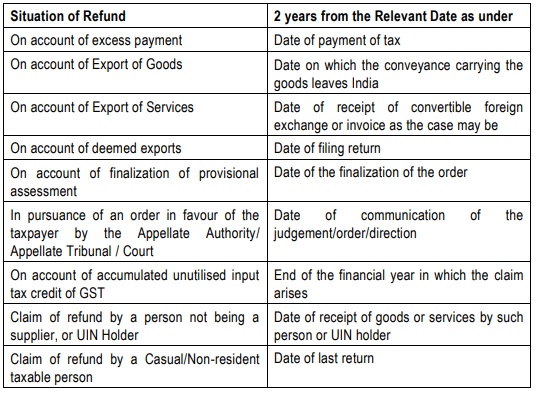

Relevant date: The relevant date is crucial to determine the time within which the refund claim has to be filed. If the refund claim is made after the relevant date, the refund claim would be rejected and there is no provision in the Act to condone the delay in filing refund claim and accept delayed refund claims.

The relevant date is identified as follows:

Refund of tax paid on goods exported or tax paid on inputs/input service

o If exported by sea or air ->date when the ship or the aircraft leaves India; or

o If exported by land ->date when such goods pass the Customs frontier; or

o If exported by post ->date of dispatch of goods by concerned Post Office to a place outside India.

Deemed exports supply of goods->the date on which the return relating to such deemed exports is furnished.

Refund of tax paid on such services exported itself or tax paid on inputs/input service

o If supply of service is completed prior to the receipt of payment–>date of receipt of payment in convertible foreign exchange;

o If payment for the service received in advance prior to the date of issue of invoice

–> date of issue of invoice.

Refund of tax as a consequence of judgment, decree, order or direction of Appellate authority, Appellate Tribunal or any Court -> date of communication of such judgement/decree/order/ direction.

Refund of unutilized input tax credit accumulated due to exports including zero rated supplies – end of the financial year in which such claim for refund arises;

Provisionally paid tax – the date of adjustment of tax after the final assessment.

In the case of a person, other than the supplier, the date of receipt of goods or services or both by such person; and

In any other case, the date of payment of tax

Relevant date

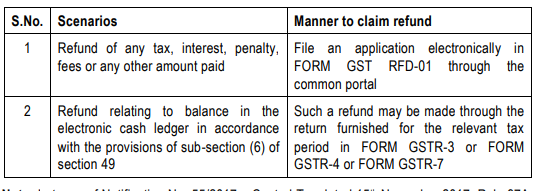

54.3 Rule 89(1) facilitates a taxable person to claim refund in following manner under various circumstances

Note: In terms of Notification No. 55/2017 – Central Tax dated 15th November 2017, Rule 97A has been inserted in the Central Goods and Service Tax Rules, 2017. In terms of Rule 97A, any reference to this Chapter (i.e., with respect to Refunds) any reference to electronic filing of an application, intimation, reply, declaration, statement or electronic issuance of a notice, order or certificate on the common portal shall, in respect of that process or procedure, include manual filing of the said application, intimation, reply, declaration, statement or issuance of the said notice, order or certificate in such Forms as appended to these rules.

In other words, the refunds may be filed manually and the processing of refund with respect to any notice, reply or order, among others, can also be issued / filed manually.