr. Cash Book Cr.

|

Particulars |

Rs. |

Particulars |

Rs. |

| To Balance b/fd |

1,00,000 |

By A’s Capital A/c |

2,10,000 |

| To Revaluation A/c | By Balance c/d |

3,10,000 |

|

| (IL. Policy surrendered) |

60,000 |

||

| To Basu’s Capital A/c |

1,10,000 |

||

| To Chauhan’s Capital A/c |

2 50 000 |

_________ |

|

|

5 20 000 |

5 20 000 |

||

| To Balance b/d |

3,10,000 |

M/s. B and C

Balance Sheet as on 1.4.2013

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Capital Accounts: | Land and Building |

2,60,000 |

|||

| Basu |

3,00,000 |

Machinery |

1,60,000 |

||

| Chauhan |

3 00 000 |

6,00,000 |

Closing Stock |

80,000 |

|

| A’s Loan |

2,10,000 |

Sundry Debtors |

2,00,000 |

||

| Sundry Creditors |

1,90,000 |

Less: Provisions | |||

| for Bad Debts |

10,000 |

1,90,000 |

|||

| Cash and Bank | |||||

| Balances |

3 10 000 |

||||

|

10,00,000 |

10,00,000 |

||||

Working Notes:

(1) Calculation of ratio of gain of remaining partners.

Ratio of gain = New ratio – Old ratio

Basu = 1/2 – 1/3 = 1/6

Chauhan = 1/2 – 1/3 = 2/6

Ratio of gain = 1:2.

(2) Goodwill borne by Basu and Chauhan:

Total goodwill of the firm = Rs.1,80,000

Ashok’s share = 1/2 x Rs.1,80,000 = Rs.90,000

Ashok’s share to be borne by Basu and Chauhan in their ratio of gain.

Basu = 1/3 x Rs. 90,000 = Rs.30,000

Chauhan = 2/3 x Rs. 90,000 = Rs. 60,000